Investor Insight

Horizon Minerals’ near-term cash-flow potential, large-scale gold resource base, and strategic processing infrastructure in the prolific Western Australian Goldfields position the company to transition into a sustainable, standalone mid-tier gold producer. Recent acquisitions, operational start-ups and high-grade resource expansions strengthen Horizon’s ability to leverage record gold prices and deliver consistent shareholder returns.

Overview

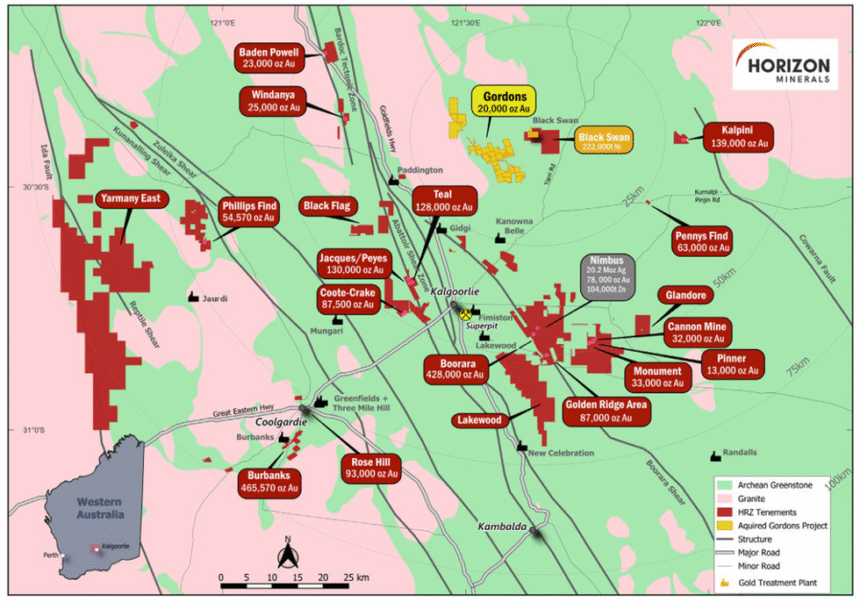

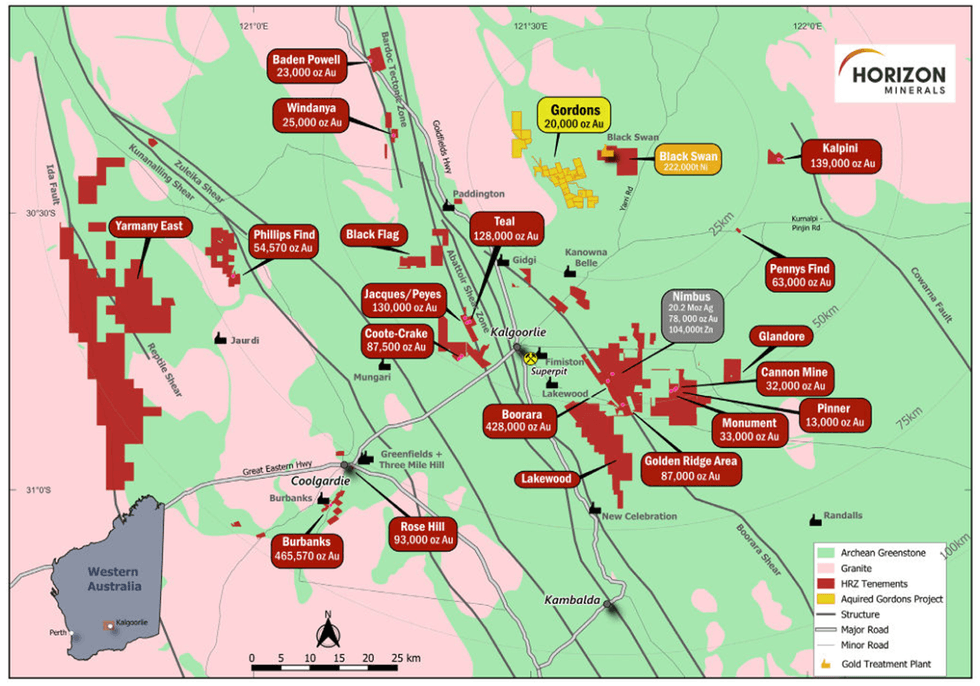

Horizon Minerals (ASX:HRZ,OTC:HRZMF) is an emerging standalone gold producer strategically positioned in the heart of Western Australia’s world-class goldfields. The company has built a robust portfolio of high-quality gold projects complemented by significant base and precious metal resources, all within easy haulage distance of key processing infrastructure.

