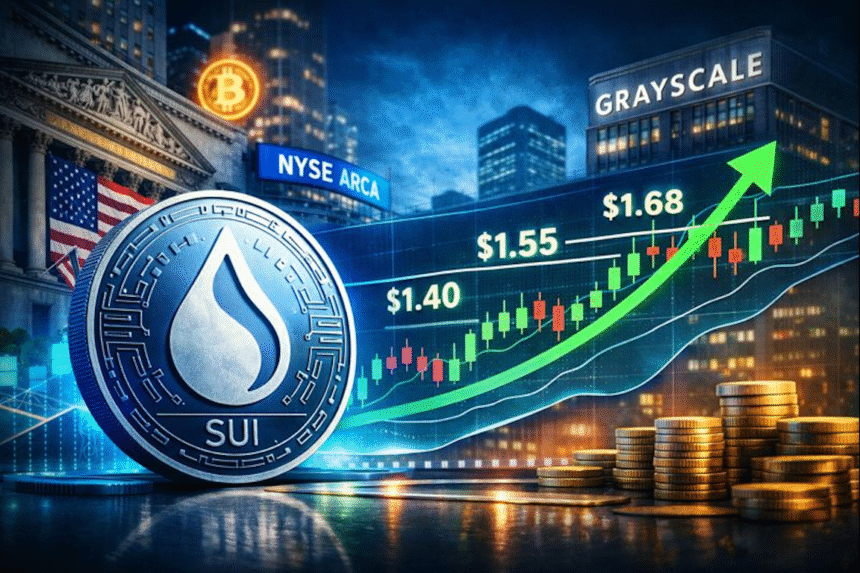

- Grayscale’s recent filing for a Sui ETF has sparked significant institutional interest in SUI, potentially paving the way for increased adoption and investment in the cryptocurrency.

- Currently, SUI is trading at $1.41, with a key resistance level at $1.55 that traders are closely watching for a potential breakout.

- Analysts are warning of a possible short-term dip in the price of SUI before a stable base is formed, emphasizing the need for cautious investment strategies.

The proposed Sui ETF, which would trade under the ticker GSUI on the NYSE Arca, is designed to include staking features, allowing investors to earn yield while holding the token and potentially increasing its appeal to a broader range of investors.

Coinbase has been appointed as the prime broker for the ETF, while the Bank of New York Mellon will provide administrative support, highlighting the involvement of major financial institutions in the Sui ecosystem.

Other firms, including Bitwise and Canary Capital, have also filed for SUI-related products, demonstrating growing competition and interest in the cryptocurrency market.

These developments are indicative of increasing institutional interest in the Sui ecosystem, suggesting that SUI may gain traction not only among retail investors but also among professional investors seeking regulated exposure to cryptocurrencies.

The filings suggest a potential shift in the market, as institutional investors begin to take notice of SUI’s potential for long-term growth and stability.

Sui price analysis

SUI is currently trading at $1.41, having experienced a 3.6% decline over the past seven days, with its 24-hour trading range remaining relatively narrow between $1.40 and $1.45.

Technical analysts are pointing to $1.55 as the next key resistance level that traders should watch, as a break above this point could pave the way for further gains toward $1.60 and $1.68, potentially driven by increased investor confidence and demand.

However, short-term support is currently around $1.40, and a decisive break below this could push SUI toward the $1.20–$1.30 range, emphasizing the need for careful risk management strategies.

The Relative Strength Index (RSI) suggests that SUI may be oversold in the short term, providing potential for a rebound as investors look to capitalize on undervalued assets in the cryptocurrency market.

Despite this, some analysts caution that the recent bounce may be weak compared to larger cryptocurrencies like Bitcoin and Ethereum, suggesting that SUI could retest lower support levels near $1 or slightly above before forming a more stable base and potentially resuming its upward trajectory.

The 7-day range of $1.38 to $1.54 indicates volatility but also shows that buyers are still defending critical price zones, highlighting the ongoing battle between bulls and bears in the SUI market.

SUI price outlook

As institutional interest grows, the broader crypto market navigates volatility, with ETF filings from multiple firms demonstrating confidence in the long-term prospects of SUI and potentially driving increased investment and adoption.

At the same time, historical performance shows that the altcoin has faced large swings, with an all-time high of $5.35 and a low of $0.3648, emphasizing the need for investors to be aware of the potential risks and rewards associated with SUI.

Even with these fluctuations, the token has gained more than 285% from its recent low, reflecting strong recovery potential and the ongoing appeal of SUI to investors seeking high-growth opportunities in the cryptocurrency market.

Trading volume remains healthy, with over $635 million exchanged in the last 24 hours, providing liquidity that can support price movements as the market reacts to ETF developments and technical patterns.

If bullish momentum persists, the cryptocurrency may challenge the $1.55 resistance in the near term, potentially driven by increased investor confidence and demand for SUI.

Conversely, failure to break above key levels could result in a consolidation phase or minor pullback, highlighting the importance of careful risk management and investment strategies in the SUI market.

The combination of institutional interest, ETF filings, and technical setups makes this a critical moment for SUI, as investors and traders closely monitor both price action and regulatory updates.

As the token navigates resistance and support levels, the next few weeks could determine its trajectory, with the potential for a renewed bullish phase and increased growth in the SUI market.

With proper momentum, SUI could be poised for a significant breakout, edging closer to $1.55 and potentially beyond, driven by increased investor confidence and demand for the cryptocurrency.