Quick Answer:

- If you want stability and global diversification, Parag Parikh Flexi Cap Fund is better.

- If you want higher short-term growth, HDFC Flexi Cap Fund is better.

Both are strong choices, but they suit different investor profiles.

HDFC flexi cap fund has seen a strong improvement in its short-term performance under the new fund manager, reflecting a shift in investment management style toward active allocation and higher domestic exposure. It suits moderately aggressive investors who are looking for higher growth and are comfortable with some level of risk.

Parag Parikh flexi cap fund focuses on stability, global diversification, and long-term consistency – a hallmark of disciplined wealth management; ideal for patient investors with a steady, compounding mindset.

Why Are PPFAS Flexi Cap and HDFC Flexi Cap Compared in 2025?

Within the flexi cap funds category, these funds dominate in size, reputation, and investor trust.

HDFC Flexi Cap Fund has seen a sharp turnaround in performance in recent years, following its reclassification and a change in fund manager.

Parag Parikh Flexi Cap Fund, meanwhile, holds a unique position as not just the largest flexi cap fund but also the biggest actively managed equity fund in India, with assets of over ₹1 lakh crore.

Comparing these two makes sense given their strong track records and massive investor bases.

Both have delivered solid long-term results but follow different investing styles.

In our analysis comparing HDFC Flexi Cap and Parag Parikh Flexi Cap, we’ll put them head-to-head, looking at trailing and rolling returns, risk-adjusted performance, downside protection, portfolio strategy, and top holdings, to help you see which fund might fit your goals better.

Key Takeaways

- Fund suitability: HDFC flexi cap fund suits investors seeking higher growth and can handle short-term swings. PPFAS flexi cap fund suits long-term investors who prefer stability and global diversification.

- Performance: HDFC flexi cap has outperformed in the last 3-5 years. Parag Parikh remains stronger over 7-10 years for consistent compounding.

- Risk & volatility: HDFC flexi cap is more volatile due to concentrated bets. Parag Parikh flexi cap offers smoother performance and better downside protection.

- Portfolio allocation: HDFC flexi cap stays domestic and shifts more actively across market caps. PPFAS flexi cap keeps a large-cap focus with 10% in global stocks.

- Management style: HDFC flexicap follows a high-conviction, fully invested approach. PPFAS flexi cap sticks to buy-and-hold with flexible cash calls.

- Final verdict: Go with HDFC flexi fap if you’re willing to take a bit more risk for potentially faster gains. Choose Parag Parikh flexi cap if you prefer steady growth and long-term consistency.

Quick Comparison: Parag Parikh Flexi Cap vs HDFC Flexi Cap

| HDFC Flexi Cap Fund | Parag Parikh Flexi Cap Fund | Winner | |

| AUM | ₹85,560 crore | ₹1,19,723 crore | Parag Parikh |

| Launch Year | 1995 (renamed 2020) | 2013 | HDFC (older) |

| 3-Year Returns | 28.11% | 23.73% | HDFC |

| 5-Year Returns | 33.22% | 29.38% | HDFC |

| 7-Year Returns | 18.50% | 20.70% | Parag Parikh |

| 10-Year Returns | 16.39% | 18.24% | Parag Parikh |

| Since Inception | 17.39% | 20.17% | Parag Parikh |

| Cash Holdings | 10% | 23% | Context-dependent |

| International Exposure | 0% | 10% | Parag Parikh |

As on October 2025

Why Flexi Cap Funds Are Popular in 2025?

Flexi Cap funds have emerged as the most popular mutual fund category in India, attracting inflows of ₹1 lakh crore in the last year alone. They offer the flexibility to invest across large, mid, and small-cap stocks, making them appealing to a wide range of investors.

| Mutual Fund Category | Inflows May 2024 to Apr 2025 |

| Flexi Cap Fund | Rs 1,01,091 cr |

| Mid Cap Fund | Rs 90,528 cr |

| Small Cap Fund | Rs 89,536 cr |

| Large Cap Fund | Rs 70,662 cr |

| Large & Mid Cap Fund | Rs 70,557 cr |

| Multi-Cap Fund | Rs 66,823 cr |

| Value Fund/Contra Fund | Rs 41,013 cr |

| Focused Fund | Rs 26,399 cr |

| ELSS | Rs 23,865 cr |

| Dividend Yield Fund | Rs 9,228 cr |

| Source: AMFI |

Fund Overview

Among flexi cap funds, two stand out for their size, reputation, and strong investor following: Parag Parikh Flexi Cap Fund and HDFC Flexi Cap Fund. Let’s take a closer look at them.

