- Appointment of Marketing Manager, Michael Tamlin, to lead product strategy and end-user engagement.

- Partnership with TiPMC Consulting extended, providing strategic titanium market insights.

- Bulk metallurgical testwork progressing well, producing concentrate for downstream processing and larger product samples for end-user evaluation.

Appointment of Marketing Managerto Accelerate Product Development

Empire has appointed Mr. Michael Tamlin as Marketing Manager, which is aligned with the Company’s objective to optimise product development, assess commercial process flowsheet options and progress the Project toward a feasibility study.

Further strengthening the Company’s in-house product development capabilities. Mr. Tamlin is a metallurgist with over 30 years’ experience in the resources sector, including senior roles in marketing and commercialising mineral products. Most recently, he served as Head of Lithium at Neometals Ltd, where he was responsible for managing the pilot development and commercialisation of the ELi™ lithium hydroxide production process in joint venture with Mineral Resources Ltd. His expertise will be instrumental in building Pitfield’s product strategy and engaging with potential end-users in high-value titanium markets.

Continuing Partnership with TiPMC Consulting:

Empire has extended its consultancy agreement with TiPMC, a highly respected, US-based titanium industry consultancy. TiPMC will provide oversight of the titanium pigment and metal markets and provide guidance to the Company’s technical and marketing team as they continue to develop the processing flowsheet and optimise the products.

Commenting on the announcement, Shaun Bunn, Managing Director, said:

“I am delighted to welcome Michael to our team. His extensive marketing expertise will be invaluable as we move toward defining the economic potential and product strategy for Pitfield. This appointment marks an important next step towards building a strong, in-house team, an approach which has been key to our successful and rapid progress.

“We are also very pleased to continue to be working with TiPMC Consulting, whose reputation and experience in the titanium industry is unparalleled.”

Product Development Update

Initial results from the large-scale metallurgical testwork programme, involving mineral separation techniques that required bulk feed samples of between approximately 0.5 to 1.5 tonnes each, was announced on 28 August 2025. The bulk testwork programme is progressing well, focusing on ore scrubbing, desliming and gravity spiral testwork, as well as flotation testwork on both the fines fraction, separated in the desliming step, and whole of ore samples. Large scale scrubbing and spiral gravity testwork has been completed on Thomas and Cosgrove weathered sandstone bulk samples and the screened fines have been sent for flotation testwork. As part of this programme, mineral concentrates will be produced for downstream processing, testing both hydrometallurgical and product finishing flowsheet concepts.

This bulk testwork programme will produce significant volumes of concentrates which will feed into the product development and optimisation testwork and result in larger product samples which can be delivered to potential end users for assessment. The role of Marketing Manager will be fundamental to identifying these potential end users and for the development of a high value customer base for a variety of titanium products from Pitfield.

The Marketing Manager will also be responsible for conducting market research, focusing on high value end uses and likely consumers, preparing a Marketing Strategy and Marketing Presentation for the Project and for identifying key customers and suitable product suites in advance of sending out marketing enquiries and product samples.

About TiPMC Consulting

TiPMC Consulting provides independent consulting analyses, perspectives and recommendations for financial as well as industry functions and segments. Their expertise includes thorough reviews of business data as well as the operational, technical, and marketing functionalities for mining, metals, pigments, and chemical industry segments.

Their industry clients recognize the value of their incisive focus on the TiO2 value chain as well as associated businesses, including thorough reviews of fluorochemicals, fluoropolymers, titanium metal and alloys, costings, and other industries associated with the titanium value chain.

