I generally come across some very basic insurance related queries like

- “I am not a smoker right now, if I buy a term plan – will I have to inform the company in case I start smoking in future”

- “My father just got diagnosed with diabetes, Can I get a health insurance which covers that?”

- “Why my premium have gone up after medicals even though I am fit and healthy?”

- “How can an insurance company pay me Rs 1 crore, when they are just charging Rs 15,000 as premium?”

All these questions are very genuine questions and if someone does not understand the principles of Insurance, they will ask them.

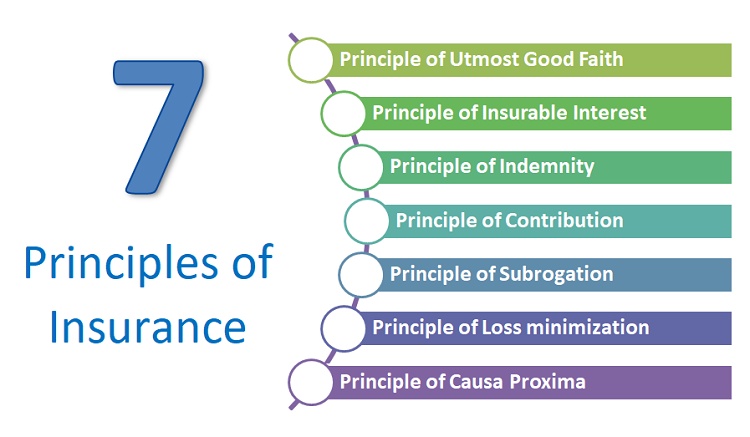

So today I am going to share with you the 7 principles on which the insurance industry runs. These are basic principles on which the business of insurance is based on. I hope these 7 principles will clear our all the myths regarding insurance.

Let’s start

Principle #1 – Principle of Utmost Good Faith (Uberrimae fidei)

The principle of utmost good faith is the most basic and primary level principle of insurance and it applies to all kind insurance policies. It simply means that the person who is getting insured must willingly disclose to the insurer, all his complete & true information regarding the subject matter of insurance.

The insurer’s liability exists only on the assumption that no material fact is hidden or falsely presented by the person getting insured.

There is a process called as “Underwriting” in insurance industry which is the activity of studying the risk and assigning the premium value for the case and it’s very important that the person buying any kind of insurance tells all the facts correctly and does not hide it.

If you think about term plan or health insurance, you need to correctly mention things like

- If you are a smoker or drinker

- Your family illness history

- The Industry you work for

- Your Income

- Your Age

- Your current illnesses (which you are already aware of)

If you do not tell these things correctly, you are violating the “Principle of utmost good faith” here and it can impact your insurance claim process in future.

Principle #2 – Principle of Insurable Interest

This principle says that the person who is taking insurance should have some insurable interest in that thing which is getting insured. So if there will be financial loss to the person if the insured object gets destroyed. If this is not the case, insurance cannot be taken

So when a breadwinner takes life insurance for his life, it makes sense because incase the person dies, there will be financial loss to family .

In the same way, you can get your car, bike, home, gold insured because you have insurable interest in that object. You can’t get your neighbor car insured and benefit because you do not have insurable interest in that.

Principle #3 – Principle of Indemnity

Principle of Indemnity says that Insurance is not to make profit, but only to compensate you against the losses incurred. It’s an assurance to restore the same position which was there before the loss.

So the compensation paid cannot be more than the losses incurred.

In term plan, people ask why companies ask for income details. It’s to make sure that a person takes limited insurance which goes with his financial status and is good enough to restore back his family life style which was there in existence.

If a person earns Rs 1 lacs per month. Then Rs 2-3 crores is a good enough life insurance for the person and they cannot take Rs 500 crore insurance even if they can pay the premiums, because then the intention is not to cover your financial loss but to benefit/profit from the insurance policy.

That’s exactly the reason why house-wife does not get very high insurance, because the motive is to profit from the death of non-earning member and not replace the income which that person was earning.

Principle #4 – Principle of Contribution

This principle is just a corollary of the principle of indemnity. As per this principle, the insured company are liable to pay only their own contribution and they have right to recover back the excess money paid from other insurer.

