The FIRE (financial independence/retire early) movement has got quite famous for the last couple of years in India. Every investor I meet these days wants to achieve FIRE asap.

I would like to discuss some important points related to FIRE movement and types of FIRE today with you all.

What is FIRE?

FIRE or Financial independence retire early is all about creating enough wealth for yourself as early as possible, so that you are financially independent and free from worries of money. Once you achieve FIRE, your wealth is enough to generate an inflation-adjusted income for you which lasts your lifetime

Let me give you an example.

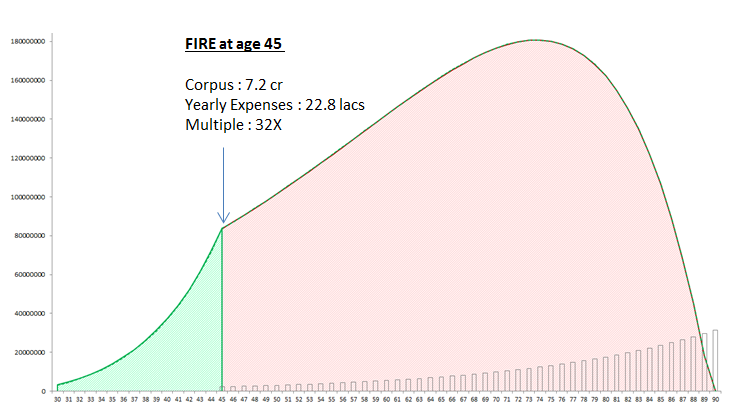

Imagine a 30 yr old person with the monthly expenses of 75,000 per month (or 9 lacs a year) who has 18 lacs of current corpus and is ready to now aggressively invest Rs 80,000 per month for the next 15 yrs and will increase the SIP by 8% each year. The investments growth will happen at 12% and the inflation assumed is 7% (pre-retirement) and 6% post-retirement along with post-retirement returns of 7%

Below is how his corpus will grow and reach a level at age 45 (in 15 yrs time). He will achieve FIRE at the age of 45 with a corpus of 7.2 crores. At that time his expenses would be around 22.8 lacs approx. And his corpus will be around 32X (32 times his expenses). His graph would look like this.

Note that the above graph is based on the rough calculations and assuming that all other goals are taken care of separately.

Do you stop working when you achieve FIRE?

Actually NO

It’s your choice if you want to work after FIRE or not. You can stop working if you wish, but if you still want to work, you can & any money you earn will be a cherry on the top and will only add up to your FIRE goal.

Top 3 reasons why people want to achieve FIRE?

- It’s getting tougher and tougher to be employed till 60 these days, and hence people don’t want to depend on the fact that they will keep earning for a very long time

- Once you achieve FIRE, life is less stressful and you get power in you to live life on your terms. People want to create a situation where they don’t have to dance to the tune of their managers and employers

- People also want to get out of stressful and demanding jobs by the time they hit a mid-life crisis and that means moving to a job that is more enjoyable, even if it pays very little. This is possible only when you have already created enough wealth

But, FIRE is tough!!

Is it very easy to achieve FIRE?

NO, is the answer

Forget FIRE, even normal retirement at 60 is not possible for many people in India. We can clearly see that a big number of investors will have a bad retirement because they are not living their financial lives in the right way and are not on the path to creating sufficient wealth.

FIRE in that sense will only be achieved by a small minority.

Our team has worked with hundreds of investors in the last many years and here are some of my comments on achieving FIRE

- Most of the people who achieve FIRE do that not because of fantastic returns, but very aggressive saving and deploying that money in meaningful investments.

- If you keep your expenses in check and keep it on the lower side, it simply means that it becomes easier for you to achieve FIRE because FIRE is not just about wealth, but both wealth and your expenses

- Most of the people who achieve FIRE are those who earn quite well. If you earn 4 lacs a month and your expenses are 50k per month, You are earning 8 times of expenses every month. That helps a lot

- Most of the people who are not able to control their lifestyle and keep upgrading their life find it tough to achieve FIRE despite having good wealth as the goal post keeps shifting.

In simple words, if you want to know how does a person who achieves FIRE looks like, its like this

- The person has a very good income

- The person saved a very big portion of that income (often more than 60-70%)

- The person is not extravagant and mostly lives a frugal and simple life (but not compromising on fun and desires)

- The person makes sensible investment choices (often earning at least more than inflation)

- The person has mostly created liquid assets and not blocked his money, because you need to generate cash flow at the end

- The person is quite confident of managing the money post FIRE and earning decent returns (he won’t keep all money in FD)

So what are various types of FIRE?

