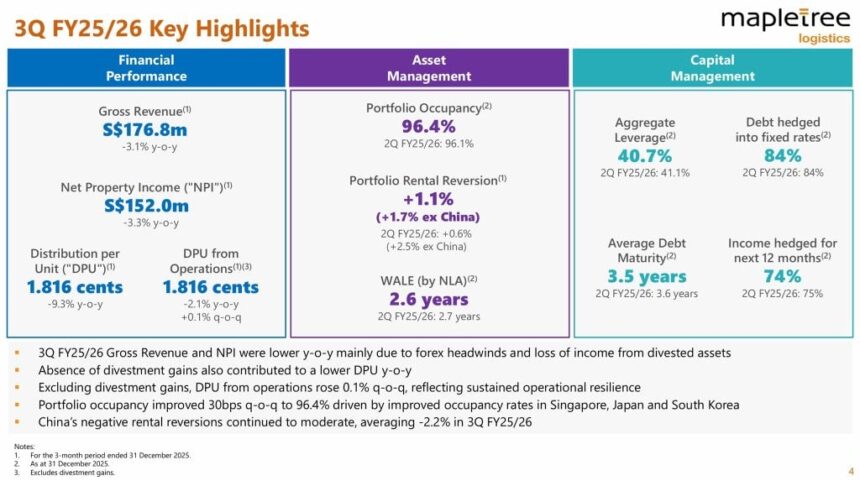

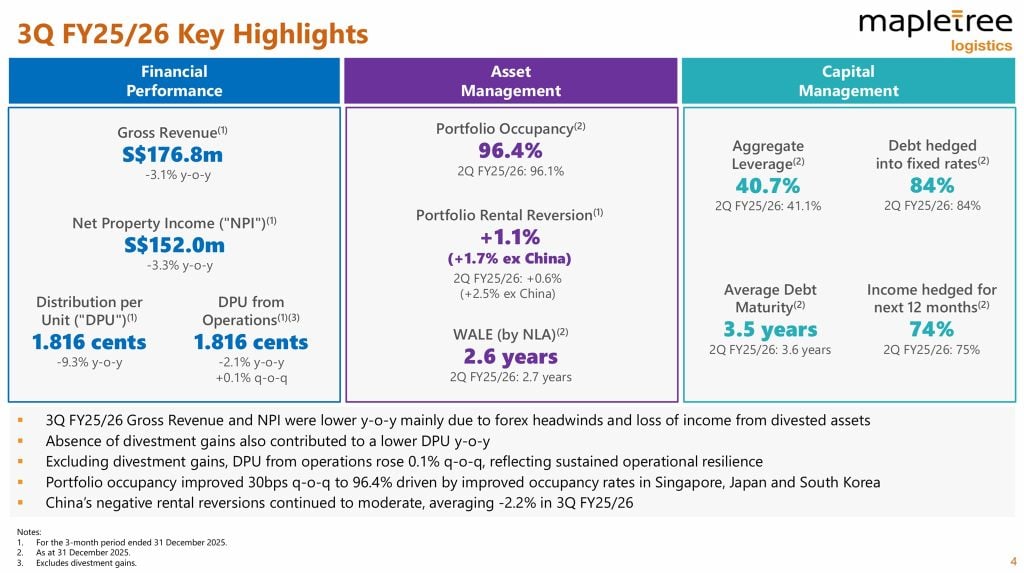

Mapletree Logistics Trust (MLT), a prominent logistics-focused real estate investment trust (REIT) in Asia, boasts an extensive and diversified portfolio that spans across key markets in Singapore, China, Japan, South Korea, Australia, and other crucial Asia-Pacific regions. By focusing on modern logistics facilities, MLT supports supply chain resilience and e-commerce growth, leveraging two significant long-term structural trends that continue to shape the logistics and industrial property landscape in the region. On 26 January 2026, MLT released its Third Quarter FY25/26 financial results, offering investors a comprehensive update on its operational performance, effective capital management strategies, and the overall health of its portfolio. Despite navigating a challenging macroeconomic environment, the REIT demonstrated stability across most key metrics, attributed to its substantial scale and a well-diversified tenant base that enhances its financial stability and reduces potential risks.

Mapletree Logistics Trust (MLT), a prominent logistics-focused real estate investment trust (REIT) in Asia, boasts an extensive and diversified portfolio that spans across key markets in Singapore, China, Japan, South Korea, Australia, and other crucial Asia-Pacific regions. By focusing on modern logistics facilities, MLT supports supply chain resilience and e-commerce growth, leveraging two significant long-term structural trends that continue to shape the logistics and industrial property landscape in the region. On 26 January 2026, MLT released its Third Quarter FY25/26 financial results, offering investors a comprehensive update on its operational performance, effective capital management strategies, and the overall health of its portfolio. Despite navigating a challenging macroeconomic environment, the REIT demonstrated stability across most key metrics, attributed to its substantial scale and a well-diversified tenant base that enhances its financial stability and reduces potential risks.

Financial Performance Overview

| 3QFY25/26 (S$’000) | 3QFY24/25 (S$’000) | % Change | |

|---|---|---|---|

| Gross Revenue | 176,829 | 182,413 | (3.1%) |

| Property Expenses | (24,836) | (25,212) | (1.5%) |

| Net Property Income | 151,993 | 157,201 | (3.3%) |

| Borrowing Costs | (38,191) | (39,925) | (4.3%) |

| Amount Distributable | 92,671 | 101,314 | (8.5%) |

…