The Pitfield Titanium Project

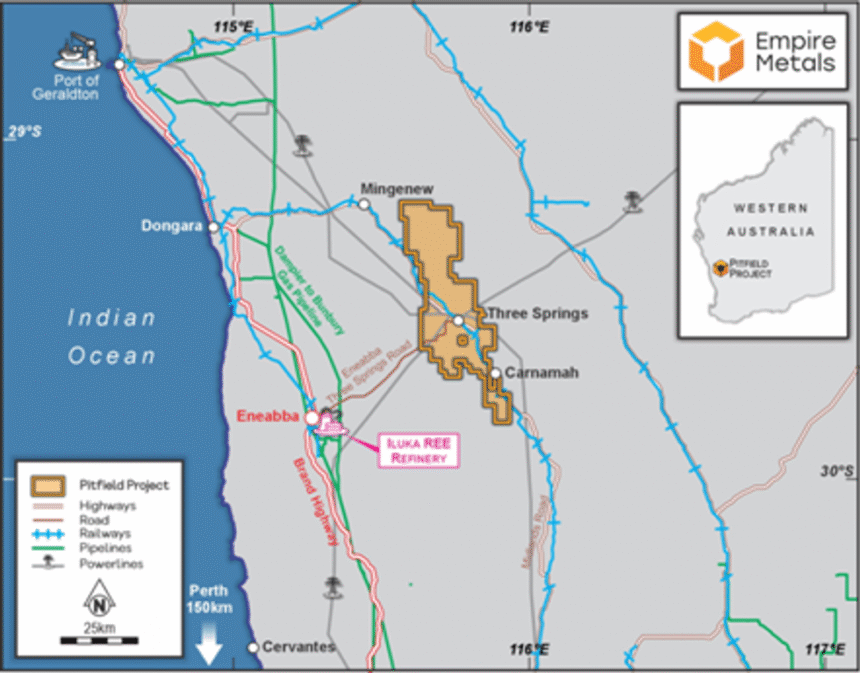

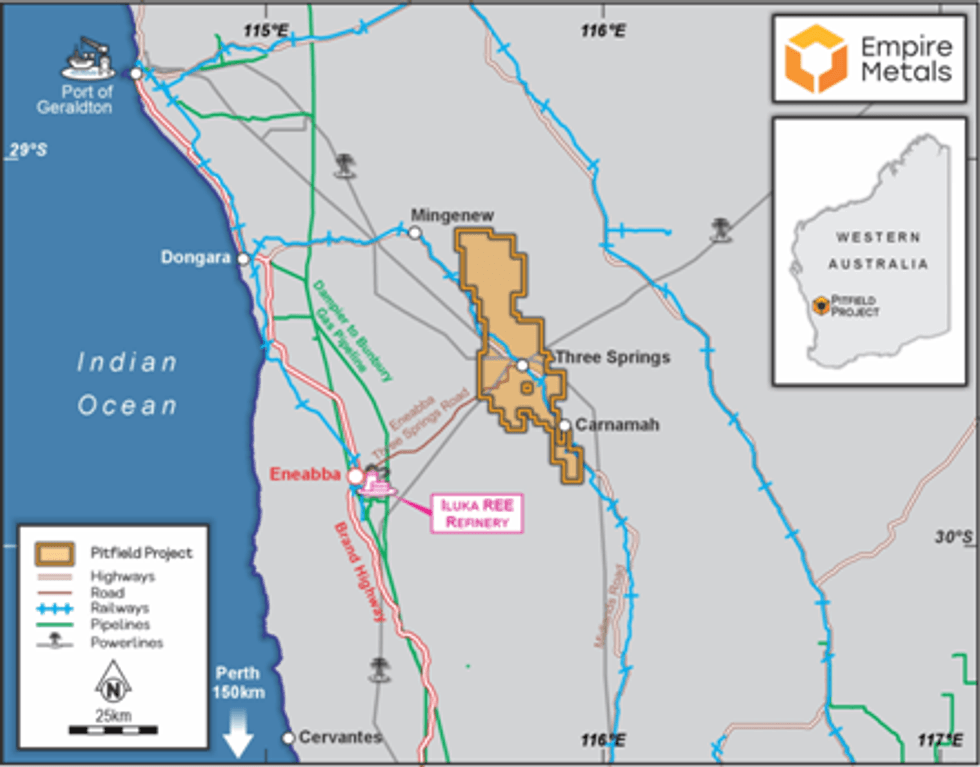

Located within the Mid-West region of Western Australia, near the northern wheatbelt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region’s capital and major port. Western Australia is a Tier 1 mining jurisdiction and has mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines (refer Figure 2).

Figure 2. Pitfield Project Location showing theMid-West Region Infrastructure and Services.

Figure 2. Pitfield Project Location showing theMid-West Region Infrastructure and Services.

Competent Person Statement

The scientific and technical information in this report that relates to process metallurgy is based on information reviewed by Ms Narelle Marriott, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Ms Marriott is a member of the AusIMM and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code 2012. Ms. Marriott consents to the inclusion in this announcement of the matters based on their information in the form and context in which it appears.

The technical information in this report that relates to the geology and exploration of the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr. Faragher is a member of the AusIMM and has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code 2012. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQX-traded exploration and resource development company (LON: EEE,OTCQX: EPMLF) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the in-situ mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, in-situ bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the in-situ weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. See RNS dated 12 June 2024 for full details.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.