Welp, it’s that time of year again when the pundits release their predictions for the year ahead.

First up is Redfin, which provides tons of interesting housing market commentary throughout the year.

But for some reason, their mortgage rate predictions always seem to play it safe.

And by safe, I mean really, really safe.

Like this year, they’re not going out on much of a limb.

Redfin Expects a 6.3% 30-Year Fixed for All of 2026

Drum roll please. Redfin’s first prediction for 2026: “The 30-year fixed rate will average 6.3% for the entire year, down from its 2025 average of 6.6%.

That’s it folks. The 30-year fixed will apparently be flat all year and do absolutely nothing.

At the moment, the 30-year fixed is averaging 6.23% according to Freddie Mac, and 6.30% according to Mortgage News Daily.

In other words, where mortgage rates are today is where they will be for the rest of the year and next.

Not the most exciting prediction, nor the boldest. But this is kind of true to their brand.

If you recall, they called flat rates for 2025 too, despite all the movement we’ve seen this year.

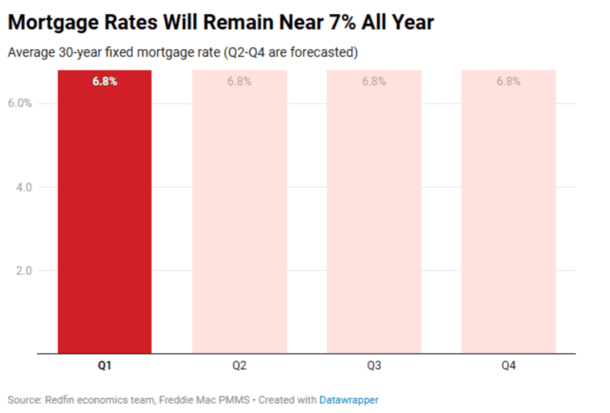

One of my favorite graphics from them is their “Mortgage Rates Will remain Near 7% All Year.”

That’s when they famously said the 30-year fixed would average 6.8% in every single quarter of 2025.

As we now know, that was not the case. In fact, the 30-year fixed nearly went sub-6% on several occasions this year.

And it hasn’t been close to 7% since May. In other words, take this prediction and the others you come across soon with a big grain of salt.

I’ll throw my hat in the ring soon and you better believe it’ll have a lot more to say than flat rates for the entire year.

Redfin Says 2026 Will Be the Year of the ‘Great Housing Reset’

Beyond their mortgage rate “prediction,” if you can call it that, they are also referring to 2026 as “The Great Housing Reset.”

What they mean by that is the housing market will gradually normalize as the year goes on, after some disjointed years thanks to the great mortgage rate surge.

When mortgage rates nearly tripled from sub-3% to 8% in the matter of less than two years, affordability plummeted and so did home sales.

We also saw a huge drop in loan origination volume, especially in the refinance realm as very few loans penciled with rates so high.

But that’s apparently going to change in 2026, with mortgage rates staying at their current levels (near three-year lows) and wages growing faster than home prices.

The result, per Redfin, is not a “quick price correction or recession,” but rather a “normalization of prices as affordability gradually improves.”

This will result in a 3% increase in home sales, coming in at 4.2 million total, and just a 1% increase in home prices.

Wages will outpace prices, meaning real, inflation-adjusted prices will be lower.

But because home prices and mortgage rates are still elevated, and the economy is deteriorating, home buyer demand will be muted.

I can actually get behind their housing market prediction. It makes sense and is perfectly logical.

To sum it up, Redfin is calling 2026 “the beginning of a long, slow recovery for the housing market.”

This counters claims by some housing bears/doomers who believe we’re due for another housing crash.

I’ve doubted another housing crash due to the quality of mortgages today, combined with limited for-sale inventory.

While the most recent vintages of mortgages are arguably riskier, the vast majority of loans were taken out when mortgage rates hit record lows.

This means your typical homeowner has a small loan amount relative to their property value and an interest rate that’s fixed for 30-years at 2-4%.

(photo: InfoWire.dk)