Key takeaways:

-

ETH futures and options data show no signs of defensive positioning despite Ether’s 7-month price high.

-

Ether ETF inflows and corporate holdings signal growing conviction from institutional investors.

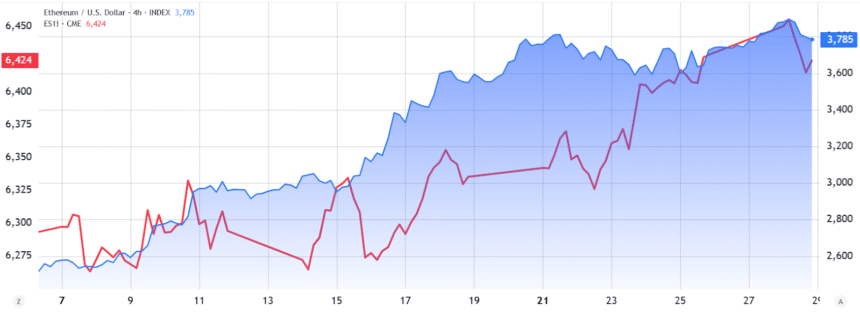

Ether (ETH) price fell 4% after briefly touching $3,940 on Monday. This drop aligned with the broader cryptocurrency market correction, suggesting that no ETH-specific factors triggered the move. While some traders may have been spooked, Ether derivatives held steady, indicating that a potential rally toward $5,000 remains on the table.

ETH traders cautiously predict move to $5,000

Global markets remain focused on United States import tariff negotiations, as analysts warn that failure to reach a deal could sharply increase recession risks. Despite a trade agreement reached with Europe on Monday, China’s deadline looms on Aug. 12. As a result, traders appear more inclined to hold cash or allocate to short-term bonds.

To evaluate whether trader sentiment has shifted following ETH’s pullback, one can look at the monthly futures premium. In neutral conditions, this metric typically ranges from 5% to 10% annualized, compensating for the longer settlement period.

Currently, the ETH futures premium stands at 8%, its highest level in nearly five months. Interestingly, this occurs despite a 55% ETH price increase over the past three weeks. From a bullish standpoint, this suggests traders still have room to apply leverage if ETH pushes above $4,000 with more conviction.

To determine if this trend is limited to futures markets, the options skew metric should be considered. When large traders and market makers anticipate downside risk, the 30-day delta skew rises above the 6% neutral line.

Currently, the Ether options skew reflects balanced expectations for price movement, in contrast to the 8% optimism seen a week earlier. The fact that professionals did not turn defensive after ETH reached its highest level in seven months signals continued confidence from whales and market makers.

The most significant driver of ETH’s recent strength has been spot Ether exchange-traded fund (ETF) inflows. This sets ETH apart from competing assets. Between July 11 and July 25, Ether ETFs posted $4.23 billion in net inflows, lifting total US-listed assets under management to $17.24 billion.

According to StrategicEthReserve, over 40 companies hold at least 1,000 ETH in corporate reserves—equivalent to $3.8 million at current prices. Notably, companies including Bitmine Immersion Tech, SharpLink Gaming, and The Ether Machine collectively hold $8.84 billion worth of ETH.

To put things in perspective, excluding Strategy, the US-listed enterprise led by Michael Saylor, and Bitcoin mining conglomerates, only eight companies hold more than $1 billion worth of BTC on their balance sheets. Despite being relatively late to this trend, companies adopting an Ether-focused strategy are gaining traction at a remarkably fast pace.

From a derivatives market view, ETH traders remain cautiously optimistic. As long as institutional demand holds steady, a move above $5,000 in the short term remains a realistic scenario.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.