Choosing the right tax regime is a crucial decision for taxpayers in India. With the introduction of the new tax regime in Budget 2020, taxpayers now have the option to choose between the old Vs new tax regimes. While the new regime offers lower tax rates, it eliminates many of the deductions and exemptions that were previously available. For many individuals, especially those in specific income brackets, the old tax regime remains a compelling choice. Here’s an in-depth look at why the old tax regime continues to be a preferred option for many taxpayers.

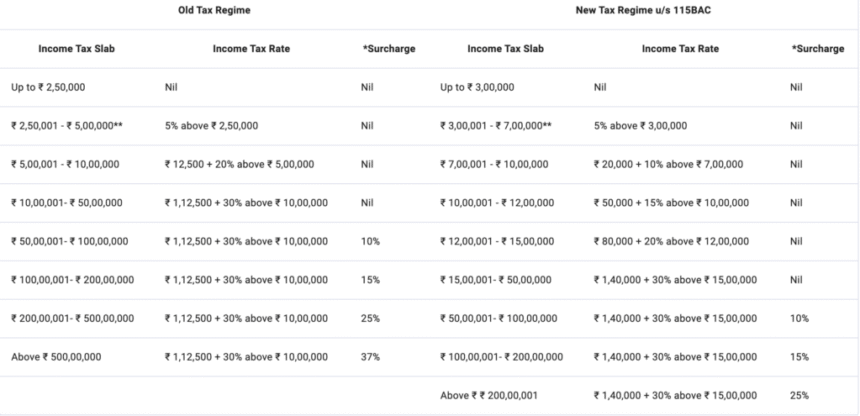

Tax Slabs – Old Vs New Regime Tax Slabs

The table below shows the tax slab for Old Vs New Tax Regime as per the income tax website. The slab rate are much better for New tax regimes.

Why People prefer Old Tax Regime?

Even though income tax slabs are favorable for New tax regime, a lot of people still prefer the old tax regime. Here are some of the reasons:

Comprehensive Deductions Under Section 80C

One of the most significant benefits of the old tax regime is the deductions available under Section 80C of the Income Tax Act. Taxpayers can claim up to ₹1.5 lakh in deductions for investments in a wide range of financial instruments. These include:

- Public Provident Fund (PPF): A secure, long-term investment option with tax-free returns.

- Employee Provident Fund (EPF): Contributions made by employees towards their EPF account are deductible.

- National Savings Certificates (NSC): These government-backed savings schemes offer tax benefits.

- Life Insurance Premiums: Premiums paid for life insurance policies qualify for deductions.

- ELSS/ Tax Saving Mutual Funds: Investments made in ELSS funds are eligible for tax deduction.

- Tax Saving Fixed Deposits: These are special 5 year FDs provided by banks and Post offices eligible for deduction.

- Children Educational Expenses: Tuition fee paid for own children are eligible for tax deductions.

- Sukanya Samriddhi Yojana (SSY): A secure, long-term investment option with tax-free returns for girl child.

By leveraging these deductions, taxpayers can significantly reduce their taxable income, which often outweighs the benefits of lower tax rates under the new regime.

Health Insurance Premiums (Section 80D)

Health insurance premiums provide additional tax-saving opportunities under the old tax regime. Taxpayers can claim:

- Up to ₹25,000 for premiums paid for self, spouse, and dependent children.

- An additional ₹50,000 for premiums paid for senior citizen parents.

- Additionally, a deduction of up to ₹5,000 is available for preventive health check-ups.

These benefits ensure that taxpayers not only save on taxes but also prioritize health security for themselves and their families.

Tax Savings on Home Loan Interest (Section 24)

For individuals with home loans, the old tax regime offers substantial tax benefits:

- Deduction of up to ₹2 lakh per annum on the interest component of a home loan for a self-occupied property.

- Tax benefits on the principal repayment of home loans under Section 80C.

These deductions make homeownership more affordable and attractive, particularly for middle-income taxpayers.

House Rent Allowance (HRA)

House Rent Allowance (HRA) is a significant benefit for salaried individuals living in rented accommodation. Under the old tax regime, HRA exemptions are calculated based on:

- The actual HRA received from the employer.

