Navigating Medicare After 65: A Guide to Avoiding Penalties While Working

on Sep 11, 2025

Reaching the age of 65 is a significant milestone, especially when it comes to navigating the complex world of health insurance. If you plan to continue working beyond 65 and remain on your employer’s health plan, it’s essential to understand the Medicare enrollment rules to avoid costly penalties and ensure a seamless transition to retirement. In this article, we’ll explore the key considerations for avoiding Medicare late enrollment penalties while working past 65, including the importance of Medicare eligibility and creditable coverage.

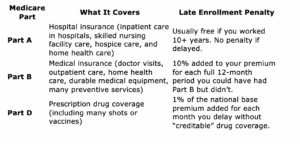

To avoid Medicare penalties, it’s crucial to understand the different parts of Medicare and how they interact with your existing health insurance. Medicare Parts A, B, and D each have distinct enrollment rules and potential penalties for late enrollment.

Understanding Medicare Parts and Potential Penalties

Medicare consists of several parts, including Medicare Part A (hospital insurance), Medicare Part B (medical insurance), and Medicare Part D (prescription drug coverage). Not all parts are mandatory at age 65, but delaying enrollment in certain parts without proper coverage can result in permanent financial penalties. It’s essential to understand the Medicare enrollment periods and how to avoid late enrollment penalties.

Do You Need to Enroll in Medicare at Age 65?

The answer depends on your current health insurance situation. If your employer (or your spouse’s) has 20 or more employees and you’re actively working, you can delay enrolling in Medicare Part B and Medicare Part D without penalty, as long as your employer’s plan is considered creditable coverage. However, if the employer has fewer than 20 employees, you generally must enroll in Medicare when you turn 65 to avoid Medicare penalties.

- If your employer has 20 or more employees, you can delay enrolling in Medicare Part B and Medicare Part D without penalty, as long as your employer’s plan is considered creditable coverage.

- If the employer has fewer than 20 employees, you generally must enroll in Medicare when you turn 65 to avoid Medicare penalties and ensure continuous health insurance coverage.

When You Retire: Using the Special Enrollment Period (SEP)

Once you stop working or lose employer coverage, you enter a Special Enrollment Period (SEP), which allows you to sign up for Medicare without facing penalties. It’s essential to understand the Medicare enrollment deadlines to avoid late enrollment penalties.

- You have 8 months to enroll in Medicare Part B after your employment or group coverage ends.

- You have 63 days to enroll in Medicare Part D after your drug coverage ends.

Failing to enroll within these windows can trigger Medicare penalties, so it’s crucial to plan carefully and understand the Medicare enrollment process.

Key Steps to Avoid Penalties

- Confirm Your Employer Coverage Is Creditable

Talk to your HR or benefits administrator to confirm whether your current plan counts as creditable coverage for Medicare Parts B and D. This will help you determine whether you can delay enrolling in Medicare without penalty.

- Creditable coverage means the employer health plan is at least as good as Medicare.

- If your current employer coverage is creditable, you may be able to delay enrolling in Medicare Part B and/or Part D without penalties.

- If it’s not creditable, you need to enroll in Medicare when first eligible to avoid Medicare penalties and ensure continuous health insurance coverage.

- Gather the Required Paperwork

When you retire and apply for Medicare Part B, you’ll need to submit Form CMS-L564 (Request for Employment Information), signed by your employer. This proves you had coverage and qualifies you for penalty-free late enrollment. - Time Your Enrollment Carefully

Enroll during your Special Enrollment Period instead of using the General Enrollment Period (January 1–March 31), which may result in a coverage gap and Medicare penalties. Also, note that COBRA isn’t considered group health plan coverage, so use the Special Enrollment Period to avoid penalties.

Should You Enroll in Medicare Part A at 65?

Many people enroll in Medicare Part A at 65, even while working, because it’s free if you or your spouse worked and paid Medicare taxes for at least 10 years. Additionally, Medicare Part A can serve as secondary insurance to your employer plan.

- It’s free if you or your spouse worked and paid Medicare taxes for at least 10 years.

- It can serve as secondary insurance to your employer plan, providing additional health insurance coverage.

However, if you have a Health Savings Account (HSA) and want to continue contributing to it, do not enroll in any part of Medicare, including Medicare Part A. Once you enroll, you can no longer contribute to your HSA.

Working past 65 doesn’t mean you’ll be penalized by Medicare — but it does require some proactive planning. By understanding your coverage options, including Medicare Advantage plans and Medigap insurance, and acting during the correct enrollment windows, you can avoid costly mistakes and ensure a smooth transition when you’re ready to retire.

For more information, visit www.medicare.gov and download the Medicare and You handbook. These resources can answer many of your questions about enrolling in Medicare and help you navigate the Medicare enrollment process.