Here’s a quick recap of the crypto landscape for Wednesday (October 8) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

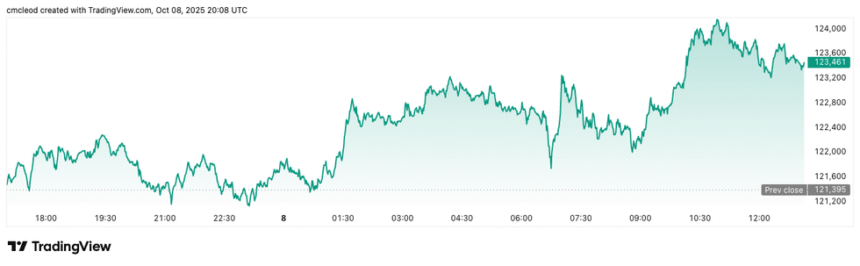

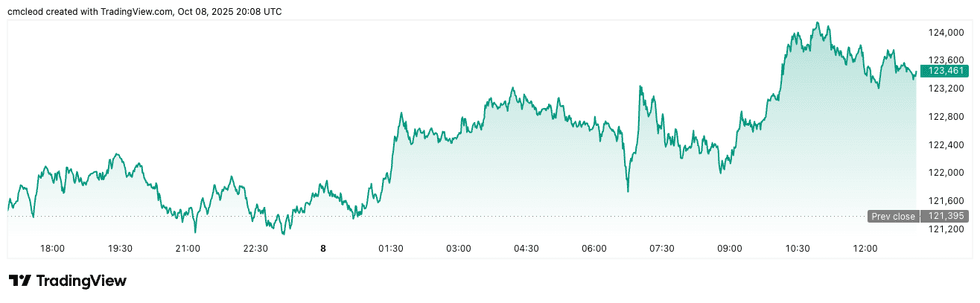

Bitcoin (BTC) was priced at US$123,495, up by 1.5 percent in 24 hours. The cryptocurrency’s lowest valuation of the day was US$121,829, and its highest was US$124,072.

Bitcoin price performance, October 8, 2025.

Chart via TradingView.

Despite retreating to around US$121,000 on Tuesday (October 7), Bitcoin on-chain data and a rising relative strength index still indicate strong momentum and accumulation, with resistance near US$135,000 and support around US$113,300. Analysts believe the crypto market is transitioning from a speculative phase to a “maturity phase,” where institutional strategies and asset allocation will drive price discovery rather than retail hype.

A new report from CF Benchmarks forecasts that Bitcoin could climb another 20 percent to reach US$148,500 by the end of 2025, while the number of crypto exchange-traded funds (ETFs) is expected to double to 80.

The report also projects that stablecoins could hit US$500 billion in circulation.

Various macro factors are shaping this bullish narrative for the sector. Market uncertainty tied to US President Donald Trump’s economic and fiscal policies, his ongoing tension with the Federal Reserve and uncertainty surrounding the ongoing government shutdown have spurred what analysts describe as a “debasement trade.” Investors seeking protection from currency risk are turning to traditional hedges like gold, and increasingly to Bitcoin.

The Fed’s recent interest rate cut has provided additional support for risk assets. CF Benchmarks expects two more reductions by the end of the year, bringing rates closer to the 3.25 percent level.

Despite inflation concerns, analysts argue that Bitcoin remains undervalued, sitting at the lower end of its estimated fair-value range between US$85,000 and US$212,000. According to trader Ted Pillows, if Bitcoin manages to hold the US$120,000 area, it could mark the beginning of a reversal phase and signal renewed bullish momentum.

By Wednesday afternoon, Bitcoin had steadied near US$123,400, recovering some losses, with ETF inflows continuing to boost institutional confidence. The total market cap of cryptocurrencies currently stands at around US$4.3 trillion, per CoinGecko, while the circulating value of stablecoins has already surpassed $300 billion.

Ether (ETH) also slid after last week’s rally, but has since recovered some of its losses. It was up by 0.7 percent over 24 hours to US$4,518.05. Ether’s lowest valuation on Wednesday was US$4,441.20, and its highest was US$4,544.36.

Altcoin price update

- Solana (SOL) was priced at US$229.20, an increase of 1.6 percent over the last 24 hours and its highest valuation of the day. Its lowest valuation on Wednesday was US$220.04.

- XRP was trading for US$2.91, up by 3.2 percent over the last 24 hours. Its lowest valuation of the day was US$2.86, and its highest was US$2.92.

Crypto derivatives and market indicators

Total Bitcoin futures open interest was at US$98.85 billion, an increase of roughly 0.84 percent in the last four hours.

Ether open interest stood at US$60.24 billion, down by 0.07 percent in four hours.

