Well, the delayed CPI report is out and we avoided any major drama.

The report actually came in cooler-than-expected, with a 0.3% increase month-over-month and a 3% annual rate of inflation.

Those numbers were both below Dow Jones estimates of 0.4% and 3.1%, respectively.

Core CPI, which removes food and energy, also came in under expectations at 0.2% monthly and 3% annually, below estimates of 0.3% and 3.1%.

Long story short, mortgage rates can breathe a sigh of relief and shouldn’t have to worry about a bounce higher. And may even inch ever closer to the 5s.

Next Stop 5% for the 30-Year Fixed Mortgage?

With the CPI report now out of the way, we can focus on the Fed meeting next week, which is expected to culminate with another 25-basis point rate cut.

Today’s inflation report made the Fed’s job a little easier because they won’t have to explain why they’re cutting with prices rising more-than-expected.

Sure, 3% is above their 2% inflation target, but as long as things are trending in the right direction, they can justify more cuts.

Remember, the Fed hiked rates 11 consecutive times before finally pivoting last September and turning to rate cuts.

So they can technically remain restrictive while still easing to some degree.

And this report will allow them to paint the narrative that inflation is cooling and less restrictive policy is acceptable.

What it means for mortgage rates is they won’t bounce higher today, something that was a real risk given they’re near three-year lows.

It also means they can continue their extended move lower as there won’t be any other major data releases while the government remains closed.

At the same time, the report wasn’t good enough to substantiate another big move lower for mortgage rates.

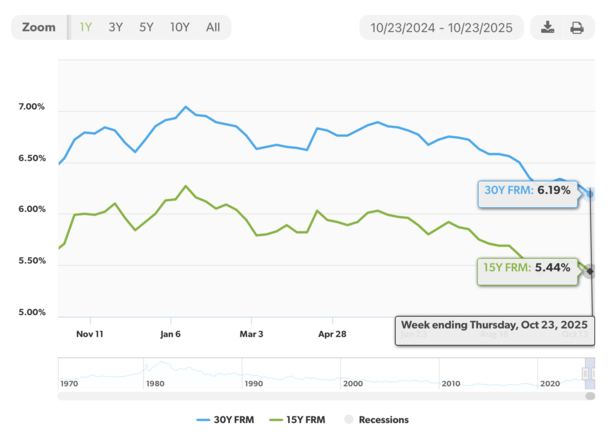

Meaning we’ll probably just see rates continue to slowly drift toward 5%. At last glance, the 30-year fixed was 6.19%, as measured by Freddie Mac.

This report allows it to continue inching toward the psychologically important 5% range.

Fed Meeting Next Week Could Push Mortgage Rates Lower

As noted, all eyes will be on the Fed next week as they get together for another meeting.

They too have been in the dark when it comes to new data due to the government shutdown.

But they’ll at least be able to comment on CPI and likely point to it showing promise, despite still elevated inflation.

They will also make a rate decision on Wednesday, with odds of another 25-bp cut now at 96.7%, per CME.

We know the Fed doesn’t control mortgage rates, but expectations that they’ll be cutting or hiking can have an effect.

Most expect them to cut two more times this year and again in January. It gets a little murkier after that, but the general idea is lower.

So it could be enough to nudge the 30-year fixed closer to the 5% range, though I could see rates facing resistance the closer we get to that key level.

This is similar to the 10-year bond yield struggling to get below 4%, also a point of resistance (which finally broke recently).

In other words, today was good news for mortgage rates in that it didn’t create any setbacks.

But it’s also not enough to move them meaningfully lower either. That’s still a win though if you were worried they might bounce higher, as you always should be!

Read on: How does CPI affect mortgage rates?