Here’s a quick recap of the crypto landscape for Wednesday (October 1) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

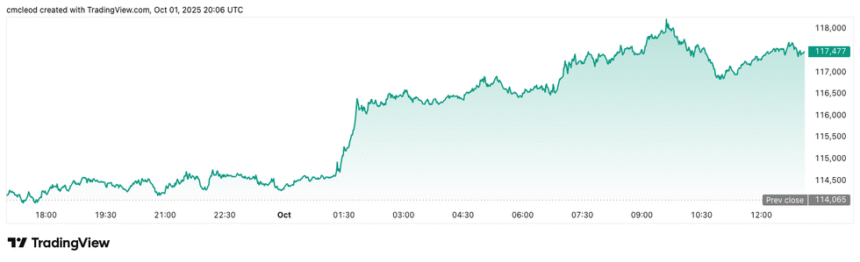

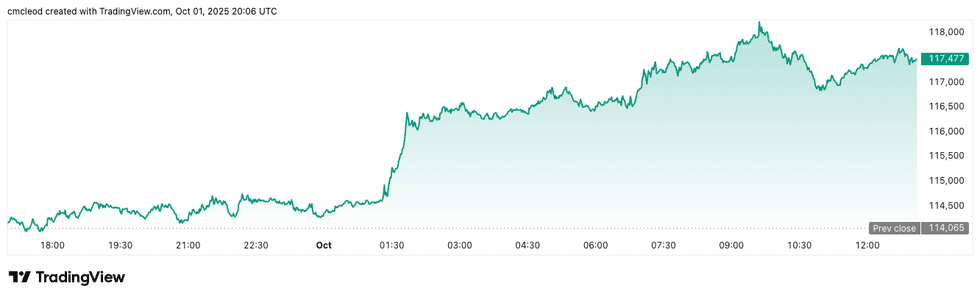

Bitcoin (BTC) was priced at US$117,469, trading 2.6 percent higher over the past 24 hours. Its lowest valuation of the day was US$116,545, while its highest was US$118,007.

Bitcoin price performance, October 1, 2025.

Chart via TradingView.

Bitcoin hit a two week high after Wall Street’s open on Wednesday as investors sought alternative safe-haven assets like crypto and gold amid a US government shutdown. Meanwhile, weak US jobs data reinforced optimism about another Federal Reserve interest rate cut later this month, further supporting risk assets.

Showing strong bullish momentum, Bitcoin is signaling that its previous resistance at US$117,300 could be challenged or potentially overcome. “Bitcoin is trying to break out from its Monthly Range already on the first day of the new month of October,” trader and analyst Rekt Capital said in his latest market commentary.

Traders suggest that the path toward the next target levels between US$122,000 and US$127,000 is opening up. A breakout could signal readiness for a move to new highs, potentially to the US$138,000 level.

Bitcoin dominance in the crypto market is at 58.2 percent, showing a slight week-on-week rise.

Ether (ETH) is also performing well, up 4.1 percent over 24 hours to US$4,334.78. Ether’s lowest valuation on Wednesday was US$4,282.50, and its highest was US$4,342.69. Market commentators note that exchange-traded fund (ETF) flows and institutional treasuries remain drivers of demand for Ether.

Crypto derivatives and market indicators

Total Bitcoin futures open interest was at US$85.39 billion, while Ether open interest stood at US$57.42 billion

Bitcoin liquidations have reached US$26.63 million over the past four hours, with shorts representing the majority, signaling ongoing buying pressure. Ether liquidations totaled US$14.29 million over the same period

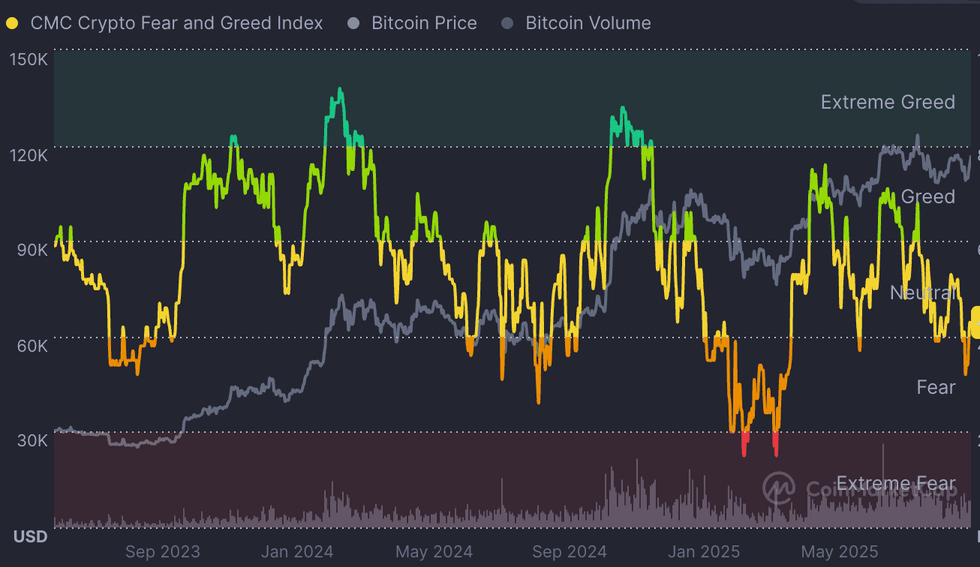

Fear and Greed Index snapshot

CMC’s Crypto Fear & Greed Index has climbed back into neutral territory after dipping to fear during the last week of September. The index currently stands around 42.

