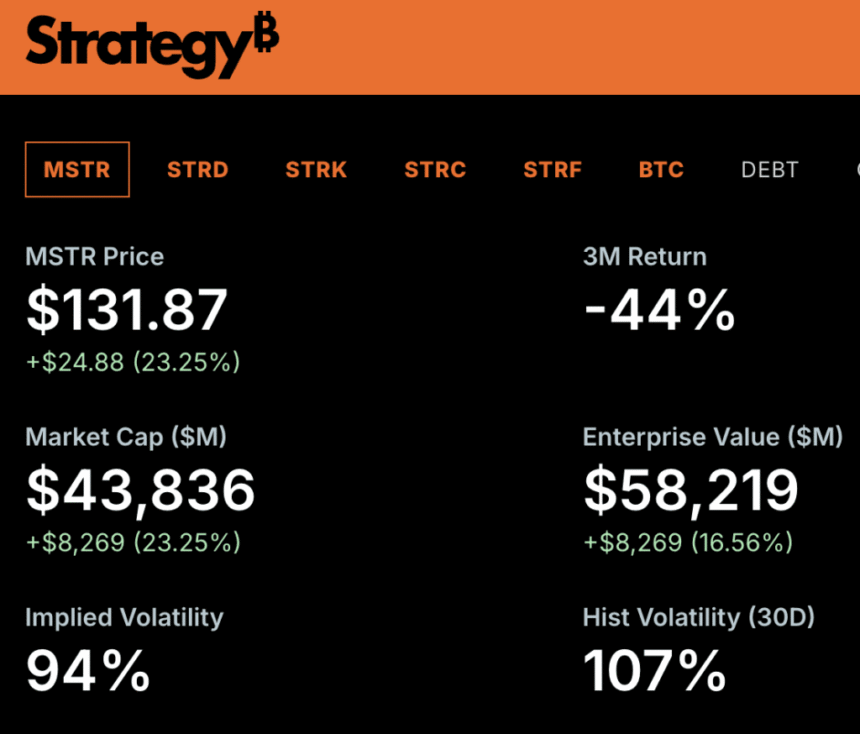

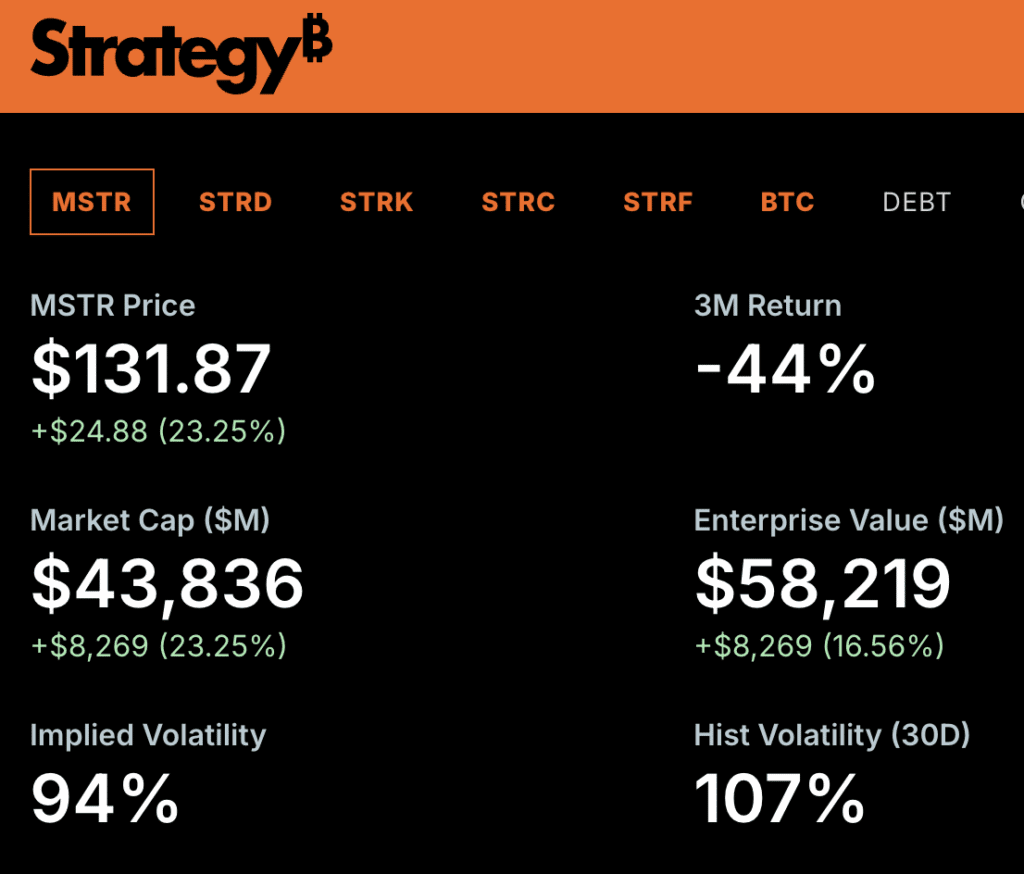

Strategy ($MSTR) shares experienced a significant surge on Friday, with prices rising over 25% at times and reaching nearly $133, following a brutal previous session that left the bitcoin-linked stock deeply oversold due to the cryptocurrency market volatility.

The stock’s rebound was driven by the stabilization of markets and bitcoin’s recovery from multi-week lows to around $71,000, which injected newfound demand into equities tied to digital assets and sparked a rally in the crypto market.

Friday’s rally marked a reversal of the dramatic sell-off on Thursday, during which MSTR shares plunged to multi-year lows due to earnings losses and renewed pressure in the crypto markets, highlighting the company’s sensitivity to bitcoin price fluctuations.

From a macro perspective, Strategy’s stock movement has closely tracked bitcoin’s sharp price swings, as the leading corporate holder of bitcoin, with MSTR’s performance highly correlated with BTC price action, making it a key player in the digital asset market.

Declines in digital assets earlier in the week sent the stock tumbling, with bears pushing Strategy prices as low as the $105 range on Thursday, underscoring the risks associated with investing in crypto-related stocks.

Strategy’s earnings losses and bitcoinvestment strategy

Strategy posted a $12.4 billion loss for the fourth quarter of 2025, largely driven by unrealized declines in the value of its vast bitcoin holdings, highlighting the risks of investing in digital assets.

The headline loss dwarfed market expectations and weighed heavily on the share price, contributing to the Thursday slump, as investors reacted to the company’s exposure to the volatile cryptocurrency market.

Despite the earnings shortfall, executives remained committed to their long-term bitcoin strategy, emphasizing the potential for growth and adoption of digital assets in the financial sector.