PPFAS Flexi Cap Fund Profile

Parag Parikh Flexi Cap Fund, launched in 2013, has quickly built a unique position in India’s mutual fund space. Managed consistently by Rajeev Thakkar, it combines strong performance with disciplined investing.

Key Highlights:

- Launch Date: May 2013

- Fund Manager: Rajeev Thakkar (since inception)

- AUM: Over Rs 1 lakh crore

- Category Rank: Largest Flexi Cap and actively managed equity fund in India

HDFC Flexi Cap Fund Profile

HDFC Flexi Cap Fund is one of India’s oldest equity funds, originally launched in 1995 as HDFC Equity Fund. Renamed in 2020 after SEBI’s reclassification, it has maintained a strong track record over the years.

Key Highlights:

- Launched Date: Jan 1995 (as HDFC Equity Fund)

- Fund Manager: Roshi Jain (since Jul 2022)

- AUM: Rs 74,105 crore (Apr 2025)

- Category Rank: 2nd-largest Flexi Cap fund, 3rd-largest actively managed equity fund in India (as per AUM)

How Did We Compare These Funds?

- For performance, we examined both trailing and rolling returns to capture consistency (3, 5, 7, 10-year).

- For volatility, we analysed standard deviation and downside capture ratio to see how each fund behaves in market corrections.

- We also compared portfolio composition, cash levels, and global exposure to understand each fund’s investment management approach and diversification.

Performance Analysis

Flexi cap funds are known for their ability to adapt to market conditions. But how have these two funds performed across different time periods? Let’s look at their trailing returns.

Trailing Returns Comparison: HDFC Flexi Cap Fund vs Parag Parikh Flexi Cap Fund

| Fund Name | CAGR (%) | ||||

| 3 Yr | 5 Yr | 7 Yr | 10 Yr | Since Inception | |

| HDFC Flexi Cap Fund | 28.11 | 33.22 | 18.5 | 16.39 | 17.39 |

| Parag Parikh Flexi Cap Fund | 23.73 | 29.38 | 20.7 | 18.24 | 20.17 |

| Returns as on May 16, 2025; Source: AMFI NAV Data | |||||

Over the last three to five years, the HDFC flexi cap fund has outperformed its peers by a healthy margin, reflecting the impact of its new fund manager. But when you stretch the horizon to 7 or 10 years, Parag Parikh flexi cap fund takes the lead, showing steadier performance over longer periods.

Quick Takeaway:

HDFC flexi cap has caught up impressively in recent years, while Parag Parikh flexi cap continues to reward patient investors.

Rolling Returns Comparison:

Trailing returns tell you how much money was made, but rolling returns show how consistently it was made. Here’s how both funds have fared when measured daily over different time frames.

| Fund Name | 1 Yr Rolling Returns (%) | 2 Yr Rolling Returns (%) | 5 Yr Rolling Return (%) | 7 Yr Rolling Return (%) |

| HDFC Flexi Cap Fund | 25.22 | 26.49 | 15.3 | 14.74 |

| Parag Parikh Flexi Cap Fund | 19.42 | 20.59 | 19.02 | 18.94 |

| Rolling returns (5 & 10 years), rolled daily in the last 10 years ending May 16, 2025. Rolling returns (1 & 2 years), rolled daily in the last 3 years; Source: AMFI NAV Data | ||||

Across 5- and 7-year rolling periods, Parag Parikh Flexi Cap Fund has shown stronger consistency, comfortably outperforming its benchmark and category.

However, in the last three years, since Roshi Jain took charge of HDFC Flexi Cap, the fund’s short-term rolling returns have surged ahead. HDFC’s 1 and 2-year rolling returns of 25-26% clearly outpace Parag Parikh’s, signalling a solid turnaround in recent times.

Quick Takeaway:

Parag Parikh Flexi Cap shines in long-term consistency, while HDFC Flexi Cap has shown a strong comeback in recent years with higher short-term returns.

Risk Analysis

Every mutual fund carries some level of risk because its returns move up and down with the market. One way to measure this is by looking at how volatile the fund’s returns have been over time, calculated using standard deviation. The higher the standard deviation, the more the fund’s performance fluctuates.

Volatility Analysis

Here’s how the two funds compare on volatility to check which is riskier, measured through rolling returns over the past decade:

| Fund Name | 5-Yr Rolling Return (%) | 7-Yr Rolling Return (%) | ||||||

| Max | Min | Mean | STD Dev | Max | Min | Mean | STD Dev | |

| HDFC Flexi Cap Fund | 35.8 | -1.82 | 15.3 | 6.16 | 20.12 | 6.98 | 14.74 | 2.69 |

| Parag Parikh Flexi Cap Fund | 33.93 | 4.09 | 19.02 | 5.11 | 22.01 | 14.62 | 18.94 | 1.6 |

| Category Average | 28.19 | 2.27 | 15.36 | 4.72 | 19.04 | 9.28 | 14.63 | 1.89 |

| Nifty 500 (Benchmark) | 28.87 | -1.05 | 13.74 | 17.53 | 6.36 | 13.75 | ||

| Rolling returns, rolled daily in the last 10 years ending May 16, 2025; Source: AMFI NAV Data | ||||||||

What This Means:

- Over shorter periods (5 years), HDFC Flexi Cap Fund has been slightly more volatile than both the category and Parag Parikh Flexi Cap Fund, with a higher standard deviation of 6.16%.