Horizon currently holds 1.8 Moz of resources across 1,386 sq km of exploration tenure.

Following the transformational merger with Poseidon Nickel in early 2025 and the acquisition of the Gordons project in August 2025, Horizon now controls a total mineral resource of 1.82 million ounces (Moz) of gold at an average grade of 1.84 grams per ton (g/t), along with substantial silver, zinc, nickel, cobalt and manganese resources.

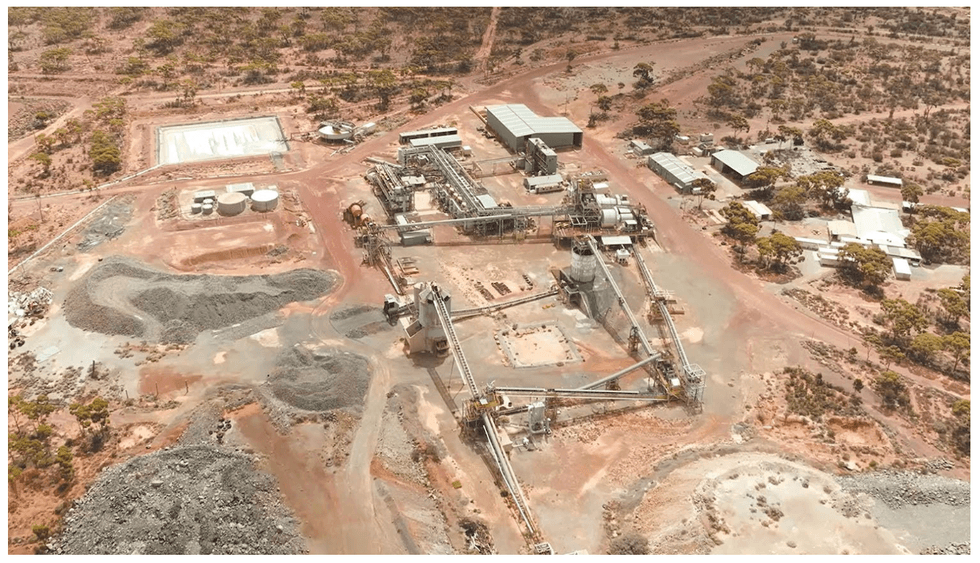

Central to Horizon’s growth strategy is the 2.2 Mtpa Black Swan processing facility, acquired through the Poseidon transaction. Located just 40 km north of Kalgoorlie, the plant is currently on care and maintenance but is fully permitted and connected to power and water. A low-capex refurbishment and conversion to a gold CIL circuit is underway, forming the backbone of Horizon’s plan to establish a sustainable ~100,000 ounce per annum production profile from late 2026.

The Black Swan processing facility is at the heart of Horizon’s stand-alone gold production strategy.

In parallel, Horizon is generating strong near-term cash flow from ore sales and toll milling arrangements at its Boorara and Phillips Find operations, respectively, both of which have delivered first gold in 2025. These operations, together with high-grade satellite deposits such as Burbanks, Penny’s Find, Cannon and the newly acquired Gordons Dam, will provide the feedstock for Black Swan’s initial five-year mine plan.

The company’s consolidated 1,386 sq km landholding spans some of the most prospective geological trends in the Goldfields, offering a mix of advanced development assets, near-mill open pits, and highly prospective exploration ground. With approximately 50,000 metres of drilling budgeted for FY25–26, Horizon is targeting both resource growth and upgrades in confidence across its portfolio.

Leveraging record gold prices and a strong balance sheet, Horizon is now at an inflection point – transitioning from a developer with multiple growth options into a fully integrated, cash-generating, standalone Western Australian gold producer.

Company Highlights

- Emerging standalone gold producer with an extensive WA Goldfields portfolio and a total mineral resource of 1.82 million ounces gold plus significant silver, zinc, nickel, cobalt and manganese resources.

- Acquisition of Poseidon Nickel delivers the 2.2 million tonnes per annum (Mtpa) Black Swan processing facility, strategically located 40 km north of Kalgoorlie, with refurbishment studies underway for conversion to a gold carbon-in-leach (CIL) plant.

- Acquisition of the Gordons project from Yandal Resources adds 77 sq km of tenure near Black Swan, including the Gordons Dam deposit (365 kt @ 1.7 grams per ton gold for 20 koz) with strong exploration upside.

- Continuous cash flow generation from two producing mines, via the ore sale agreement for Boorara (~AU$30 million estimated free cashflow at AU$3,600/oz) and the joint venture toll milling agreement at Phillips Find.

- Record gold prices (>AU$5,000/oz) underpin robust margins and fund ~50,000 metres of drilling in FY25–26, targeting both resource growth and confidence upgrades.