Executive Chairman Michael Saylor said that the company is starting a Bitcoin Security Program to coordinate with global cyber and crypto communities, framing quantum computing as a long-term challenge unlikely to threaten Bitcoin for over a decade, and highlighting the company’s efforts to address concerns around bitcoin security.

The company said that quantum fears are the latest form of Bitcoin “FUD,” noting ongoing global investment in quantum-resistant security and potential protocol upgrades through broad consensus, as the digital asset community continues to evolve and address potential risks.

Strategy’s leadership stressed resilience, saying the company could withstand extreme bitcoin price drops without immediate solvency concerns, and expressing confidence in the long-term potential of bitcoin and digital assets.

Executives, like CEO Phong Le, highlighted long-term strategy, ongoing capital raises, and confidence that Bitcoin will emerge stronger from future technological or market challenges, emphasizing the company’s commitment to its digital asset investment strategy.

Le said Bitcoin would need to fall to around $8,000 per coin and stay at that level for five to six years before the company would face serious difficulty servicing its convertible debt, providing insight into the company’s risk management and financial planning.

“In the extreme downside, if we were to have a 90% decline in bitcoin price, and the price was $8,000, that is the point at which our bitcoin reserve equals our net debt,” Le said. He noted that under such conditions, the company could consider restructuring or raising additional capital, highlighting the potential risks and challenges associated with investing in digital assets.

At the time of writing, the price of Bitcoin is $70,040, with a 24-hour trading volume of 157 B. BTC is 7% in the last 24 hours, reflecting the ongoing volatility and fluctuations in the cryptocurrency market.

It is currently -2% from its 7-day all-time high of $71,258, and 16% from its 7-day all-time low of $60,256. BTC has a circulating supply of 19,985,218 BTC and a max supply of 21,000,000 BTC, providing insight into the current state of the bitcoin market and its potential for future growth.