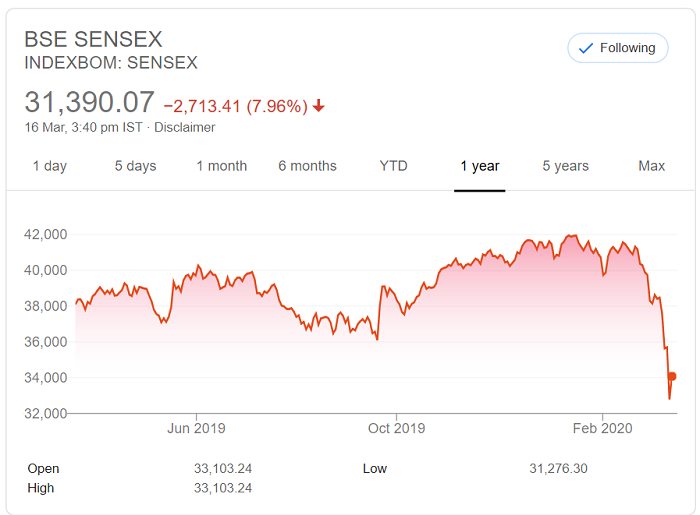

Sensex is down by 7.96% today

In the last 1 month alone the markets have corrected by 23% and it was one of the fastest and steepest declines ever in the history of stock markets in India (and globally)

A lot of equity investors are very new to this game and many might be wondering what is going on and why markets are falling?

So in this article, I will just jot down 2 big reasons which are contributing to this steep fall.

Reason #1 – Fear and Panic because of Coronavirus

The biggest reason and the trigger of this huge market falls from the last 1 month is because of the coronavirus.

The entire world is fearful about the spread of this virus and its impact on the world.

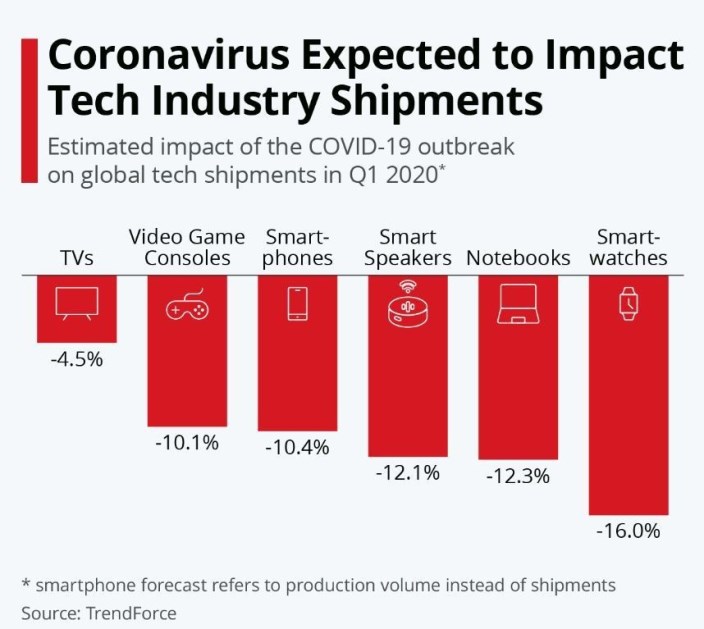

In the entire world, the businesses are hugely impacted because of coronavirus. Because of this virus and the fear around it, various factories are shut down and work is stopped. Other companies which needed raw material are not getting it and production is down. Overall manufacturing is HIT.

Which also means that consumption is down and will be down in the near future also and it will only go up slowly over time.

One very simple example is APPLE. Its products get manufactured in China and because China factories is shut down, the apple stock is down because it’s going to hit their profitability.

One more way of understanding coronavirus impact on business is simple meat/poultry businesses especially in India. The demand for Chicken/mutton or other similar items have drastically gone down. No one is buying it. Now imagine the job losses, no sale of associated products like poultry feeds by poultry farms..

Another example is the tourism industry. People are not going on vacations, or booking very less flights, etc. which is directly going to impact so many companies on at a deeper level.

So in general various businesses around the world are impacted and as you might be knowing stock markets chase earnings. Because the future earnings of companies across the world are going to be impacted, the stock markets are just reflecting that today.

Markets are desperately looking for news where we develop some medicine or vaccine for coronavirus which gives some kind of assurance that we will be able to control this virus and further damage.

Reason #2 – Crude Oil Price Crash

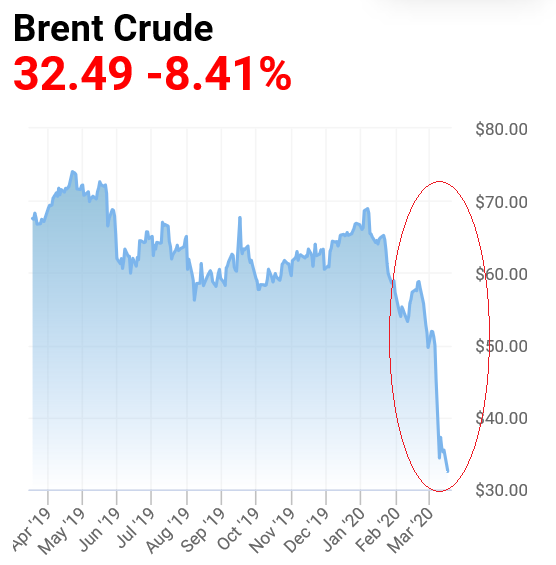

Crude oil in international markets has crashed badly.

The oil price was a few days back fell by almost 30% in one single day and hit around $30 per barrel (Oil price in 1947 was $28 per barrel)

This was $120-130 around 10 yrs back and just 2 yrs back it was in $60-70 range.

The huge drop in oil prices also indicates huge slowdown and low demand, even though it’s amazing news for India because we import oil and it’s going to save us billions of dollars in oil bill.

Why is it happening?

Well, its extremely complicated thing for a retail investor like you and me, but for now you should know that there is a price was going on between Russia and Saudi Arabia which has triggered this oil crash. Russia did not honor its promise as per its OPEC promises and now Saudi Arabia is kind of punishing it for going against OPEC and have crashed the prices which as per some analyst is not going up very soon.

You can either read this article or watch this excellent YouTube video to understand about oil crash.

Conclusion

For the last many months, there was a correction expected but the sudden rise of coronavirus has added a new level of fear among investors and the crash happened before people even realize what is happening.

Markets have corrected by a good margin and now we have officially entered into a bear market (above 20% fall is bear market). While no one can catch the bottom and can’t guarantee that more down fall cannot happen, this is surely not the time to sell off your long term money. If it was your short term money, it should not have been there in equity markets at all.

One of the suggestions right now would be to partly invest some money which you don’t need for the next 8-10 yrs and be ready with some cash incase the market falls further from here.

Disclaimer: This is a highly complex topic and I do not claim to be an expert on this matter. I have shared my opinion and my limited understanding, so please feel free to correct me on any point.