GreenFI is a fintech company that offers a “climate-friendly” checking and savings account, an investment fund, a cash-back rewards program, and more.

Many Americans want to deal with businesses that strike a balance between profits and conservation, doing what’s good for the planet.

If that’s you, GreenFi might be the right choice as a banking alternative. However, you need to ensure that it has the necessary features to manage your finances effectively. In this full review, we cover the key features, pros and cons, and share some alternatives.

|

GreenFI Details |

|

|---|---|

|

Product Name |

Checking and Savings Account |

|

Monthly Fees |

$0 to $7.99/mo |

|

Cash Back Rewards |

Up to 6% |

|

Savings APY |

Up to 3.00% APY |

|

Promotions |

None |

What Is GreenFi?

GreenFI, formerly Aspiration, is a financial services company that’s dedicated to fighting climate change. For example, deposits never go towards funding oil companies, and through the “Plant Your Change” program, customers can opt to have a tree planted every time their debit card is swiped.

For Plus plan customers, GreenFI will also buy carbon offsets to counter the climate impact of your gas purchases. The company also offers a decent APY on savings and pays cash back of up to 6% at companies that are part of the Conscience Coalition. GreenFi’s banking services are provided by Coastal Community Bank, a member of the FDIC.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Aspiration is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

GreenFi offers both checking and savings accounts with free and paid plan options, a socially responsible investment fund, and cash-back rewards. Here’s a closer look at the key features of each product:

GreenFi (Free Plan)

The free plan allows you to decide how much you want to pay. GreenFI called this “pay what is fair,” but there are no monthly mandatory fees. This plan includes the following features:

- Savings APY of 1.00%* (must have $500 of qualifying debit card transactions during the month)

- Up to 3% cash back on Green Marketplace purchases

- Access to a network of over 55,000 ATMs (deposit services at some locations)

- Mobile app

- Early direct deposit (up to 2 days early)

- Option to plant a tree with every debit card swipe

- Mastercard Purchase Assurance

- Mastercard Cell Phone Protection Benefit

GreenFi Plus (The Paid Plan)

The paid plan is $7.99/mo or pay $5.99/mo if you pay annually. The paid plan comes with fewer restrictions and more benefits.

- Savings APY of 3.00%* (must have $500 of qualifying debit card transactions during the month)

- Up to 6% cash back on Green Marketplace purchases

- Access to a network of over 55,000 ATMs (deposit services at some locations)

- Mobile app

- Early direct deposit (up to 2 days early)

- Option to plant a tree with every debit card swipe

- Mastercard Purchase Assurance

- Mastercard Cell Phone Protection Benefit

- Carbon offsets

- One out-of-network ATM reimbursement monthly

*The higher savings APY of 1.00% or 3.00% is only available on balances up to $10,000. For balances over $10,000, your APY drops to 0.00% (Free plan) or 0.25% (Plus plan). If you have more cash than that, you’re better off using another high-yield savings account that doesn’t have limits on its top APY.