Let me now talk about various types of FIRE. You can pick which type of FIRE you want to work on and you will get some ideas

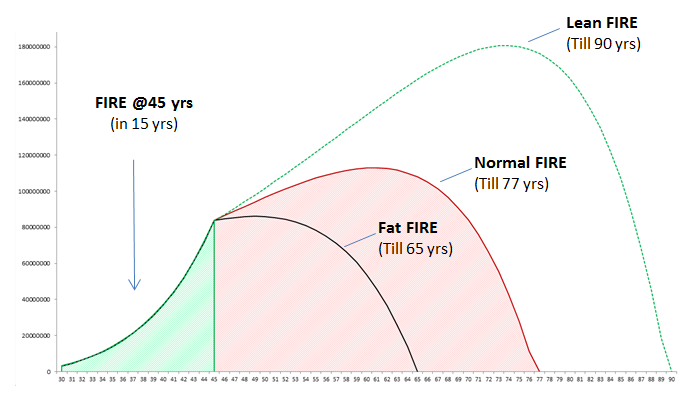

Normal FIRE

Normal FIRE is when you want to create enough wealth which can sustain your current lifestyle and desires for all your life. Note the word “Current lifestyle”, which means that going forward your expenses, your vacations, your spendings, your outings, your desires will be maintained at roughly the same level. This I think is the default mindset and something which most people will like to pursue.

A very high-level thumb rule says that if a 45 yr old has achieved approx 35X corpus (35 times of their yearly expenses), you have achieved normal FIRE

Lean FIRE

Lean FIRE is a concept where you are ready to compromise on your expenses and lifestyle, and ready to live lower expenses. A lot of times it may not be possible for a person to achieve normal FIRE. In which case you can say – “I am ready to live with just 75% of my current expenses, but I want to FIRE faster.. I can’t wait”.

This is like a little compromised version of normal FIRE.. but hey, it’s still some kind of FIRE!

A very high-level thumb rule says that if a 45 yr old has achieved approx 25-28X corpus (25-28 times of their yearly expenses), you have achieved Lean FIRE (Living with 75-80% of your expenses)

Fat FIRE

Fat FIRE is exactly the opposite of Lean FIRE, here you want to spend your life like a king and want to want to freely spend money after FIRE. You don’t want to restrict yourself and take expensive vacations etc. In which case obviously, you need a much bigger corpus to last all your life.

A very high-level thumb rule says that if a 45 yr old has achieved approx 45-50X corpus (45-50 times of their yearly expenses), you have achieved Fat FIRE (Living with 125-140% of your expenses)

What is COAST FIRE?

There is one more concept called Coast FIRE, which is something many of you may have already achieved.

A person is said to have achieved Coast FIRE when he/she has enough corpus already which will grow to FIRE corpus in the future without the need for any new investments. This simply means reaching a point, where you just have to earn money equivalent to your monthly requirements and wait for 5-10-15 yrs to achieve the actual FIRE

Example of Coast FIRE

Let’s say a 30 yrs old person is earning Rs 2 lacs a month. In order to achieve FIRE at age 50, he has to create a corpus of Rs. 6crore. The person aggressively invests his 60% income (ie Rs 1.2 lacs) and starts his wealth creation journey.. In the next 10 yrs, when he turns 40 yrs old he has already created a corpus of 2.5 crores.

At this point, his income is let say 4 lacs a month and he is still saving 2 lacs out of that (his expenses are 2 lacs a month). However now, if he wants to reach his original target of 6 crores in the next 10 yrs, he does not need to put in any new investments. His 2.5 crores will anyways grow to 6 crores in 10 yrs @10% returns.

So his direction and speed is already set in such a way that he can reach his target without putting in any extra effort. If he wants, at this stage of life, he does not need to create an income of 4 lacs.. If he wants he can move to another low-stress job or something else which he wishes which pays less. All he needs is to create an income that can take care of his expenses for another 10 yrs and let his existing corpus grow without touching.

I am sure many of you who are reading this have already achieved Coast FIRE in your life and you are unaware of it. Try to do the calculations

Which category of FIRE you Are Pursuing?

So, which category of FIRE are you pursuing?

I can’t comment on which category of FIRE is right for you because only you can define how kind of life you want to pursue going forward. What money means for you and what level of comfort you want, however, I think Lean FIRE is not for everyone. Lean FIRE is surely some level of compromise and there is almost no margin of safety there. If a few things go wrong, your FIRE goal can go for a toss.

Hence I think one shall target normal FIRE as it’s more realistic and practical. However having said that, one shall try to first reach Lean FIRE and target normal FIRE 5-6 yrs after that.

If you are quite lucky and have enough interest left to earn and invest more money, you can try moving towards Fat FIRE too..

Important Disclaimer

FIRE is a concept and based on mathematical calculations. A small difference in inflation or returns assumption can change the target amount or target year by a big margin, hence look at the discussions above as just an example. You need quite a good level of calculations and discussions with a good financial planner to project your calculations. Also, these are all complicated topics in reality, but for discussion’s sake, these points look simple.

To give you a simple example, if your calculation says that you achieved FIRE and your money will last till age 90 yrs. It’s more of just mathematics. Now if you increase the inflation by 1% and decrease the return by 1%, this may tell you that now your money will last only till 73 yrs (a reduction of 17 yrs) which tells you that these calculations are very dynamic and sensitive to assumptions.

So please take precautions which doing any kind of calculations. This discussion above is just for basic knowledge.

I would love to know what you feel about FIRE and what are your thoughts about it?