The fourth quarter of 2025 has been a wild ride for Bitcoin, marked by significant price fluctuations and heightened volatility. In December alone, the cryptocurrency’s value dropped by nearly 9%, with volatility spiking to levels not seen since April 2025. Despite this turmoil, a recent “ChainCheck” report by VanEck’s digital asset analysts offers a nuanced outlook, suggesting that while on-chain activity remains weak, improving liquidity conditions and resetting speculative leverage could signal cautious optimism for long-term holders.

The report highlights the contrasting behaviors of different investor groups. Digital Asset Treasuries (DATs) have been aggressively buying the dip, accumulating 42,000 BTC – their largest addition since July – and bringing their aggregate holdings above one million BTC. This trend is in stark contrast to Bitcoin exchange-traded product (ETP) investors, who have reduced their exposure, underscoring a shift towards corporate accumulation over retail-led speculation.

VanEck’s analysts note that some DATs are exploring alternative financing methods, including issuing preferred shares rather than common stock, to fund purchases and operations. This strategic approach reflects a more long-term focus, rather than short-term speculation. On-chain data also reveals a divergence between medium- and long-term holders, with tokens held for one to five years seeing significant movement, suggesting profit-taking or portfolio rotation, while coins held for more than five years remain largely untouched.

VanEck interprets this as a signal that cyclical or shorter-term participants are offloading assets, whereas the oldest cohorts maintain conviction in Bitcoin’s future. This trend is supported by the fact that Bitcoin has doubled in value over the past two years and nearly tripled over three, despite the current volatility.

Bitcoin miners face a falling hashrate

Meanwhile, miners are facing a challenging environment, with network hash rates falling 4% in December – the sharpest decline since April 2024. This decline is largely due to high-capacity operations in regions such as Xinjiang reducing output amid regulatory pressures. Breakeven electricity costs for major mining rigs have also dropped, reflecting tighter profit margins. However, VanEck notes that falling hash rates can serve as a bullish contrarian indicator, as periods of declining network power have often preceded positive 90- to 180-day forward returns.

VanEck’s analysis is framed within the GEO (Global Liquidity, Ecosystem Leverage, Onchain Activity) framework, which assesses Bitcoin’s structural health beyond daily price fluctuations. Under this lens, improving liquidity and accumulation by DATs provide a counterweight to softer on-chain metrics, including stagnating new addresses and declining transaction fees.

Broader macro trends add complexity to Bitcoin’s outlook. The U.S. dollar has weakened to near three-month lows, rallying precious metals, but Bitcoin and other crypto assets have remained under pressure. However, the evolving financial ecosystem may offer new support, with the rise of “everything exchanges” and platforms integrating stocks, crypto, and prediction markets, leveraging AI-driven trading and settlement systems.

Just last week, Coinbase made an ‘everything exchange’ like move, launching an expansion of its platform and introducing stock trading, prediction markets, futures, and other features. Companies entering this space are vying for market share, potentially increasing Bitcoin’s liquidity and utility over time, VanEck says.

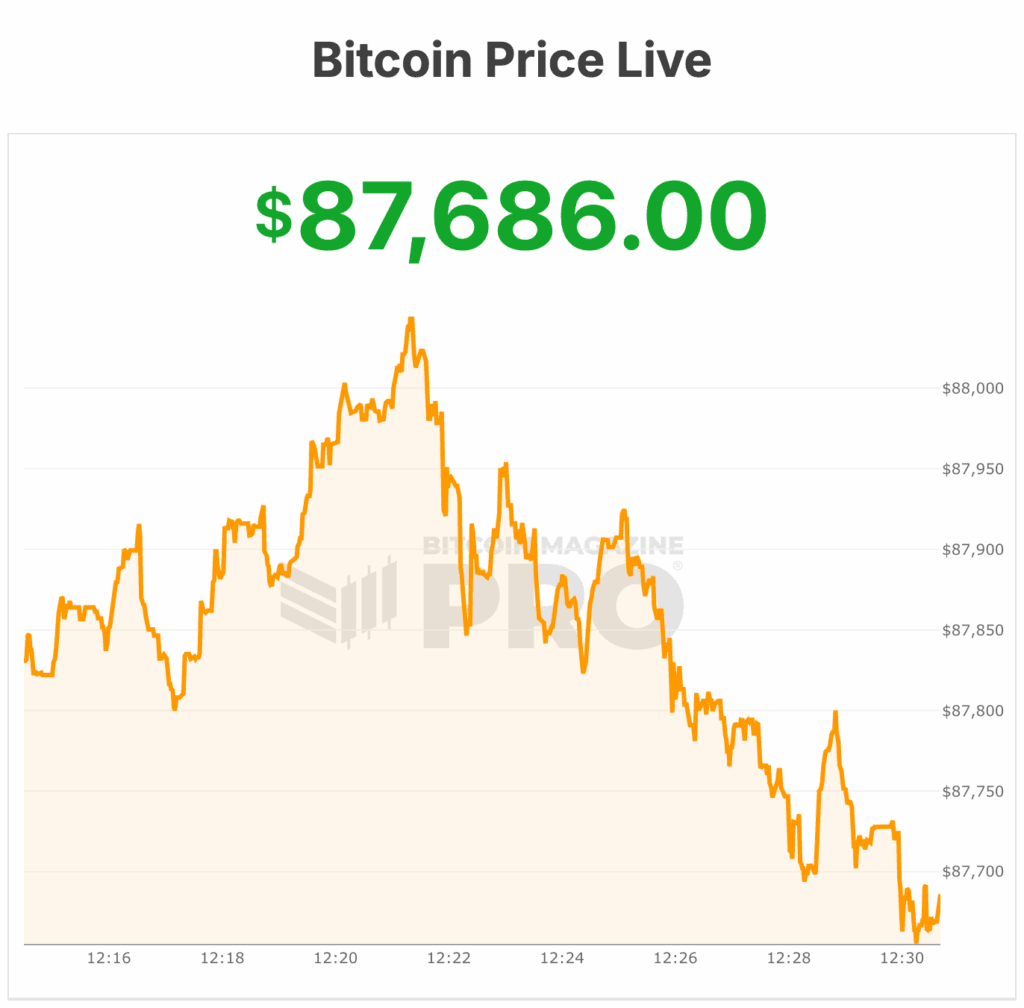

Bitcoin price volatility

Despite the current volatility, VanEck notes that the broader market is in correction, with short- to medium-term speculative activity retreating, long-term holders holding steady, and institutional accumulation rising. Coupled with signs of miner capitulation, subdued volatility, and macroeconomic dynamics, the firm frames the current environment as one of structural recalibration.

As 2025 draws to a close, Bitcoin may be in a period of consolidation that reflects broader market maturation, VanEck said. This may result in some strong positive price moves in the first quarter of next year, driven by improving liquidity, declining volatility, and increasing institutional investment.