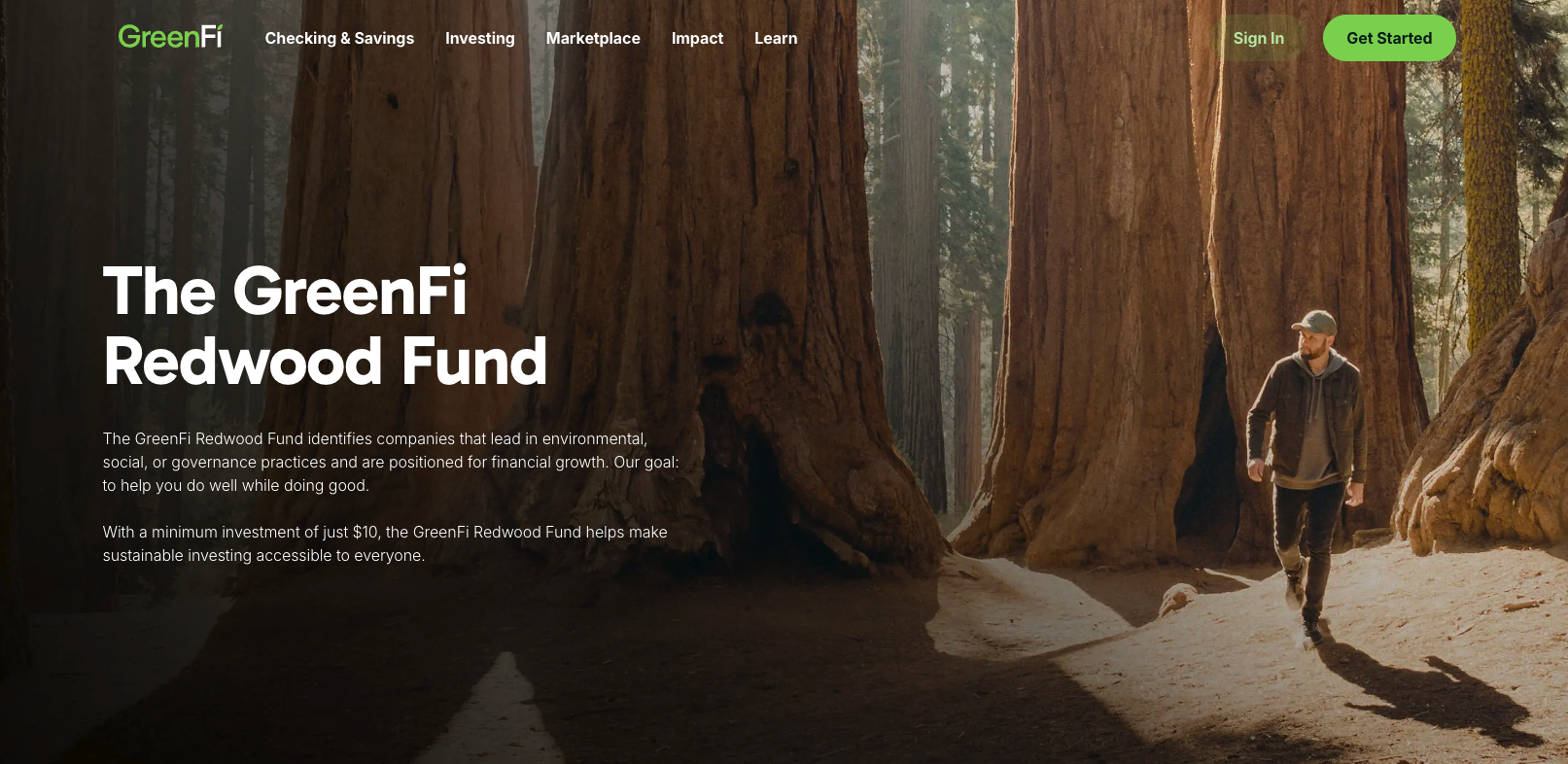

GreenFi Redwood Fund

With a minimum investment of just $10, you can invest in GreenFi’s socially responsible investment fund, which focuses on companies that excel in environmental, social, and governance practices (ESG). The fund is available as a taxable account or in a Traditional IRA.

|

|

Taxable Account |

Traditional IRA |

|---|---|---|

|

Ticker |

REDWX |

REDWX |

|

Min. Investment |

$10 |

$10 |

|

Annual Custodial Fee |

None |

$15 |

|

Annual Contribution Limit |

None |

$7,000 ($8,000 for 50+) |

|

Access to Funds |

Any time |

Age 59.5 |

Cash-Back Rewards

GreenFi’s cash back rewards rate of up to 6% sounds fantastic, but it’s only available from GreenFi partner retailers in its Green Marketplace. These are companies that GreenFI has identified as climate-friendly, and include many popular brands, including the following:

- Burt’s Bees

- Columbia Sportswear

- EV Connect

- Hello Fresh

- Patagonia

- Samsonite

- Tentree

- Tesla Supercharger

- Thrive Market

If you don’t spend a lot of money with those companies, you may want to consider a bank that offers cash back on every purchase instead. Please note that cash back is not available for ACH transfers, mobile check deposits, check payments made through the Payments feature, or ATM withdrawals.