- Combined landholding of 1,386 sq km in Western Australia’s most productive gold belts, following the Poseidon and Gordons acquisitions

Key Projects

Boorara Gold Project

The Boorara gold project, located just 15 kilometres east of Kalgoorlie-Boulder, is Horizon’s cornerstone operation and the foundation of its near-term cashflow strategy. Over the past decade, extensive reverse circulation and diamond drilling has defined a substantial JORC 2012 mineral resource of 10.53 Mt grading 1.27 g/t gold for 428,000 ounces. Boorara is strategically positioned within trucking distance of multiple third-party processing facilities and only two kilometres from Horizon’s 100-percent-owned Nimbus silver-zinc project.

Mine operations at the Boorara gold project

Open pit mining commenced in August 2024, marking the start of Horizon’s transition to gold production. First ore was exposed and mined in late September 2024, with the inaugural gold pour achieved in January 2025. Mining operations are planned over approximately 14 months, with processing to occur over 19 months. A binding ore sale agreement with Paddington Gold provides for the processing of 1.24 Mt of Boorara ore at their Paddington mill until Q2 2026. The agreement is forecast to deliver more than AU$30 million in free cash flow at a gold price of AU$3,600/oz, with upside potential given current spot prices exceeding AU$5,000/oz.

Importantly, Boorara is not just a standalone deposit; it is the central baseload feed source in Horizon’s integrated production plan. It will be supplemented by higher-grade satellite ore from projects such as Burbanks, Penny’s Find, Cannon, Phillips Find and Gordons Dam. This blend of tonnage and grade is designed to optimise mill feed once Black Swan is recommissioned, extending the life of mine and improving overall project economics..

Phillips Find Gold Project

The Phillips Find gold project, 45 kilometres northwest of Coolgardie, is a high-grade goldfield with a production history of about 33,000 ounces. Horizon is advancing the project under a low-risk joint venture with BML Ventures, which funds and manages all mining and operational activities.

First ore was mined in late 2024, with the initial gold pour in February 2025 from toll treatment at FMR Investments’ Greenfields mill. Early campaigns processed 56,300 dry tonnes at 1.63 g/t gold for 2,807 ounces, sold at an average AU$4,894/oz, generating approximately AU$13.7 million in gross revenue to the JV.

Milling agreements include capacity at the Greenfields mill from February to June 2025 and a September-October 2025 campaign for 70,000 tonnes at Focus Minerals’ Three Mile Hill plant. An additional 80,000 tonnes of capacity has been reserved at Greenfields for future ore, giving Horizon strong processing flexibility while complementing production from Boorara and other satellite deposits.

Burbanks Gold Project

Horizon’s high-grade growth asset, the Burbanks gold project, lies nine kilometres southeast of Coolgardie on the prolific Burbanks Shear Zone. With historical production exceeding 420,000 ounces, Burbanks now hosts 465,000 ounces at 2.80 g/t gold across open pit and underground resources. The deposit remains open in all directions, and recent drilling has demonstrated strong potential for significant extensions, with a major 30,000 metre drill campaign underway to support the Black Swan five-year mine plan.

Gordons Project

In August 2025, Horizon expanded its near-mill project pipeline with the acquisition of the Gordons project from Yandal Resources. This 77 sq km package, only 10 kilometres from the Black Swan facility, includes the Gordons Dam deposit with 20,000 ounces in resource and multiple drill-ready prospects, such as Star of Gordon and Malone. The strategic location and exploration upside of Gordons make it an ideal fit for Horizon’s centralised processing strategy.

Black Swan Processing Facility

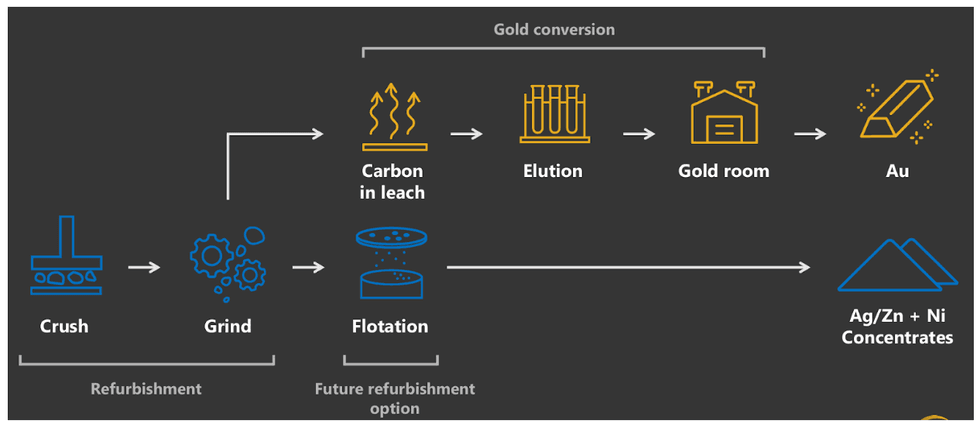

Existing flotation circuit and planned changes to facilitate gold production at Black Swan

