Key Points

- A W-4 tells your employer how much federal income tax to withhold from your paycheck.

- A W-2 reports your annual wages and the total taxes withheld so you can file your tax return.

- You fill out a W-4 when you start a job or update your tax situation and your employer issues a W-2 each January.

If you’ve ever started a new job and wondered why you fill out one form in January and receive another the following January, you’re not alone.

The W-4 form and W-2 form are two of the most common IRS documents employees handle, and they’re closely related. The W-4 controls how much tax is taken out of each paycheck. The W-2 summarizes those details at year’s end so you can report your income and file your tax return.

Understanding how these forms work together can prevent surprises at tax time – like unexpected bills or refunds that are larger than necessary.

|

Feature |

Form W-4 |

Form W-2 |

|---|---|---|

|

Purpose |

Tells employer how much tax to withhold from your paycheck |

Reports annual income and withheld taxes and benefits |

|

Who Fills It Out |

Employee |

Employer |

|

When Completed |

When you start a new job or after a life event |

Every January |

|

Used By |

Employer payroll department |

Employee, IRS, and state tax agencies |

|

Where To Get It |

Employer HR or IRS Website |

Provided by Employer |

Would you like to save this?

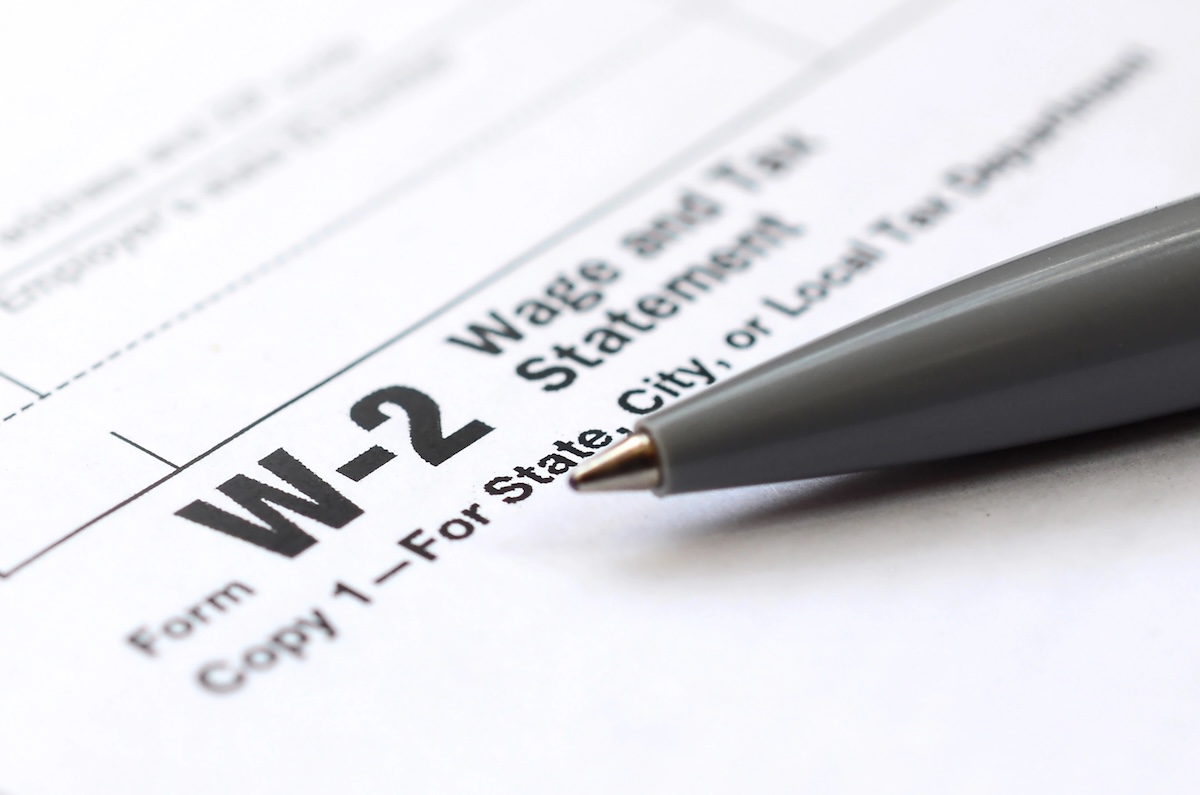

What If Form W-4?