Are There Any Fees?

GreenFI offers a free plan for its checking and savings accounts. If you want to maximize your savings APY and cash back rewards, you can choose to pay $7.99 monthly for the GreenFI Plus plan. The Plus plan also reimburses you for one out-of-network ATM fee per month. There is no fee for in-network withdrawals at over 55,000 ATMs.

How Does GreenFi Compare?

GreenFi offers a solid savings APY of up to 3.00%, but you have to subscribe to the Plus plan at $7.99/month ($5.99/month paid annually) to benefit from the top interest rate. Not only that, but the rate is only available on balances up to $10,000. If you’re looking for the best possible rate on your savings, you’ll want to consider other online banks.

For example, CIT Bank is currently offering 3.75% on its Savings Connect account. A minimum deposit of $100 is required, but unlike GreenFI Plus, there are no monthly fees. And Axos Bank is currently offering a high 4.46% APY on its Axos One Savings account, with no monthly maintenance, minimum balance, account opening, or overdraft fees.

|

Header

|

|

|

|

|---|---|---|---|

|

Rating |

|||

|

Top APY |

3.00% |

3.75% |

4.46% |

|

Cashback Rate |

Up to 6% |

N/A |

1% |

|

FDIC Insured |

|||

|

Cell

|

How Do I Open An Account?

You must be at least 18 years old and a US citizen or permanent resident to open the account. If you qualify, you can open an account within minutes by following a few simple steps:

- Download the GreenFI app and open your account.

- Transfer money using a debit card linked to a U.S. bank account in your name or other apps. The minimum deposit amount is $10. You cannot fund your account with a prepaid debit card or credit card

- As soon as your account is funded, you can start spending with your digital GreenFI debit Mastercard. You will receive a physical card in the mail.

Please note that it may take 2-3 business days for the transferred funds to be credited to your account.

Is My Money Safe?

Yes, deposits in your GreenFI account are FDIC-insured up to $250,000 per depositor, per bank. With four participating banks available, you could receive up to $1 million in coverage.

How Do I Contact GreenFi?

GreenFi is an online fintech, meaning it has no physical branches. You can access customer support by email at support@greenfi.com or by calling 1-800-683-8529, Monday through Friday, 6 AM to 6 PM PST, or Saturday through Sunday, 6 AM to 3 PM PST.

Is It Worth It?

GreenFI is geared for customers who are willing to sacrifice some key features offered by other top online banks in an effort to bank in a way that doesn’t harm the environment. While its 3.00% APY and cash back rewards are decent, you can get more interest on your savings elsewhere (without paying any fees). Additionally, some online banks offer cash back rewards on all of your spending, as well as other perks.

If you’re looking for the most features and highest rates, you’ll want to look elsewhere. If you’re willing to compromise for the good of the planet, put GreenFI at or near the top of your list.

GreenFi Features

|

Account Types |

Checking and savings account, ESG investment fund |

|

Minimum Deposit |

$10 to open, no minimum |

|

Savings APY |

Up to 3.00% APY |

|

Cash-back Rewards |

Up to 6% at Green Marketplace partner retailers |

|

Maintenance Fees |

$0 to $7.99 per month |

|

Branches |

None (online-only bank) |

|

ATM Availability |

55,000 free ATMs |

|

Out-Of-Network ATM Reimbursement |

|

|

Mobile Check Deposits |

Yes |

|

Cash Deposits |

Limited |

|

Customer Service Number |

800-683-8529 |

|

Customer Service Hours |

Mon – Fri: 6am – 6pm PST |

|

Mobile App Availability |

iOS and Android |

|

Bill Pay |

Yes |

|

FDIC-Insured |

Yes, through partnership with Coastal Community Bank |

|

Promotions |

None |

The post GreenFi Review | Eco-Friendly Online Banking & Investing appeared first on The College Investor.