I’ve mentioned on several occasions that I predicted a sub-6% mortgage rate by the fourth quarter of 2025.

We are now in the fourth quarter, but still have about two and half months left before the calendar rolls over to Q1 2026.

That actually feels like an eternity given mortgage rates can change daily, and often experience all kinds of unforeseen twists and turns.

And seeing the trend lately, of lower and lower rates, one cannot rule out a 30-year fixed mortgage rate that begins with a 5 at some point this year.

But the “odds” of it happening still remain quite low, at least by the market makers.

Will the 30-Year Fixed Rate Fall Below 6.00% at Any Point by December 31st?

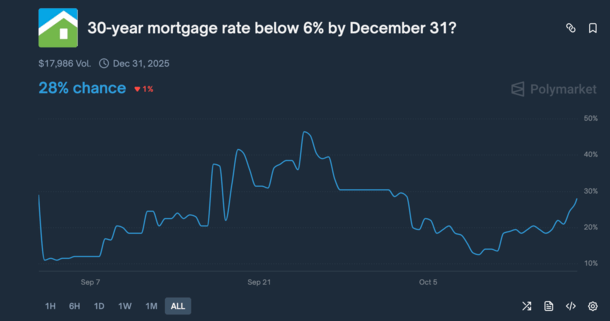

I checked out Polymarket this morning to see what the odds were for a 30-year fixed below 6% by December 31st.

I knew it was one of the markets on there so I was curious if it had become more of a favorite lately.

After all, mortgage rates have been moving lower lately and are hovering near three-year lows.

They’re also not too far above 6% anymore, so the thought of a mortgage rate starting with a “5” doesn’t sound so crazy anymore.

Despite this, there are still long odds for us to see a 30-year fixed below 6% in the next 75 days or so.

At last glance, there was just a “28% chance” of this happening on Polymarket, which seems pretty low given the 30-year fixed was last reported to be 6.27%, per Freddie Mac.

That’s the source used for this proposition. The 30-year fixed-rate mortgage (FRM) average found in Freddie Mac’s weekly Primary Mortgage Market Survey (PMMS).

While it seems so close, the Freddie mortgage rate index can move slowly and often lags (the problem with mortgage rate surveys).

It’s also a survey! So the banks and lenders they ask have to tell you rates are sub-6%.

Anyway, I felt it was interesting that the odds of a 30-year mortgage rate below 6% were nearly 50% just three weeks ago.

And today, despite rates moving lower, odds are just 28%, albeit up markedly from 13% last week.

Why Mortgage Rates Might Not Fall Below 6% This Year

I already explained why mortgage rates could fall below 6% by December.

Now let’s talk about why they might not, since those are the odds we’re looking at. A 28% chance indicates something is a longshot after all.

So what’s the rationale here? Well, one issue standing in the way of even lower mortgage rates, which only need to fall ~0.25% from here, is a lack of new data.

With the government shutdown festering, there is no new data from the government.

So we don’t get the monthly jobs report, which is the biggest mover of mortgage rates (both up and down).

And the one that’s been pushing them lower lately because the reports have been so very bad.

Since we aren’t getting new job creation and unemployment data, mortgage rates could be a little “stuck” at the moment.

They can move some, but might be kind of range-bound because their biggest driver is out of commission right now.

One caveat here is we will get a delayed CPI report next Friday, which could carry more weight than normal since other reports are on hold.

If that comes in hot, mortgage rates could bounce higher. But if it’s another cool report, it could nudge mortgage rates even closer to the 5s.

Another issue is the sheer number of days left in the calendar year. We’ve got about 75 days left in 2025.

It’s not a small number of days by any stretch, but it’s not getting any longer. So each day that passes, you’ve got fewer days to “win.”

Also, the Freddie Mac survey only comes out once a week, on Thursdays, so the timing needs to be just right to catch a low-rate day.

For example, mortgage rates could dip below 6% on a Monday and bounce back by Wednesday, and never show up in the data.

So that in itself can drive the odds of this happening lower. With less and less time it’s becoming harder.

It does seem like we’re heading in that direction though, even if it’s just a matter of time.

(photo: k)

agdj9t

dtktas