- The gap widens over longer periods (7 years). Parag Parikh Flexi Cap Fund shows lower volatility (1.6%) than both HDFC Flexi Cap (2.69%) and the category average (1.89%).

- In simple terms, Parag Parikh Flexi Cap has offered a smoother ride for investors. At the same time, HDFC Flexi Cap has seen more performance swings, partly reflecting its portfolio shifts during the turnaround phase.

Downside Protection Analysis

Risk is not solely defined by volatility. It is also important to understand how a fund performs during the period when the stock markets correct.

We analysed 47 quarters of performance data since Parag Parikh Flexi Cap’s launch in 2013.

| Quarter End | NIFTY 500 – TRI | HDFC Flexi Cap Fund | Parag Parikh Flexi Cap Fund |

| Mar-2020 | -28.87 | -31.95 | -21.38 |

| Jun-2022 | -9.71 | -5.19 | -11.08 |

| Dec-2024 | -7.59 | -4.65 | -1.24 |

| Mar-2018 | -5.79 | -9.36 | -4.67 |

| Mar-2023 | -5.66 | -2.75 | 3.73 |

| Dec-2016 | -5.45 | -4.33 | -0.92 |

| Mar-2025 | -4.44 | -0.73 | -2.3 |

| Mar-2016 | -3.78 | -6.28 | -4.11 |

| Sep-2015 | -3.28 | -4.22 | -3.73 |

| Sep-2019 | -2.79 | -8.18 | 0.75 |

| Sep-2013 | -2.2 | -4.68 | 2.34 |

| Jun-2015 | -0.86 | -1.15 | 1.51 |

| Mar-2022 | -0.44 | 3.73 | -3.8 |

| Dec-2021 | -0.17 | -0.72 | 3.76 |

| Sep-2018 | -0.05 | 3.7 | 2.32 |

| Source: AMFI NAV Data | |||

Market Correction Performance:

- During this period, the Nifty 500 TRI saw negative returns in 15 quarters.

- HDFC Flexi Cap outperformed the benchmark in 7 of those quarters.

- Parag Parikh Flexi Cap did better in 11 of them.

Positive Returns During Market Falls:

Interestingly, Parag Parikh delivered positive returns in 6 of those 15 down quarters, while HDFC managed that in only 2. This shows PPFAS’s ability to cushion investors during corrections.

Quick Takeaway:

In short, Parag Parikh Flexi Cap offers stronger downside protection, whereas HDFC Flexi Cap tends to recover faster during market rebounds.

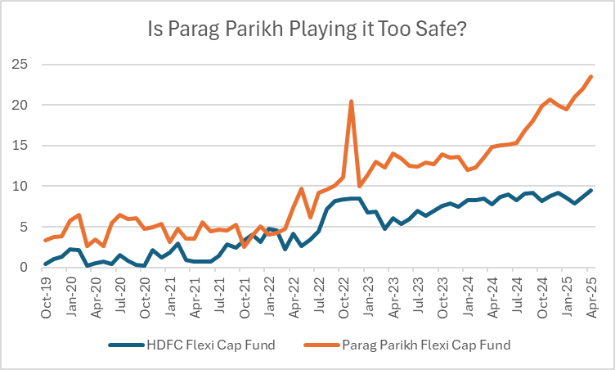

Asset Allocation

A fund’s cash position often reveals how its manager views the market. Let’s look at how these two Flexi Cap funds have managed their cash over time.

Cash Holdings

Parag Parikh Flexi Cap Fund

The fund has steadily increased its cash holdings since late 2021. Back then, it kept only about 3-4% of its portfolio in cash. In 2025, that number has jumped to around 23%, nearly one-fourth of the portfolio, reflecting a more cautious stance amid high valuations.

HDFC Flexi Cap Fund

This fund, too, has raised its cash levels, but much more modestly. From around 3-4% in 2021, cash holdings now stand near 10%. It remains primarily invested, showing its preference for capturing market upswings.

Monthly Cash Holdings in Portfolio

Source: Ace MF

Snippet takeaway: Parag Parikh prefers to wait for the right valuations, while HDFC stays more fully invested through market cycles.