Purpose: Tells your employer how much federal income tax to withhold from your pay.

When you start a new job, you complete a W-4 form. Your employer uses it to determine how much federal tax to withhold based on your filing status, dependents, and income adjustments.

Key Information You Provide

- Filing status — single, married, or head of household.

- Dependents — how many qualifying dependents you have.

- Other income or deductions — side jobs, second incomes, or itemized deductions.

- Extra withholding — you can request additional tax withheld per paycheck.

The IRS redesigned the W-4 to simplify calculations. It no longer uses “allowances.” Instead, you directly enter dollar amounts for dependents and other income. You can view the example below or on the IRS website (PDF File).

When To Update Your W-4

Update your W-4 whenever your financial situation changes:

- You get married or divorced.

- You have or adopt a child.

- You take a second job or your spouse starts working.

- You want more (or less) withheld to match your expected tax bill.

Your employer will adjust your withholding on future paychecks based on the new form.

Example

Maria, a nurse earning $60,000, fills out her W-4 as “Married, filing jointly,” claiming two dependents. Her employer withholds about $4,500 in federal tax across the year. After filing her tax return, her total tax due is $4,600—so she owes just $100. Her W-4 helped keep her withholdings accurate.

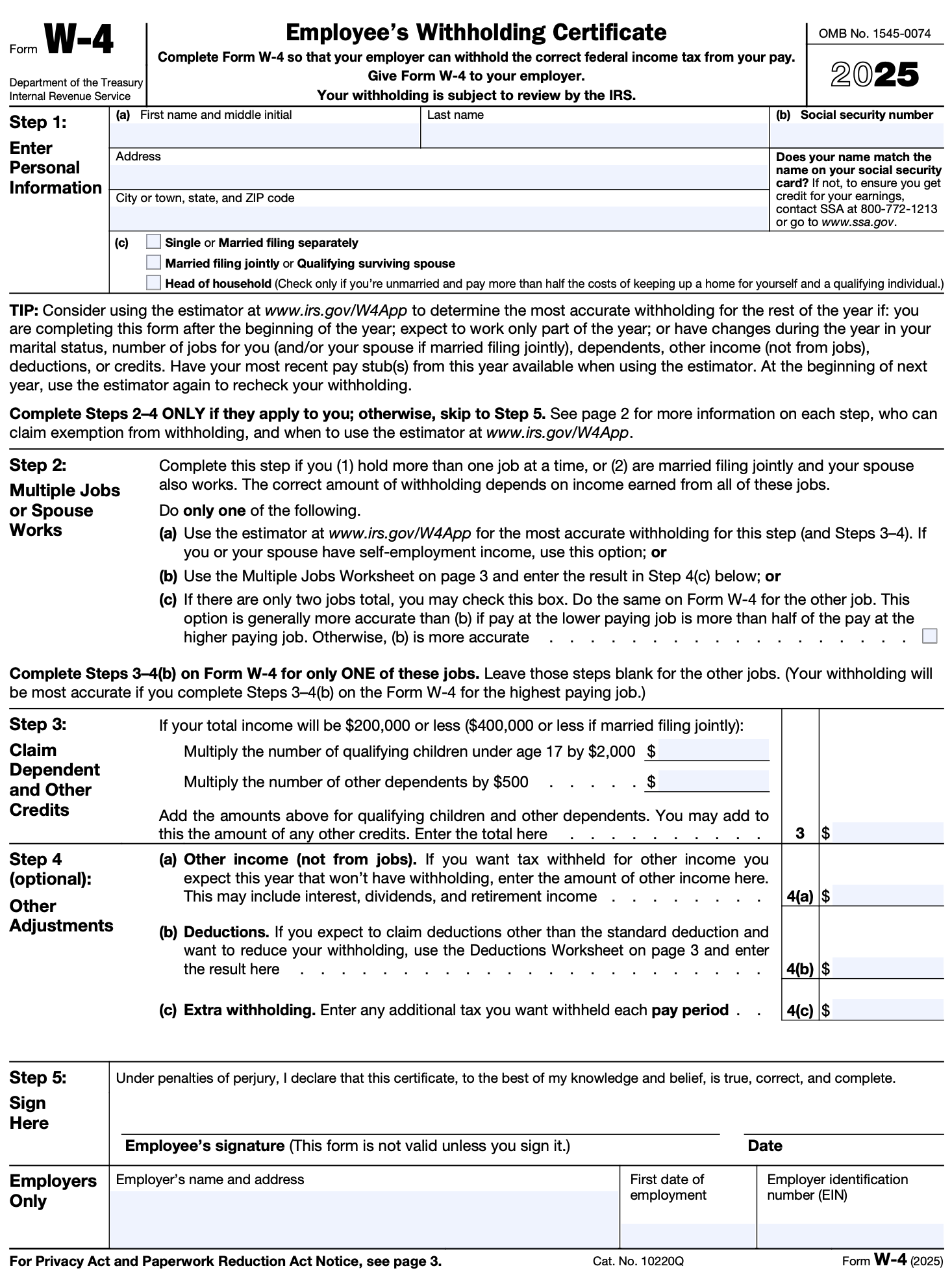

What Is Form W-2?

Purpose: Reports your annual income and total tax withheld for the year.

At the end of each calendar year, your employer must send you a W-2 form by January 31. This form summarizes your wages, tips, and other compensation, plus how much tax was withheld for federal, state, and Social Security purposes.

What’s on a W-2

- Box 1: Wages, tips, and other compensation.

- Box 2: Federal income tax withheld.

- Box 3–6: Social Security and Medicare wages and tax.

- Box 15–20: State wages and state tax withheld.

