Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that Platinum Diamond Drilling Inc. (“Platinum”) has been contracted to undertake the Mineral Resource focussed drilling programme at the Winston Tailings Project in Ontario, Canada.1, 2, 3

The appointment of Platinum follows on from the appointment of SRK Exploration Ltd (“SRK EX”) as independent consultants to conduct the Mineral Resource estimate (“MRE”).

The MRE will be one of a series of workstreams to quantify, evaluate and permit the contained high-grade gold (Au), gallium (Ga), silver (Ag), zinc (Zn), copper (Cu) and cobalt (Co) and other recoverable minerals located within the historic Winston Lake Mine tailings storage facility (“TSF”).

Darren Hazelwood, Chief Executive Officer commented:

“The appointment of a drilling contractor for the Winston Tailings Project marks a pivotal step forward for the Company. This programme is designed to validate the historic recovery production and produce a CIM compliant Mineral Resource estimate, a key milestone in taking the project through the recovery permitting process.

The historical Winston Lake mine processing data indicates that the tailings have the potential to host commodities in quantities significant enough to fundamentally transform our business.

Quantifying the grade and tonnage of recoverable minerals in the TSF will provide a clear pathway to near-term production and meaningful cash flow, supporting our strategy to rapidly advance Winston from an historic asset into a modern, cash-generating operation.

We look forward to updating shareholders as work progresses.”

The MRE programme is an integral part of the process to advance the Winston Tailing Project through permitting towards a cashflow proposition and will be based upon the resource drilling programme, mineralogical and metallurgical testwork and associated studies which will be conducted during winter 2025/26.

Panther is aiming for a seamless transition from MRE to Ore Reserves in as short a time as possible, and it is envisaged that successful outcomes to the tailing MRE, will in turn support the declaration of Ore Reserves following further technical studies. The MRE work will also provide inputs into the Application for Recovery of Minerals Permit (the “Recovery Permit”) process as announced 1 September 2025.3, 4

The MRE will be reported in compliance with the standards and best practices set out by the Canadian Institute of Mining, Metallurgy and Petroleum’s (“CIM”) for reporting Mineral Resources, Ore Reserves, and related exploration information. This will also facilitate future NI 43-101 reporting, as required.

Background

The Winston Tailings Project entails a series of workstreams to quantify, evaluate and permit the contained high-grade gold (Au), gallium (Ga), silver (Ag), zinc (Zn), copper (Cu) and cobalt (Co) and other recoverable minerals located within the historic Winston Lake Mine tailings storage facility. Reprocessing the mine tailings, potentially offers Panther the opportunity to unlock residual metal value and contribute to the long-term environmental rehabilitation of the Winston Project site.1, 2

The Winston Lake Mine was operational from 1988 to 1998, producing approximately 3.3 million tonnes of ore and yielding zinc, copper, silver, and gold. Based on historic recoveries from mining activities in the 1980s and 1990s, it is believed that a significant quantity of valuable material remains in the tailing storage facility.

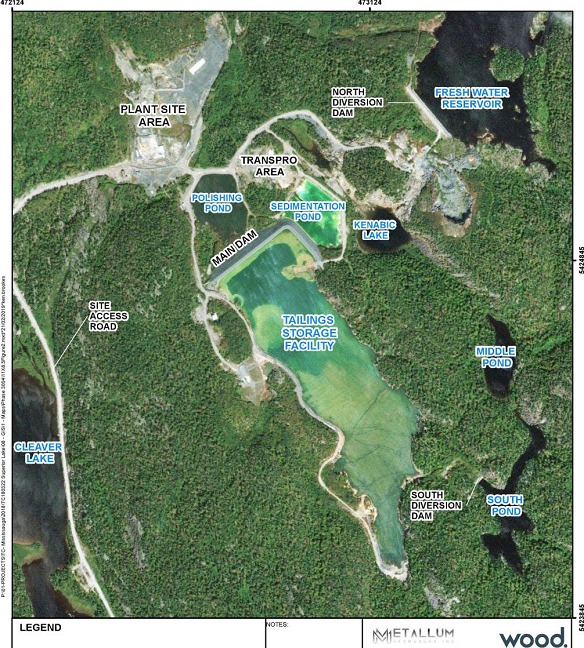

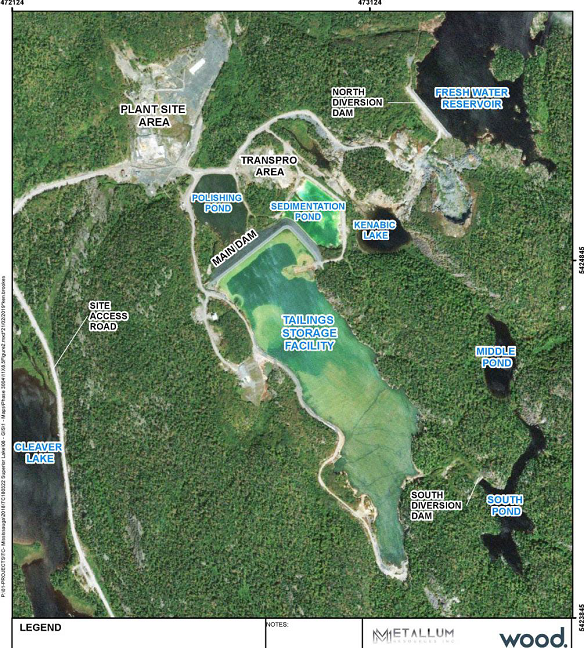

Source: NI 43-101 Technical Report Feasibility Study for the Superior Zinc and Copper Project, 2021. Site is connected to high-voltage grid power.