Equity Holdings

To understand how Parag Parikh Flexi Cap Fund and HDFC Flexi Cap Fund manage their money, we looked at their allocation to large-cap, mid-cap, and small-cap stocks over the past five years. Both funds have a strong large-cap bias, but how they manage that exposure is quite different.

HDFC Flexicap Fund:

HDFC Flexi Cap has maintained a predominantly large-cap portfolio, averaging around 78% over the last five years. Since fund manager Roshi Jain took charge in 2022, the large-cap share has dropped by 10 percentage points, while small-cap exposure has more than doubled from 4% to 10%. Mid-caps, meanwhile, have fallen sharply from 16% to just about 5%.

PPFAS Flexicap:

PPFAS Flexi Cap has leaned even more toward large caps in recent years, holding around 60% in that segment since late 2022. Its mid- and small-cap exposure has stayed minimal, barely 2-2.5%. The fund prefers high-quality, stable businesses over riskier mid- or small-cap bets.

What also sets PPFAS apart is its international exposure. Around 10% of its portfolio is invested in global companies like Meta, Alphabet, Microsoft, and Amazon, adding diversification beyond Indian markets.

| Company | Industry | Allocation (%) |

| Meta Platforms Registered Shares A | Computer Software | 2.78 |

| Alphabet Inc A | Computer Software | 2.57 |

| Microsoft Corp | Computer Software | 2.48 |

| Amazon.com Inc | Catalog/Specialty Distribution | 2.17 |

| Total | 10 | |

| Source: Factsheet for April 2025 | ||

Quick takeaway:

HDFC Flexi Cap maintains a domestic focus and adjusts across market caps more actively. PPFAS Flexi Cap keeps a steady large-cap bias and uses global stocks for diversification rather than shifting between Indian market segments.

Portfolio Turnover & Management Style

Portfolio turnover tells how often a fund manager buys or sells stocks yearly. A 100% turnover means the entire portfolio was replaced within 12 months.

From May 2022 to April 2025, here are the turnover % ages for both funds:

- HDFC Flexi Cap Fund: ~ 35%

- Parag Parikh Flexi Cap Fund: ~27%.

Neither of these numbers is a red flag; in fact, it suggests that both fund managers tend to stick with their investments and follow a buy-and-hold strategy, but their styles differ.

HDFC Flexi Cap Fund tends to hold a more concentrated portfolio with higher conviction bets. In contrast, the PPFAS Flexi Cap Fund takes a steady, valuation-driven approach with a global flavour and more flexibility in cash positioning.

Quick Takeaway:

HDFC Flexi Cap = conviction + aggressive positioning

PPFAS Flexi Cap = discipline + valuation focus + diversification

Final Verdict

Choose Parag Parikh Flexi Cap Fund If:

- You prefer a value-driven approach and a globally diversified portfolio.

- You want lower volatility and stronger downside protection.

- You’re comfortable with a fund manager who takes cash calls based on market valuations.

- You’re focused on consistency and long-term compounding over short-term returns.

Choose HDFC Flexi Cap Fund If:

- You believe in a high-conviction, concentrated investing style.

- You prefer a fully invested, India-focused portfolio.

- You want to back a fund that’s shown a strong turnaround under its new manager.

- You’re comfortable with a slightly higher risk for potentially better short-term outperformance.

Conclusion

Both funds have clear strengths: HDFC Flexi Cap for those who want higher short-term potential and don’t mind market swings, and Parag Parikh Flexi Cap for those who value stability, discipline, and long-term growth.

Both funds stand out for investors who value professional wealth management expertise backed by strong track records and clearly defined philosophies.

Your choice should depend on your risk appetite and horizon: HDFC if you’re chasing momentum, Parag Parikh if you’re playing the long game.

FAQs

Parag Parikh Flexi Cap continues to show the traits of a steady long-term performer – consistent track record, lower volatility, and global exposure that helps balance out risks.

Yes. HDFC Flexi Cap’s performance has improved sharply under the new manager.

Parag Parikh Flexi Cap carries lower volatility and offers stronger downside protection as compared to HDFC Flexi Cap.

Yes. They follow different styles – HDFC is more aggressive and India-focused, while PPFAS adds global exposure and stability.

For long-term wealth creation with steadier compounding, Parag Parikh Flexi Cap stands out. HDFC Flexi Cap suits those seeking higher short-term growth.

Absolutely. Both are well-suited for SIPs, helping you average out costs and benefit from long-term compounding.

Investment Disclaimer

This analysis is for educational purposes only and not investment advice. Past performance is not indicative of future results. Mutual fund investments are subject to market risks. Please consult a qualified financial advisor before making investment decisions.