The gold price has been trading at record highs above US$4,000 per ounce since October.

As top tech companies like NVIDIA (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) battle for AI supremacy, investors are wondering if this arms race is boosting the rush to gold.

Gold is an essential material in sophisticated computer infrastructure, sparking headlines about potential future demand. But there’s also another angle in play — fears that the AI boom is on track to become an AI bubble is seen as a major driver for gold demand as investors seek out safe-haven assets.

Gold a key material in AI technology

In its Q3 gold demand trends report, the World Gold Council (WGC) indicates that demand for gold originating from the electronics sector was down by 1 percent compared to the same quarter last year.

US President Donald Trump’s tariff policy is weighing on what’s typically a season of upward momentum for demand from this segment of the market as manufacturers gear up for new product launches.

In an interview with the Investing News Network, Joe Cavatoni, senior market strategist, Americas, at the WGC, explained that the AI segment of the tech sector represents a minute portion of the gold market, meaning it’s not considered a significant driver of demand for the precious metal. However, it still has an important role.

“Typically in a technological development era, you’ll see gold used early on in the technological developments, and then often very quickly substituted out because it’s expensive,” said Cavatoni. “But what’s been encouraging for us is that gold’s superior properties are keeping it very much in the discussion around the technological uses.”

Gold’s electrical conductivity and resistance to corrosion make it an ideal component in AI tech, which relies on high-performance computing infrastructure such as specialized processors, memory chips and high-speed connectors.

Gold demand from the memory sector jumped during Q3 as AI infrastructure continued its rapid expansion. But perhaps the strongest growth came from gold’s use in printed circuit boards, essential for AI servers.

“Strong performance was recorded in AI server infrastructure, satellite communications, consumer graphics cards, and PC market applications,” notes the WGC report. “AI server demand was the single most significant factor driving growth, propelling gold usage through continuous specification upgrades.”

Record-high gold prices have not been an impediment to demand in the AI sector because of two important factors. For one, alternatives such as silver or copper cannot match gold’s superior resistance to corrosion and oxidation for long-term reliability. Secondly, the actual amount of gold used is only a fraction of the materials used in the fabrication of these products, so manufacturers are still comfortable with their margins even at US$4,000 gold.

It seems that for now, AI tech makers are willing to pay a premium for gold to ensure the reliable performance and longevity of their products. While gold usage in AI technology is a relatively small part of the overall demand for the metal, it is helping to support otherwise weakening demand in the technology sector.

Gold as a hedge for a potential AI tech bubble

A more prominent AI-related driver of gold demand is growing fears of an AI tech bubble on the verge of bursting. That’s because gold’s main purpose in an investment portfolio is to hedge against stock market volatility through asset diversification. As safe-haven demand for gold grows, so too does its price.

Analysts at major financial institutions have said that some of the increasing investment demand for gold can be attributed to investors using the metal as a hedge against a significant market correction in AI stocks.

A prime example of the gold price taking off following a tech bubble bursting occurred in the early 2000s with the end of the dot-com rally. The price of gold gained more than 620 percent between 1999 and 2011 to reach US$1,825 as investors pulled out of the stock market in droves and the US Federal Reserve lowered interest rates.

Is the market growing too fast? A UBS Group (NYSE:UBS) report shows that this year global AI spending is expected to reach US$375 billion and then climb further to hit US$500 billion in 2026.

The hype around AI is fueling valuation growth for many tech companies, especially the giants. The biggest AI stocks also rank among the Magnificent 7 technology stocks, which make up a significant portion of the overall valuations of both the S&P 500 (INDEXSP:.INX) and Nasdaq Composite (INDEXNASDAQ:.IXIC). Apple (NASDAQ:AAPL) and Microsoft are now boasting US$4 trillion market caps, while chipmaker NVIDIA recently surpassed US$5 trillion.

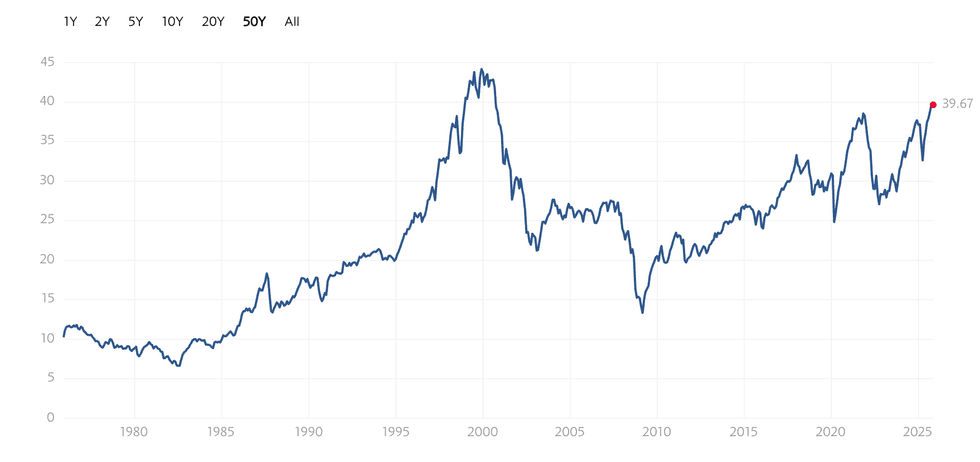

Shiller price-to-earnings ratio.

Chart via Multpl.com.

Another indication that the equity markets may be in trouble is that the Shiller price-to-earnings (PE) ratio, also known as the cyclically adjusted PE ratio, is now flashing red.

An important metric of market health and future returns, the ratio is calculated by dividing the current stock or market index price by the average of the past 10 years’ earnings, adjusted for inflation.

A typical range for the Shiller PE ratio for the S&P 500 is between 17 and 28. Right before the dot-com bubble burst and investors fled to gold, this ratio was flashing red at 44.19, its highest recorded ratio.

As of November 10, the S&P 500 had a Shiller PE ratio of between 39 and 40.

US AI stocks slumped during the second week of November, reported CNBC, on the perception that equity valuations are overstretched amid a backdrop of a slowing economy. Looking ahead at the next two years, Goldman Sachs (NYSE:GS) CEO David Solomon is predicting a potential 10 to 20 percent pullback in the equity markets.

Similarly, Bloomberg reported that Michael Hartnett, chief investment strategist at Bank of America Global Research, said in a note to clients that AI growth has spurred the top tech stocks to sky-high valuations, and gold may be one of the best hedges for a possible bubble burst in AI-related equities.

Macquarie analysts are also pointing to gold as a hedge against a potential AI bubble burst if tech firms can’t deliver on their high productivity promises. The firm has an interesting take on the parallel rallies that have occurred in gold and AI this year: “Optimists buy tech, pessimists buy gold, hedgers buy both.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web