Let’s see how it works.

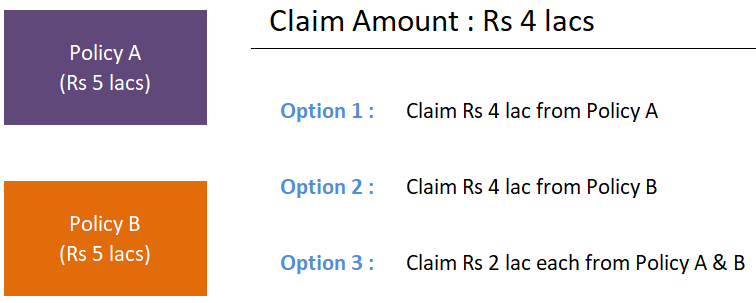

Imagine you have two health insurance policies A and B , both for Rs 5 lacs sum assured. If there is a claim for Rs 4 lacs, then each insurer is liable to contribute Rs 2 lacs each for this claim.

However in real life, you as insurer can go to any insurer and claim it from them or divide it between insurers. So you can claim full Rs 4 lacs either from policy A or policy B or Rs 2 lacs from A and B each.

However if you claim Rs 4 lacs from company A, in that case company A can recover back Rs 2 lacs from company B as per the principle of contribution.

Principle #5 – Principle of Subrogation

As per this principle, once the insured is paid for the losses due to damage to his insured property, then the ownership right of such property shifts to the insurer. So if your car / bike / house / valuables which you have insured is fully damaged and once you get compensation from insurance company, then they get the ownership of the item and now they can sell off the remains to recover their dues by that process

You can’t benefit from the remains of that item.

Imagine this scenario : You have car insurance and the car is stolen. The insurance company will pay you the full claim amount. However now the ownership rights are transferred to the insurance company and if the car is found in future by Police, it will be owned by insurance company

Also, imagine a scenario where a car is insured and the car is badly damaged beyond the use. In that case the insurance company will pay you the claim fully. Now you can’t say that you will still sell off the car parts by getting it repaired because you lose the rights to property.

One more thing ..

As per this principle, the insurer will try to recover their losses from other party later as if they were at your place. Let me give you an example

Let’s say your house is insured for Rs 1 crore. Because of some reason, let’s say your neighbor negligence there was a fire in your house and your house is fully damaged. In this case you will claim from insurance company, and get the money.

But after that the company will try to recover the losses from the culprit in the way you might have done it if there was no insurance. So might file a case against the neighbor’s in court claiming for damages.

Principle #6 – Principle of Loss minimization

As per this principle, it’s the insured duty & responsibility to take all actions to minimize the losses if it’s in their control. The insured person should take all necessary steps to control and reduce the losses if possible

Imagine there is a small fire in the car for example. If the car is insured, the insured person can’t just sit and relax thinking that the car is insured, he will get the claim for sure.

If it’s in his control, he can try to control the fire, call the fire department or take first level steps like throwing water etc. If they don’t do it, it’s the violation of this principle.

Principle #7 – Principle of Causa Proxima (Nearest Cause)

This is a very important principle of insurance which an insured person should be aware about.

As per this principle of causa proxima, when a loss if caused by more than one causes, then the nearest or the closest cause should be taken into consideration to decide the liability of the insurer.

The nearest cause should be insured by the insurer, only then the insurer liability comes into picture and policy holder will be paid. Insurer will not be liable for the farthest cause.

One of the common examples given for this is this

A cargo ship base was punctured by rats and because of that puncture, sea water entered the ship. If you look at the events, there are two reasons for damage of ship

- Rats punctured the base of ship (farthest)

- Sea Water entered the ship (closest)

Here as the insurance company will have to pay because the ship was insured against sea water entering the ship and that reason was closest.

Conclusion

Understanding these principles are a good way to understand how insurance works and how claim process works. Just because you have taken an insurance policy does not mean that it’s written in stone that your claim will be paid. You claim will be paid only when insurer liability arises in a given condition.