This opinion piece was submitted to the Investing News Network (INN) by Darren Brady Nelson, who is an external contributor. INN believes it may be of interest to readers and has copy edited the material to ensure adherence to the company’s style guide; however, INN does not guarantee the accuracy or thoroughness of the information reported by external contributors. The opinions expressed by external contributors do not reflect the opinions of INN and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

By Darren Brady Nelson

One of former President Ronald Reagan’s most famous quotes is “trust, but verify.” He made that remark on December 8, 1987, to then-Soviet General Secretary Mikhail Gorbachev as the audience gathered on that historic day for a nuclear arms treaty.

In the wake of US President Donald Trump’s April “Liberation Day” tariffs, it is time once again to “trust, but verify.” That is, that the economy is still on track for a new “golden age of America.” And that we will continue in a “golden age,” pun intended, for investing in gold.

Tariffs are not inflation

Trump’s tariffs have added to uncertainty, but they are not inflationary per se. The famous Nobel Prize-winning monetary economist, Milton Friedman, summarized what he had learned from the most comprehensive empirical study ever undertaken on inflation in the following quote:

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. A steady rate of monetary growth at a moderate level [may allow] little inflation and much growth.”

Another monetary economist of the 20th century, but not quite as famous as Friedman, was Ludwig von Mises. He agreed with the first half of the quote above, but not the second. He also supported a gold standard, as seen below, as protection from inflation and accompanying boom-bust cycles:

“All economic activity is based upon an uncertain future. It is therefore bound up with risk.” Thus: “There is no such thing as a safe investment.” But: “The…gold standard alone is a truly effective check on the power of the government to inflate the currency.”

Tariffs are just taxes

A student of Mises was Murray Rothbard. The latter wrote in Power and Market that the burden of a sales tax falls entirely on the supplier and supply chain, not the consumers, yet tariffs inexplicably do the opposite. The former is closer to the truth, depending on elasticities.

Media pundits often claim that businesses pass forward tax increases, like tariffs, to consumers. This is a half-truth. The other half of this half-truth is that businesses take a hit, so that they invest and hire less. This means foreign businesses, more than American consumers.

And rather than just a 50/50 split between supply and demand, as per the graph below, economics and history show it is more like an 80/20 situation. That 80 includes a pass backward in the supply chain. This means foreign supply chains, more than American supply chains.

Rationale for Trump’s tariffs

Trump’s tariffs have created extra uncertainty, but not nearly as much as the neoliberals, on the left or right, would suggest by their outrage and alarm. Firstly, imports and import elasticities are relatively low in the US.

Secondly, Trump’s strategy is consistent with the same three exceptions to free trade, and in the same order, as did the classical liberal, and godfather of free trade economics, Adam Smith.

The first exception is not only about directly decoupling from communist China, for targeted defense purposes, but also indirectly, for broader strategic purposes, by weakening the Communist Party of China to the point of regime change, as Reagan did to the USSR.

The second and third exceptions, of reciprocity and retaliation, are part of the “art of the deal.” This three-pronged strategy, despite the outcry as being anti-free trade, is not only trying to put America first, but also to restore genuine free trade. It is a well-calculated risk.

Impact of these tariffs

According to the US Bureau of Labor Statistics (BLS) in its press release of July 17: “Import prices ticked up 0.1% in June, following a decrease of 0.4% in May, and an advance of 0.1% in April.”

The BLS added that: “Prices for US imports fell 0.2% from June 2024 to June 2025, matching the 12- month decline for the year ended May 2025. Those were the largest annual decreases since the index fell 0.9% for the year ended February 2024.”

The BLS also provided an interactive chart of the Import Price Index (IPI). Highlights from the Trump 47 era for “all imports” include: IPI increased, but at a declining rate, by 1.7 percent in February, 0.8 percent in March and 0.1 percent in April; then decreased by -0.2 percent in May and -0.2 percent in June.

“Consumer goods” are also illuminating: IPI dropped from 1.2 percent in November 2024 to -0.8 percent in March 2025; then sunk further to -1.2 percent in May before rising to -0.6 percent in June, but still negative.

The story with “industrial supplies and materials” was that: IPI grew at 5.7 percent in February, then plunged to 1.9 percent in March; followed by shrinking down into negative territory of -2 percent in April, -3.6 percent in May and -3.2 percent in June.

