Rare earth element (REE) recycling is moving from niche curiosity to strategic necessity as the clean energy transition increasingly stokes demand for permanent magnets.

Currently, less than 1 percent of rare earths are recycled, even as magnet demand is projected to triple by 2035. The gap could leave the west facing as much as a 30 percent supply shortfall unless scrap flows are tapped at scale.

“Today, magnetic REEs make up around 30 percent of overall REE volume, but they capture more than 80 percent of the value,” McKinsey notes in a July report. “Moving forward, global demand for magnetic REEs is expected to triple from 59 kilotons (kt) in 2022 to 176 kt in 2035, driven by strong growth in electric vehicle (EV) adoption, which is outpacing the substitution of REEs with copper coil magnets, as well as the high rate of renewable capacity expansions in wind.”

Policymakers are also starting to act: the EU’s Critical Raw Materials rules aim for recycling to meet roughly a quarter of the region’s rare earths needs by 2030, prompting public-private pilots and new plants across Europe.

At the same time, startups are commercializing lower-emission and higher-yield separation methods for NdFeB magnets and other feedstocks, from automotive scrap to end-of-life wind turbines.

One such company is Cyclic Materials. Founded in 2021, the privately owned Canadian cleantech company is working to advance a circular supply chain for REEs in North America.

The Investing News Network sat down with CEO and co-founder Ahmad Ghahreman at the recent Rare Earth Mines, Magnets & Motors event in Toronto, Canada, to discuss rare earths recycling and his vision for Cyclic’s growth.

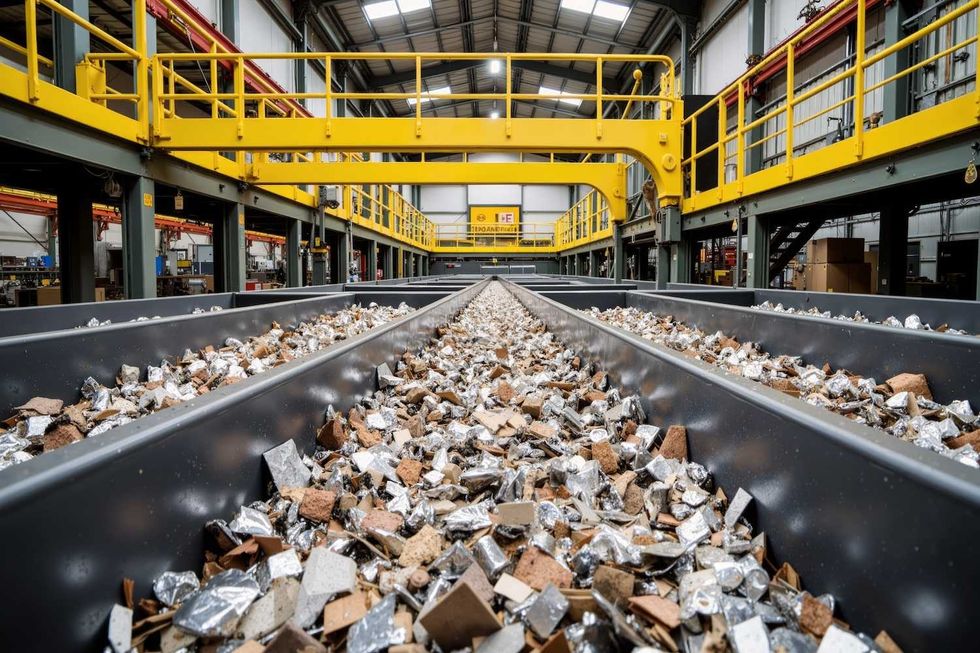

“Our goal is to make these metals more circular by recycling end-of-life products, from electric motors in your cars to power tools in the garage, hard disk drives in data centers. The list really goes on — MRI machines, medical devices and whatnot, and basically recycle REEs and supply those back into the market,” he said.

Unlike other metals like copper, aluminum and nickel, which boast recycling rates of 40 percent, the rare earths recycling market has struggled. Part of the problem is the difficulty in separation.

Citing McKinsey’s report, Ghahreman noted that technical challenges are a major impediment to REE recycling. Magnets, often bonded with iron or steel, typically end up in steel recycling streams, causing valuable REEs to be lost.

Historically, low volumes of magnets in the market limited recycling efforts, but with demand for magnets set to surge — driven by EVs, wind turbines and electronics — recycling is becoming increasingly critical.

Cyclic’s proprietary MagCycle and REEPure technologies recover and refine REEs from end-of-life magnets in the products Ghahreman listed above, turning waste into reusable raw materials.

“For every 100 tonnes of material that comes to Cyclic Materials, more than 99 tonnes of that is recycled as a product,” he said. The remaining 1 percent is mixed, unrecyclable plastics.

After launching its first commercial demo plant in 2023 and a hydrometallurgical facility in Kingston, Ontario, in 2024, Cyclic is now expanding internationally, with Mesa, Arizona, marking its first US site.

Domestic rare earths supply key as China tensions rise

Rare earths recycling is expected to be crucial to developing a robust critical metals supply chain outside China, which has dominated the sector’s refining and processing capacity for decades.

China is known for flexing its control over the market during times of tension — earlier this year, Beijing responded to US President Donald Trump’s tariffs with retaliatory rare earths export controls. In June, China granted several automakers fast-track licences helping to ease some of the market tension.

However, in October, China once again tightened export controls on 12 of the 17 rare earths, including holmium, erbium and europium — key inputs for EVs, aerospace and defense. Exporters now need licenses, and Beijing is expected to reject applications linked to military or advanced artificial intelligence uses.

The rules extend to foreign companies using Chinese rare earths or technology, echoing US-style export restrictions, with violators risking loss of access to Chinese suppliers.

The new export restrictions have escalated tensions with the US, with Trump threatening to impose “massive” new tariffs on Chinese imports. He has also criticized China’s actions as “hostile,” and accused it of attempting to monopolize global supply of rare earths, which are crucial for industries like EVs and aviation.

Against that backdrop, Ghahreman sees Cyclic steadily ramping up its capacity and output for the next decade.

“Within the next five to 10 years, Cyclic Materials’ recycled rare earth products are expected to supply enough material equivalent to three or four rare earth mines,” he said, adding that the company isn’t competition for traditional miners, but more of a supplement to the mining sector as demand for rare earths is projected to outpace production.

More immediately, Cyclic announced a US$25 million investment to establish North America’s first Center of Excellence for rare earths recycling in Kingston, Ontario, in June.

Ghahreman expects the Mesa, Arizona, site to open during the first half of 2026.

While he would not speculate on when an initial public offering may be coming, in April, Amazon’s (NASDAQ:AMZN) Climate Pledge Fund was announced as an investor in Cyclic’s Series B round.

Although the company has growth ambitions like any other, Ghahreman was adamant that Cyclic exists because of two very specific statistics. “The key reason Cyclic Materials was started was that rare earth metals are the most critical of metals because of the projection for their consumption in our future gadgets, but at the same time, the least circular of metals because they’re not being recycled today,” he explained.

“Those two stats didn’t sit well with me, and I really needed and wanted to change that.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web