Figure 1: Existing Infrastructure at Winston Tailings Storage Facility

References

1. Panther Metals PLC, announcement, Winston Tailings Assays Confirm Gold, Gallium, Silver, Zinc, Copper & Cobalt, Tailings Sample Assay Results Exceed Expectations, dated 31 July 2025 ( https://polaris.brighterir.com/public/panther_metals/news/rns/story/w00eo6w )

2. Panther Metals PLC, announcement, Tailings Sampling Programme Underway at Winston Project, dated 15 July 2025 (https://polaris.brighterir.com/public/panther_metals/news/rns/story/w606ngw )

3. Panther Metals PLC, announcement, Winston Tailings: Gold & Critical Mineral Reprocessing, Evaluation and Permitting Workstreams Commencing, dated 8 August 2025

( https://polaris.brighterir.com/public/panther_metals/news/rns/story/rm7movr )

4. Panther Metals PLC, announcement, Winston Tailings Project Update and Warrant Expiry, Permitting Process Commenced. Warrant Expiry Notice , dated 1 September 2025

( https://polaris.brighterir.com/public/panther_metals/news/rns/story/x20od6r )

5. Recovery of Minerals Permitting process details available at https://www.ontario.ca/page/recovery-minerals

For further information, please contact:

|

Panther Metals PLC: Darren Hazelwood, Chief Executive Officer: |

+44 (0)1462 429 743 +44 (0)7971 957 685 |

|

Brokers: |

|

|

Hybridan LLP Claire Louise Noyce |

+44 (0)20 3764 2341 |

|

SI Capital Limited Nick Emerson |

+44 (0)1438 416 500 |

Obonga Project – Expanding Canada’s Next VMS and Critical Minerals District

Panther Metals’ Obonga Project in Ontario continues to demonstrate significant potential as a leading exploration initiative targeting both base and critical minerals. Since acquiring the Obonga Greenstone Belt in July 2021, the Company has rapidly advanced five high-priority targets: Wishbone, Awkward, Survey, Ottertooth, and Silver Rim.

In June 2024, Panther secured a key Exploration Permit for the Wishbone Prospect, valid through 2027, authorizing extensive drilling and geophysical surveys. Previous campaigns confirmed compelling volcanogenic massive sulphide (VMS)-style mineralisation, highlighted by intercepts such as 27.3m of massive sulphide and 51m of sulphide-dominated mineralisation with multiple mineralised lenses. High-grade copper anomalies in lake sediment further enhance the prospectivity of this landmark target.

July 2024 saw Panther awarded an Exploration Permit for Awkward West, supporting an aggressive exploration program including up to 31 drill holes. Historic drilling here revealed notable graphite mineralisation-27.2m at 2.25% Total Graphitic Carbon (TGC) with zones exceeding 5% TGC-alongside promising signs of nickel, copper, and platinum group elements, aligning with Panther’s strategic focus on critical minerals.

Additional exploration efforts include high-resolution magnetic geophysical surveys across key prospects, optimizing drill targeting and advancing the geological model. Survey and Ottertooth remain highly prospective, with multiple magnetic and electromagnetic anomalies and historic intercepts of massive sulphides, many targets still largely untested.

Obonga’s combination of VMS-style base metals and critical mineral potential, situated in a stable and mining-friendly jurisdiction with strong infrastructure, positions Panther Metals to unlock a district-scale mineral system with significant commercial upside.

Dotted Lake Project – Hemlo-Adjacent Gold Opportunity with Growing Momentum

Panther Metals’ Dotted Lake Project, acquired in July 2020, lies just 16km from Barrick Gold’s renowned Hemlo Mine, in one of Canada’s premier gold-producing regions. The project offers a strategically located and scalable gold exploration play.

Initial soil sampling in 2021 identified numerous gold and base metal targets, and subsequent access improvements facilitated an initial drilling program that confirmed gold mineralisation with anomalous values extending along strike.

In early 2025, Panther completed a follow-up campaign featuring detailed geological mapping, trenching, and targeted diamond drilling. These efforts extended mineralisation both laterally and at depth, identified new structural controls, and reinforced the potential for a broader, high-grade gold system. Multiple zones have been prioritised for expanded drilling, underscoring Dotted Lake’s significant upside.

The project’s proximity to established infrastructure and Hemlo’s extensive mining operations, combined with robust recent results, makes Dotted Lake a key asset in Panther’s growth portfolio.

Commercial Strategy – Discovery-Driven Value Creation

Panther Metals is committed to creating substantial shareholder value through focused exploration and disciplined capital management. The Company combines deep geological expertise with an understanding of market and financing dynamics to advance high-potential projects efficiently.

With access to a global network of industry leaders and a rigorous operational focus on drilling, Panther prioritises activities that directly contribute to discovery and resource growth. The drill hole remains the ultimate validation in mineral exploration, and Panther’s strategy is to fast-track world-class targets into drill-ready assets – delivering tangible results that underpin long-term value creation for shareholders.