Bitcoin liquidations were at US$34.01 million over four hours, primarily forcing long positions to close, which could lead to selling pressure. Ether liquidations totaled US$25.18 million, with the majority being short positions.

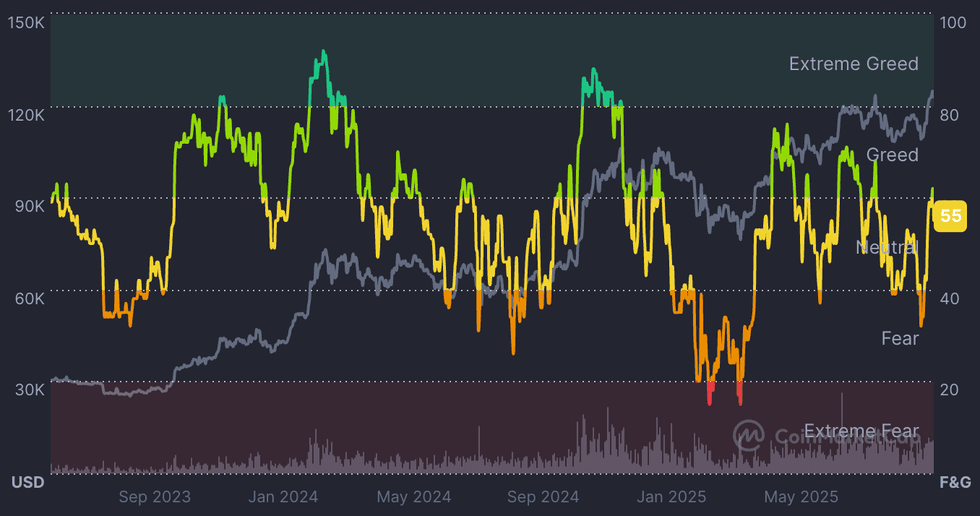

Fear and Greed Index snapshot

CMC’s Crypto Fear & Greed Index climbed into high neutral territory after dipping to fear during the last week of September. The index currently stands around 55, inching closer to greed.

Today’s crypto news to know

JPMorgan says stablecoins could add US$1.4 trillion in dollar demand by 2027

A new JPMorgan Chase (NYSE:JPM) research note estimates that global stablecoin adoption could generate up to US$1.4 trillion in additional demand for US dollars within the next two years, according to Reuters.

The bank’s analysts argue that as foreign investors and corporations increasingly hold dollar-pegged stablecoins, they will effectively strengthen the greenback’s global position. The report projects that the stablecoin market could reach US$2 trillion in a high-end scenario, up from roughly US$260 billion today.

With 99 percent of stablecoins pegged 1:1 to the US dollar, JPMorgan says expansion will translate directly into higher dollar-denominated reserves. The findings counter fears that digital currencies could accelerate “de-dollarization” by offering alternatives to the US financial system.

ICE to invest US$2 billion in Polymarket

Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, is making a major bet on crypto-powered prediction markets. The company announced plans to invest up to US$2 billion in Polymarket, valuing the blockchain-based betting platform at about US$8 billion, a sharp rise from its US$1 billion valuation just two months ago.

Polymarket has gained prominence for its political, sports and entertainment wagers, including high-profile bets on the US presidential race. The deal will allow ICE to distribute Polymarket’s market data globally, signaling a push to integrate event-based contracts into mainstream finance. Founder Shayne Coplan said in a press release that the investment “marks a major step in bringing prediction markets into the financial mainstream.”

The firm is also working to re-enter the US market after acquiring a small derivatives exchange earlier this year.

BNY Mellon to explore tokenized deposits

BNY Mellon, the world’s largest custodian bank, is reportedly exploring tokenized deposits to enable instant, 24/7 fund transfers for clients, aiming to overcome limitations in legacy systems. Carl Slabicki, executive platform owner for Treasury Services, stated that this initiative is part of an effort to upgrade real-time and cross-border payments. The goal is to move a portion of BNY’s US$2.5 trillion daily payment flow onto the blockchain.

Slabicki highlighted that tokenized deposits help banks overcome technology constraints, facilitating the movement of deposits and payments within their own ecosystems and eventually across the broader market.

S&P Global to launch new crypto ecosystem index

The S&P Global, in partnership with Dinari, is creating a new investment index that will bring together both cryptocurrencies and publicly traded blockchain-related companies into a single benchmark called the S&P Digital Markets 50 Index. The index will include 15 cryptocurrencies and 35 public companies in the sector.

No single component will exceed 5 percent. Major companies like Strategy (NASDAQ:MSTR), Coinbase Global (NASDAQ:COIN) and Riot Platforms (NASDAQ:RIOT) are expected to be included.

Dinari plans to issue a tokenized version of the index, known as a “dShare,” which would allow investors to gain direct exposure. The investable version is expected to launch by the end of 2025.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web