You use the information on your W-2 when filing your annual tax return with the IRS.

Employers send copies of the same W-2 to the IRS and state tax authorities, so the government can verify your reported income. You can see an example form W-2 below or via the IRS website.

What To Do If Your W-2 Has Errors

If your W-2 is wrong (say, it lists the wrong Social Security number or income) ask your employer for a corrected W-2c form. Keep both the original and corrected copies for your records.

How W-4 and W-2 Work Together

These forms are directly connected:

- Your W-4 determines how much tax is withheld from each paycheck.

- Your W-2 shows the results of that withholding at year’s end.

In short, your W-4 influences your W-2. The more exemptions or dependents you claim on the W-4, the less tax is withheld—and vice versa.

Tip: If you consistently get a big refund or owe money each April, review and adjust your W-4. The IRS Withholding Estimator can help fine-tune your settings.

How W-4 and W-2 Work Together

Can I update my W-4 during the year?

Yes. You can submit a new W-4 at any time if your situation changes or if you want to adjust your tax withholding.

What happens if I don’t fill out a W-4?

Your employer must withhold taxes as if you were single with no adjustments, usually resulting in higher withholding than necessary.

Can I have multiple W-2s in one year?

Yes. Each employer you worked for must issue a separate W-2. You’ll need to include all of them when filing your tax return.

Does my W-2 include state taxes?

Yes, if your state collects income tax. W-2 boxes 15–20 show state wages and tax withheld.

Bottom Line

Both the W-4 and W-2 are essential parts of your tax life.

- Your W-4 helps ensure your employer withholds the right amount of tax.

- Your W-2 summarizes what happened over the year so you can file your return accurately.

Check your W-4 once a year—or after any major life event—to keep your paycheck and tax refund balanced.

Don’t Miss These Other Stories:

The post What’s The Difference Between A W2 and W4? appeared first on The College Investor.