- 50% of salary (basic salary + DA) for metro cities or 40% for non-metro cities.

- Rent paid minus 10% of salary.

This exemption helps salaried individuals reduce their taxable income considerably.

Leave Travel Allowance (LTA)

Under the old tax regime, salaried employees can claim exemptions for travel expenses incurred during vacations within India. The exemption covers the cost of travel for the taxpayer and their family. However, it is subject to specific conditions:

- Only the actual travel cost (airfare, rail, or road travel) is covered.

- Expenses on food, lodging, and other incidentals are not included.

- The exemption is available for two journeys in a block of four calendar years.

This benefit not only helps save taxes but also encourages employees to take breaks and rejuvenate.

Education Loan Interest (Section 80E)

Taxpayers repaying education loans for higher studies can claim deductions on the interest paid under Section 80E. Key features include:

- The deduction is available for up to 8 years or until the loan is fully repaid, whichever is earlier.

- There is no upper limit on the amount of interest that can be claimed as a deduction.

- The loan can be taken for higher education of self, spouse, or children, and even for a student for whom the taxpayer is a legal guardian.

This deduction ensures that education remains accessible and affordable for taxpayers and their families.

Savings Account Interest (Section 80TTA/80TTB)

Interest earned on savings accounts is eligible for tax deductions under Section 80TTA. Taxpayers can claim:

- Up to ₹10,000 in deductions for interest earned from savings accounts with banks, post offices, or cooperative societies.

- Senior citizens, however, can claim deductions under Section 80TTB, which offers a higher limit of up to ₹50,000.

This benefit encourages taxpayers to maintain savings while reducing their tax liability.

Flexibility and Customization

The old tax regime allows taxpayers to customize their tax-saving strategies based on their financial goals and preferences. For example:

- Individuals can choose between fixed-income investments like PPF and NSC or market-linked instruments like ELSS.

- Taxpayers can allocate funds towards health, education, and retirement planning to maximize deductions.

This flexibility is absent in the new tax regime, which offers a one-size-fits-all approach.

Tax Planning for the Long Term

By investing in instruments that offer deductions under the old tax regime, taxpayers can build long-term financial stability. These investments often come with additional benefits, such as guaranteed returns, safety, and retirement planning. For instance:

- PPF and EPF provide risk-free returns and are ideal for retirement planning.

- Life insurance policies ensure financial security for dependents.

- Education loans encourage investment in higher education, leading to better career opportunities.

Why Some Taxpayers Prefer the New Tax Regime?

While the old tax regime has several advantages, it’s worth noting why some taxpayers might opt for the new regime. The new regime simplifies the tax filing process by eliminating the need to track deductions and exemptions. It is beneficial for individuals who do not have significant investments or expenses that qualify for deductions. For higher-income earners, the lower tax rates under the new regime may result in greater tax savings.

To encourage more and more people to opt for new tax regime, Budget 2024 has increased the Standard Deduction for salaried and family pension for new tax regime.

- Salaried Person from Rs 50,000 to Rs 75,000

- Family Pension from Rs 15,000 to Rs 25,000

This deduction is automatic and does not require any investment proofs or documentation.

Another benefit with New Tax Regime is related to employer contribution to NPS u/s 80CCD(2). The employer can contribute tax free up to 14% if the employee follows new tax regime Vs 10% in case of old tax regime. This change came in effect in Budget 2024.

Old Vs New Tax Regime – Which is Better for You?

The choice between the old and new tax regimes depends on several factors:

- Income Level: Taxpayers in lower income brackets may benefit more from the old regime due to deductions.

- Investment Habits: Individuals who actively invest in tax-saving instruments will find the old regime advantageous.

- Financial Goals: Taxpayers focused on long-term financial planning often prefer the old regime.

To make an informed decision, it’s advisable to calculate your tax liability under both regimes using an online tax calculator or consulting a tax advisor.

Conclusion

The old tax regime continues to be a viable and attractive option for many taxpayers in India. With its wide range of deductions and exemptions, it offers significant tax-saving opportunities while promoting financial discipline and long-term planning. However, the right choice depends on individual circumstances, income levels, and financial goals. By carefully evaluating both options – old and new tax regime, taxpayers can maximize their savings and achieve their financial objectives.

6z0wg1