At the heart of Horizon’s stand-along gold production strategy is the Black Swan processing facility, secured through a February 2025 merger with Poseidon Nickel. This 2.2 Mtpa concentrator, currently on care and maintenance, is being refurbished and converted to include a gold CIL circuit. All necessary approvals are in place, and engineering studies led by GR Engineering are progressing towards first gold production from Black Swan in late 2026. The plant’s location and capacity offer Horizon the ability to unlock value from its own resources and potentially treat stranded third-party ores.

Other Projects

Cannon Underground Project

- Fully permitted high-grade underground project 30km ESE of Kalgoorlie

- Pre-feasibility study complete

Penny’s Find

- High-grade UG project with MRE of 0.43Mt @ 4.57g/t Au for 63koz

- Pre-feasibility completed December 2024

Nimbus Silver-Zinc Project

- 12.1 Mt @ 52 g/t silver, 0.2 g/t gold, 0.9 percent zinc for 20.2 Moz silver, 77 koz gold, 104 kt zinc

- High-grade core: 0.26 Mt @ 774 g/t silver, 12.8 percent zinc

- Concept study supports concentrate production pathway

Management Team

Ashok Parekh – Non-executive Chairman

Ashok Parekh has over 33 years of experience advising mining companies and service providers in the mining industry. He has spent many years negotiating mining deals with publicly listed companies and prospectors, leading to new IPOs and the initiation of new gold mining operations. Additionally, he has been involved in managing gold mining and milling companies in the Kalgoorlie region, where he has served as managing director for some of these firms. Parekh is well-known in the West Australian mining industry and has a highly successful background in owning numerous businesses in the Goldfields. He was the executive chairman of ASX-listed A1 Consolidated Gold (ASX:AYC) from 2011 to 2014. He is a chartered accountant.

Warren Hallam – Non-executive Director

Warren Hallam is currently a non-executive director of St Barbara Limited and Poseidon Nickel Limited, and non-executive chairman of Kingfisher Mining Limited. Hallam has built a strong track record over 35 years in operations, corporate and senior leadership roles across multiple commodities. This includes previous Managing Director roles at Metals X Limited, Millenium Metals and Capricorn Metals. Hallam is a metallurgist with a Master in Mineral Economics from Curtin University.

Grant Haywood – Managing Director and Chief Executive Officer

Grant Haywood brings over three decades of experience in both underground and open-cut mining operations. During his career, he has served in senior leadership capacities in various mining companies, guiding them from feasibility through to development and operations. His experience spans various roles within junior and multinational gold mining companies, predominantly in the Western Australian goldfields, including positions at Phoenix Gold, Saracen Mineral Holdings, and Gold Fields. He is a graduate of the Western Australian School of Mines (WASM) and has also earned a Masters in Mineral Economics from the same institution.

Julian Tambyrajah – Chief Financial Officer & Company Secretary

Julian Tambyrajah is an accomplished global mining finance executive with more than 25 years of industry expertise. He is a certified public accountant and chartered company secretary. He has served as CFO of several listed companies including Central Petroleum (CTP), Crescent Gold (CRE), Rusina Mining NL, DRDGold, and Dome Resources NL. He has extensive experience in capital raising, some of which includes raising US$49 million for BMC UK, AU$122 million for Crescent Gold and AU$105 million for Central Petroleum.

Stephen Guy – Chief Geologist

Stephen Guy is a geologist with over 25 years of experience in the mining industry, specialising in exploration, production, and project start-ups for both open pit and underground operations. His career spans key regions in Australia, including Western Australia, New South Wales, and Queensland, where he has collaborated with leading companies such as BHP, Newcrest, St Barbara Gold, Fortescue Metals Group (FMG), and Gindalbie Metals. Guy’s expertise covers a diverse range of commodities, including gold, copper, nickel, base metals, and iron ore.

Rob Waugh – Non-Executive Director

Rob Waugh is a senior mining executive with more than 35 years’ experience in the resources sector, operating predominantly in gold and base metals. With a strong track record of exploration and discovery success, Waugh has held senior exploration management roles at WMC Resources and BHP and was previously the managing director of Musgrave Minerals, which was acquired for AU$200 million by Ramelius Resources in 2023.