Here’s a quick recap of the crypto landscape for Wednesday (August 13) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

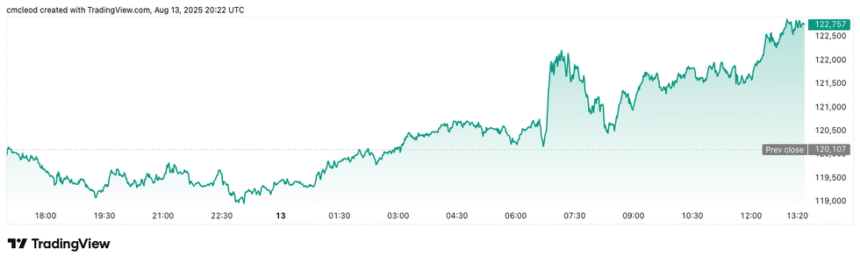

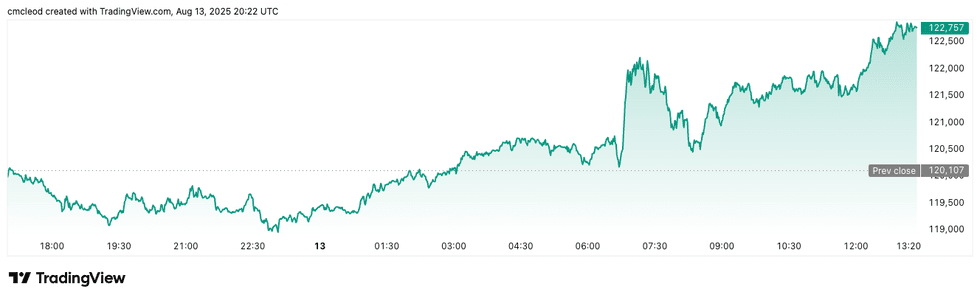

Bitcoin (BTC) was priced at US$122,444, up by 2.6 percent over the last 24 hours, and its highest valuation of the day. It briefly dropped to its lowest valuation of $120,414 shortly after the opening bell.

Bitcoin has found itself at the crossroads of macroeconomic data, political influence and shifting capital flows. US inflation statistics and global central bank dynamics have introduced caution, while stablecoin activity and institutional appetite are hinting at a redistribution into altcoins.

Bitcoin price performance, August 13, 2025.

Chart via TradingView.

Meanwhile, Ethereum (ETH) continued to rally, up by 4.5 percent to US$4,716.60. The cryptocurrency’s lowest valuation on Wednesday was US$4,638.43, and its highest was US$4,738.59.

Glassnode notes that ETH is a bellwether for altcoins, and its current move as capital continues to flow into exchange-traded funds suggests further upside. In an X post on Wednesday, Charles Edwards, founder of crypto quantitative digital asset fund Capriole Investments, shared data showing that 75 percent of Coinbase Global’s (NASDAQ:COIN) volume came from institutional players on Tuesday (August 12).

He also pointed to the outlook for interest rates following the release of July inflation data.

Altcoin price update

- Solana (SOL) was priced at US$200.74, up by 6.1 percent over 24 hours, and its highest valuation of the day. Its lowest valuation was US$195.81.

- XRP was trading for US$3.27, up 0.1 percent in the past 24 hours and at its highest valuation of the day. Its lowest was US$3.24.

- Sui (SUI) was trading at US$3.99, up by 2.3 percent over the past 24 hours, and its highest valuation of the day. Its lowest level was US$3.93.

- Cardano (ADA) was trading at US$0.8827, up by 4.6 percent over 24 hours, and its highest valuation on Wednesday. Its lowest was US$0.866.

Today’s crypto news to know

World Liberty Financial sets up US$1.5 billion crypto treasury

World Liberty Financial, a digital asset venture backed by US President Donald Trump and his sons, has announced plans to establish a US$1.5 billion “crypto treasury” in partnership with ALT5 Sigma (NASDAQ:ALTS).

Under the deal, ALT5 will raise US$1.5 billion through the sale of its own shares. The funds will go toward the purchase of World Liberty’s in-house token, $WLFI, and will also be used to settle litigation, pay down debt and for other corporate uses. ALT5 will ultimately hold about 7.5 percent of existing $WLFI tokens.

Unnamed institutional investors and venture capital firms participated in the share sale. Crypto treasury models have grown in popularity this year amid a friendlier US regulatory stance under the Trump administration.

The project’s leadership is heavily tied to the Trump family, with Trump himself listed as “co-founder emeritus,” and Eric, Donald Jr. and Barron Trump holding co-founder titles.

As part of the arrangement, Eric Trump will join ALT5’s board and Zach Witkoff will serve as its chair.

Bullish shares surge on NYSE debut

Bullish (NYSE:BLSH), the parent company of Bullish Exchange and CoinDesk, began trading on the New York Stock Exchange on Wednesday. Shares were priced at US$37 each, an increase from an earlier target of US$33, with 30 million on offer to raise US$1.1 billion and value the company at nearly US$5.4 billion.

Shares surged as much as 218 percent to reach US$118 on trading volume of roughly 38 million shares, before pulling back to close at US$70.65. The initial public offering pushed the company’s market cap above US$10 billion.

Banking groups push for stablecoin loophole closure

US banking groups, led by the Bank Policy Institute, are urging Congress to close a loophole that allows stablecoin issuers to indirectly offer yields through affiliates. They argue that while new stablecoin laws prevent issuers from directly offering yield, they don’t prohibit crypto exchanges or affiliated businesses from doing so.

The groups contend that this circumvents the law and could lead to a US$6.6 trillion outflow of deposits from traditional banks, potentially disrupting credit flow to American businesses and families.

Banks are concerned that yield-bearing stablecoins undermine their ability to attract deposits, which are crucial for backing loans. The offering of yield is a significant marketing draw for stablecoins, with some, like USDC, already rewarding holders on exchanges such as Kraken and Coinbase.

Safe harbor programs proposed for DeFi

In a Wednesday letter, Andreessen Horowitz (a16z) and the DeFi Education Fund asked the US Securities and Exchange Commission (SEC) and Hester Peirce, head of the commission’s Crypto Task Force, to set up a safe harbor program from broker-dealer registration requirements for non-fungible token (NFT) and DeFi applications.

The group said the letter was a follow up to Trump’s Working Group on Digital Assets, which called on the SEC to give certain DeFi service providers relief from registration provisions under the Exchange Act, specifically those related to broker-dealers, exchanges and clearing agencies. SEC Chair Paul Atkins also directed staff to update “antiquated agency rules and regulations” for certain crypto and blockchain applications in July.

To avoid enforcement actions, a safe harbor provision would exempt some companies that offer crypto-related products and services from enforcement actions. a16z has sent two previous letters to the commission this year recommending safe harbors for NFTs, airdrops and network tokens.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web