Lately, mortgage rates have been kind of stuck in a holding pattern, though drifting lower at the same time.

At last glance, the 30-year fixed was priced at around 6.25%, which is pretty good in the grand scheme of things. Definitely lower than the historical average of 7.75%.

Given rates were closer to 7% for most of the past 52 weeks, it’s a decent spot to be in.

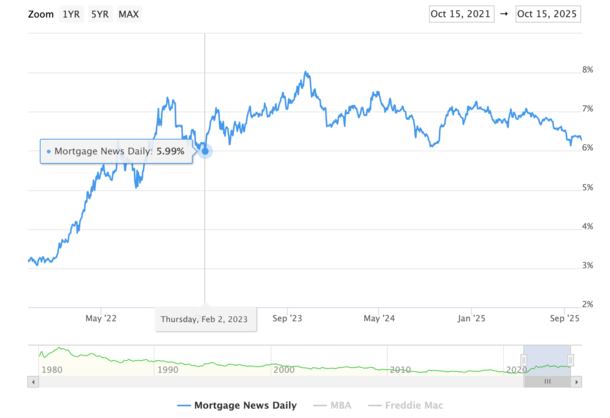

They’re also basically hovering just above the lowest levels seen over the past three years, another positive takeaway.

The question is how do they get their big break and finally duck below 6% again?

Mortgage Rates Are Close to Breaking Below 6% for the First Time in Nearly Three Years

Mortgage rates haven’t been sub-6% since February 2nd, 2023, at least according to Mortgage News Daily.

And Freddie Mac hasn’t recorded a sub-6% reading for the 30-year fixed since the week ending September 8th, 2022!

That’s a long time. Nearly three years now. Of course, they’ve been close to those levels at times since then.

And at the moment, they’re not far off at all. In reality, homeowners are receiving mortgages that start with 5 already.

But if we’re going to use a mortgage rate index like the highly-cited MND, or Freddie Mac’s Primary Mortgage Market Survey, we’re still above 6%.

So how do we get below that key psychological level after nearly 36 months? Well, the best route is likely continued economic weakness and lower inflation.

The problem right now is a lack of economic data due to the ongoing government shutdown, which is now on day 16.

Even without it though, there are private data reports and even alternative ways of collecting data or gauging sentiment (OpenTable anyone?).

Forget all that though. We’re nearly at sub-6% levels as it stands, so we don’t need a lot of news to go a little lower.

And as I’ve said before, mortgage rates tend to fall during government shutdowns anyway.

Where’s the Flight to Safety?

Just take a look at 10-year bond yields, which are the bellwether for 30-year fixed mortgage rates.

The 10-year yield is currently at 4.02%, doing a little standoff just above the 3s. It has briefly dipped below 4% at times in the past week, but hasn’t held there.

It continues to stay just above 4% as it’s a point of resistance. Just as it seems 6% is a point of resistance for consumer mortgage rates.

Here’s the thing though. We’re knocking at the door to a sub-4% 10-year bond yield without fresh economic data.

And we’re also doing so at a time when the stock market is at/near all-time highs!

Generally, stocks and bonds have an inverse relationship, in that if one goes up, the other goes down and vice versa.

So if stocks are red hot, which they seem to be at the moment, it means bonds should be ice cold. And if bonds are ice cold, their associated yield (or interest rate) should be quite high to attract investors.

Does that mean if and when stocks take a breather, we’ll see a flight to safety in bonds, which will finally lift bond prices and lower their yields?

It certainly makes sense, and given we are already hovering just above 4%, you could envision a scenario where we finally bust through into the 3s.

Bond Yields Could Push to the Low End of Their Range

Back in May, JPMorgan Asset Management fixed income portfolio manager Kelsey Berro noted that the 10-year bond yield was trading in a range from 3.75% to 4.50%.

And with the Fed in a neutral if not arguably easing position, chances are we should be moving to the lowest end of the range.

Assuming that happens, and we get down to 3.75%, mortgage rates should follow, as they historically do.

If we currently have a 30-year fixed at 6.25%, you can see a path down to 5.99% and even lower.

It could even happen in the final three months of the year, as there’s still plenty of year left in 2025.

You really only need a flight to safety in bonds and a stock market pullback, which many seem to believe is long overdue.

We’ve got some sky-high valuations at the moment, an abundance of meme stocks, including mortgage and real estate-related names, and general euphoria happening in the market right now.

So it wouldn’t be unrealistic to see a big move from stocks to bonds at some point over the next few months.

As noted, we’re already almost there anyway. Just about 25 basis points and mortgage rates could be back to levels last seen in 2022.

Read on: How to track mortgage rates.

(photo: Courtney)

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/register?ref=IHJUI7TF