Conclusion

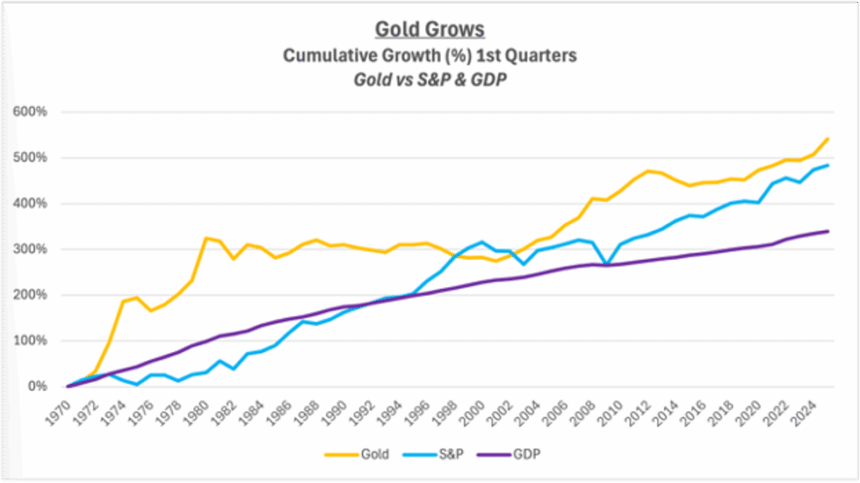

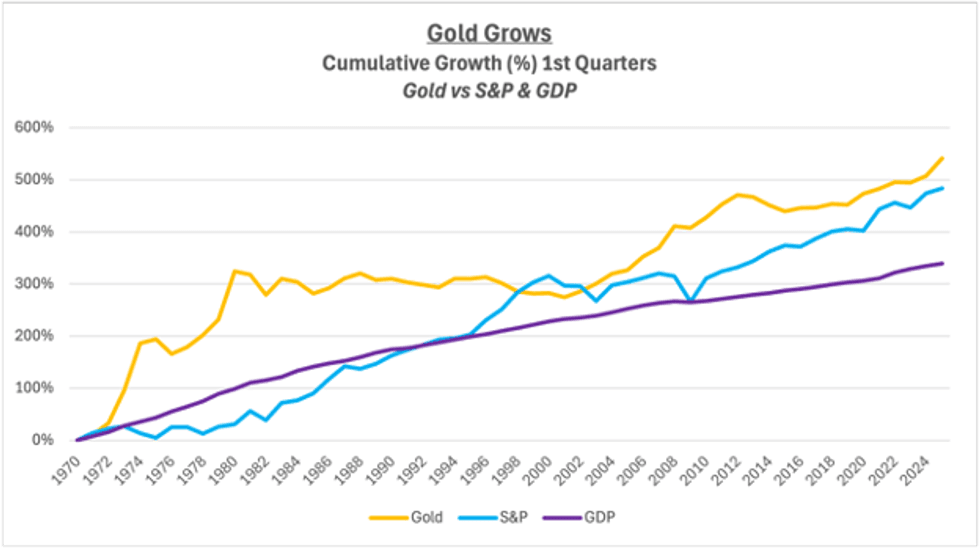

Many Main Street investors, and even those on Wall Street, are aware that gold is a great hedge against both inflation and uncertainty; and it is. But few on either streets also know that it is a great investment that outperforms the S&P Index; and it does.

Gold is very rare indeed, and not just in terms of its physical scarcity, but in its unique ability to be both a safe-haven investment and a performance investment as well. The two charts at the end demonstrate gold’s protection and gold’s growth over the decades.

Therefore, for American investors it is still the right time to “trust” in gold growth to come, “but verify” through gold protection in the meantime. Thus, when one has gold, “heads” you win and “tails” you don’t lose.

About Darren Brady Nelson

Darren Brady Nelson is chief economist with Fisher Liberty Gold and policy advisor to The Heartland Institute. He previously was economic advisor to Australian Senator Malcolm Roberts. He authored the Ten Principles of Regulation and Reform, and the CPI-X approach to budget cuts.

Read the rest of the series: Goldenomics 101: Follow the Money, Goldenomics 102: The Shadow Price of Gold, Goldenomics 103: Gold Protects and Performs.