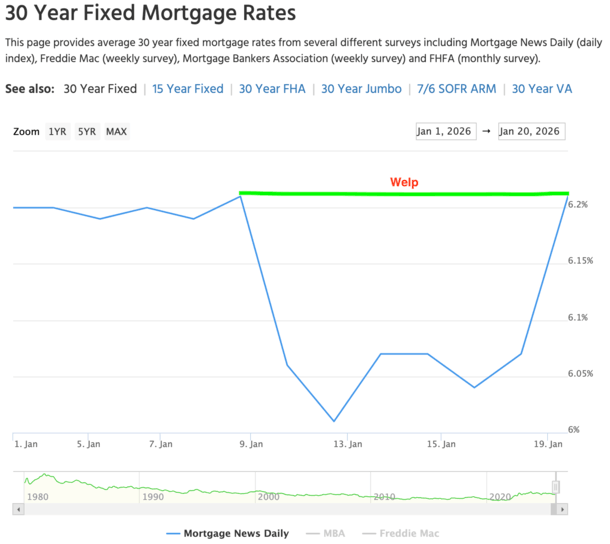

It’s only been 20 days into the new year, and we’ve already seen a significant shift in mortgage rates. The 30-year fixed mortgage rate has completed a round trip, returning to its previous level of 6.21% after a brief dip below 6% following the Trump administration’s announcement of a new MBS buying proposal.

This proposal aimed to lower mortgage rates, but its effects were short-lived. The rates responded initially, falling to 5.99%, but have now risen back to 6.21% due to concerns over a potential new trade war sparked by Trump’s demand for Greenland.

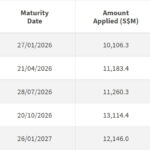

Adding to the volatility is the surge in Japanese bond yields, which can push US yields higher and subsequently impact mortgage rates. This can lead to a ripple effect, making it more expensive for borrowers to secure a mortgage.

According to Mortgage News Daily, the 30-year fixed mortgage rate averaged 6.21% today, erasing all the gains made after the MBS buying news. This means that borrowers who were hoping to secure a mortgage at a lower rate may now face higher costs.

The recent developments highlight the interconnectedness of mortgage rates with the broader economy. The threat of a new trade war and rising bond yields can have a significant impact on mortgage rates, making it essential for borrowers to stay informed and adapt to the changing landscape.

I previously discussed how the Greenland situation could affect mortgage rates, and the recent rate spike confirms this. The surge in mortgage rates can be attributed to the uncertainty and volatility in the market, making it crucial for borrowers to be aware of the factors that influence mortgage rates.

Remember, mortgage rates can fluctuate daily, and sometimes these changes can be substantial. The recent rate hike is a testament to this, and borrowers should be prepared for further changes in the market.

The rise in Japanese bond yields is also a concern, as it can lead to higher bond yields in the US, ultimately resulting in higher mortgage rates. This can create a challenging environment for borrowers, making it essential to stay up-to-date with the latest developments and trends in the mortgage market.

The 30-Year Fixed Mortgage Is Back to 6.21%

In a surprising turn of events, the 30-year fixed mortgage rate has returned to its previous level, highlighting the complexities and uncertainties of the mortgage market. The initial reaction to the MBS buying news was positive, but the subsequent rate hike demonstrates that mortgage rates are influenced by a wide range of factors, including global economic trends and trade policies.

As I’ve emphasized before, mortgage rates are interconnected with the broader economy. The recent developments serve as a reminder that mortgage rates don’t exist in a vacuum and are susceptible to changes in the global economic landscape.

Mortgage Rates Don’t Happen in a Bubble

The recent fluctuations in mortgage rates demonstrate that they are influenced by a complex array of factors, including trade policies, bond yields, and global economic trends. While the MBS buying proposal aimed to lower mortgage rates, its effects were short-lived, and the subsequent rate hike highlights the need for a more comprehensive approach to managing mortgage rates.

To achieve lower mortgage rates, policymakers must consider the broader economic context and implement policies that address the underlying drivers of mortgage rates, such as inflation and government debt. A more nuanced approach is necessary to create a stable and favorable environment for borrowers.