Altcoin price update

- Solana (SOL) was priced at US$220.16, an increase of 5.4 percent over the last 24 hours. Its lowest valuation on Wednesday was US$217.81, and its highest valuation was US$220.69.

- XRP was trading for US$2.96, up by 3.2 percent over the last 24 hours, and its highest valuation of the day. Its lowest valuation of the day was US$2.92.

Today’s crypto news to know

Met seizes US$7 billion in Bitcoin in largest crypto bust

The Metropolitan Police have confirmed the largest cryptocurrency seizure in history, confiscating 61,000 BTC worth around US$7.2 billion. The stash was uncovered during a 2018 raid on Zhimin Qian, a Chinese national convicted last week of acquiring criminal property under the UK’s Proceeds of Crime Act.

Prosecutors said Qian ran a Ponzi-style investment scheme in China from 2014 to 2017, targeting more than 128,000 victims, many of them elderly. She converted the stolen funds into Bitcoin, which authorities later recovered from hardware wallets in her London residence. Police described the seizure as the culmination of a seven year investigation, noting that the value eclipses previous records for any single Bitcoin confiscation.

Trump-linked crypto firm eyes commodities, consumer products

World Liberty Financial, the crypto venture tied to US President Donald Trump, has announced plans to expand into tokenized commodities and launch a crypto-linked debit card.

Speaking at Token 2049 in Singapore, CEO Zach Witkoff said the card will bridge digital assets with retail spending, with a pilot expected by early 2026. The company is also exploring the tokenization of oil, gas, timber and other raw materials, positioning the firm to move beyond stablecoins and governance tokens.

World Liberty’s flagship stablecoin, USD1, has quickly grown into the fifth largest in circulation, backed by US treasuries and marketed as a tool to reinforce dollar demand abroad.

Metaplanet becomes fourth largest corporate Bitcoin holder

Japanese investment firm Metaplanet (TSE:3350,OTCQX:MTPLF) has acquired 9,021 BTC valued at US$623 million, becoming the fourth largest corporate holder of the asset. The company now trails only Strategy (NASDAQ:MSTR), MARA Holdings (NASDAQ:MARA) and XXI in corporate Bitcoin reserves.

CEO Simon Gerovich said Metaplanet is targeting 210,000 BTC by 2027, a level equal to about 1 percent of total supply. The firm reported US$16.3 million in Q3 revenue, a 116 percent increase over the prior quarter. Management has raised its 2025 revenue forecast to US$45.4 million following the strong quarter.

Foresight Ventures launches stablecoin infrastructure fund

Foresight Ventures, a global crypto venture capital firm, has launched a US$50 million stablecoin infrastructure fund, calling it the first fund specifically dedicated to supporting the entire stablecoin ecosystem.

The fund will invest in companies and projects involved in stablecoin issuance, coordination, exchange mechanisms, compliance, payment-focused blockchains and other innovative applications where stablecoins intersect with real-world assets, artificial intelligence, on-chain foreign exchange and merchant acquiring.

“Stablecoins are no longer peripheral — they are fast becoming the backbone of modern payments,” said Alice Li, managing partner at Foresight Ventures. “With this dedicated fund, we aim to accelerate their integration into the traditional financial framework in a way that is seamless, compliant, and scalable, enabling mass adoption worldwide.”

By deploying targeted capital, the fund aims to accelerate the integration of stablecoins into traditional finance in a way that is scalable, compliant and user-friendly, enabling mass adoption worldwide.

Foresight Ventures has backed projects like Ethena, Noble, Codex, Agora and WSPN. The fund comes alongside the company’s research report on stablecoin-native blockchains.

CoinShares to acquire Bastion Asset Management

CoinShares announced Wednesday that it will acquire London-based crypto investment manager Bastion Asset Management as part of its strategy to expand crypto investment products in the US.

CoinShares expects to obtain deep quantitative expertise and proven systematic trading capabilities from Bastion to offer actively managed investment exchange-traded products.

“This acquisition perfectly aligns with our vision to provide our global investor base with comprehensive digital asset management solutions,” said Jean-Marie Mognetti, CEO and co-founder of CoinShares, in a press release announcing the acquisition. “Having worked closely with Bastion over the course of the last year, we have experienced firsthand the performance of their strategies and witnessed their expertise in systematic digital asset investing. Bastion’s institutional-grade approach and proven track record in quantitative alpha generation significantly enhances our ability to serve sophisticated investors seeking actively managed digital asset solutions.”

Hashdex adds Cardano token to Nasdaq Crypto Index US ETF

Hashdex Asset Management announced that its Hashdex Nasdaq Crypto Index US ETF (NASDAQ:NCIQ) has added Cardano to its portfolio, increasing the number of cryptocurrencies from five to six.

This makes NCIQ the only crypto index fund with more than five assets.

Cardano was added upon its completion of six months of derivatives trading on regulated US markets, meeting the rules needed for inclusion by the US Securities and Exchange Commission. The ETF started with two cryptocurrencies and has grown to include Bitcoin, Ether, Solana, XRP, Stellar and now Cardano.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web