Key points:

-

Bitcoin remains strong as long as it stays above $110,530.

-

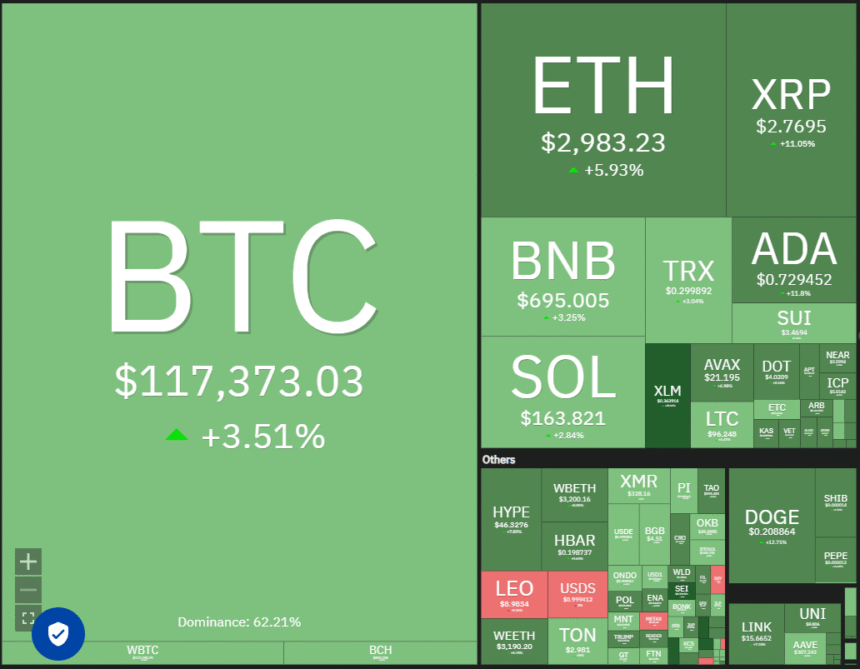

Bitcoin breaking to new all-time highs has attracted buying in select altcoins such as ETH, HYPE, UNI, and SEI.

Bitcoin (BTC) has been on a roll, rising above $118,800 on Friday, indicating sustained buying by the bulls and short covering by the bears. CoinGlass data shows that roughly $570 million in BTC short positions were liquidated on Thursday.

Another positive is that the US spot Bitcoin exchange-traded funds witnessed the second-largest daily inflows of $1.17 billion on Thursday, according to Farside Investors data. That suggests the institutional investors expect BTC’s up move to continue.

Market analyst Axel Adler Jr said in a post on X that studying the Market Value to Realized Value (MVRV) oscillator and its data over the past 4 years shows that distribution starts when MVRV hits the 2.75 mark. That corresponds to roughly $130,900 on Bitcoin.

Could Bitcoin extend its uptrend, pulling select altcoins higher? Let’s analyze the charts of the top 5 cryptocurrencies that look strong on the charts.

Bitcoin price prediction

BTC completed a bullish inverse head-and-shoulders (H&S) pattern after breaking above the neckline on Thursday.

Usually, after the breakout from a pattern, the price turns down and retests the breakout level. If the BTC/USDT pair rebounds off the neckline, it signals that the bulls have flipped the level into support. That increases the likelihood of the continuation of the uptrend toward the pattern target of $150,000.

The first sign of weakness will be a break and close below the neckline. That signals profit-booking at higher levels. The bears will have to pull the price below the 50-day simple moving average ($106,981) to gain the upper hand.

The price turned up sharply from $110,530 and broke above the neckline. The up move has pushed the relative strength index (RSI) into the overbought territory on the 4-hour chart. That increases the possibility of a short-term correction or consolidation. If the price maintains above the neckline, the uptrend could reach $123,000.

This optimistic view will be negated in the near term if the price turns down sharply and breaks below the $110,530 support.

ETH price prediction

Ether (ETH) rallied sharply from the 20-day EMA ($2,613) on Tuesday and soared above the $2,879 resistance on Thursday.

The 20-day EMA has turned up, and the RSI is in the overbought zone, indicating that bulls have the upper hand. There is minor resistance at $3,153, but if the level is crossed, the ETH/USDT pair could ascend to $3,400 and subsequently to $3,750.

The first support on the downside is at $2,879 and then at $2,733. Sellers will have to pull the price below $2,733 to trap the aggressive bulls. Until then, every minor dip is likely to be viewed as a buying opportunity.

The RSI on the 4-hour chart has jumped into the overbought zone, suggesting a short-term consolidation or correction. The pair could pull back to $2,879, where the buyers are expected to step in. If the price bounces off $2,879 with force, it indicates that the bulls are trying to flip the level into support. That improves the prospects of the continuation of the uptrend.

Short-term buyers may book profits if the price tumbles below $2,879. The pair may then descend to the 20-EMA.

HYPE price prediction

Hyperliquid (HYPE) rebounded off the 50-day SMA ($37.66) on Tuesday and picked up momentum after breaking above the 20-day EMA ($39.69).

The upsloping 20-day EMA and the RSI near the overbought zone indicate the path of least resistance is to the upside. If buyers sustain the price above $45.80, the H&S pattern will be invalidated. The failure of a bearish setup is a bullish sign, which could catapult the price to $50 and later to $60.

Sellers will have to yank the price below the 50-day SMA to stall the bullish momentum. The HYPE/USDT pair may then slump to $30.70.

The pair is witnessing a tough battle between the bulls and the bears at the $45.80 level. If the price turns down, it is likely to find support at the 38.2% Fibonacci retracement level of $42.83 and then at the 20-EMA. A strong bounce off the 20-EMA increases the possibility of a break above $46.46. The pair may then soar to $50.

Contrarily, a break and close below the 20-EMA suggests that the bulls are booking profits. The pair may slump to the 50-SMA and then to $37.

Related: Here’s what happened in crypto today

UNI price prediction

Uniswap (UNI) has been forming a series of higher highs and higher lows, signaling a potential trend change.

Both moving averages are sloping up, and the RSI is in the positive zone, indicating that buyers have the edge. There is resistance at $8.64, but a close above it opens the doors for a rally to $10.36. Sellers will try to halt the rally at $10.36, but if buyers do not allow the price to dip below $8.64 on the way down, the UNI/USDT pair could soar to $13.

This bullish view will be invalidated in the near term if the price turns down and breaks below the 50-day SMA ($7).

The pair has broken out of the $8.64 resistance, signaling the continuation of the up move. If the price maintains above $8.64, the pair could surge to $10.

Sellers are likely to have other plans. They will try to pull the price back below the breakout level of $8.64. If they can pull it off, the pair could slide to the 20-EMA. A strong bounce off the 20-EMA indicates buying on dips. The bulls will then again try to resume the uptrend.

The selling could accelerate if the price turns down and breaks below the 20-EMA. That could sink the pair to the 50-SMA.

SEI price prediction

Sei (SEI) turned up sharply from the 20-day EMA ($0.26) on Thursday and has reached the overhead resistance of $0.34.

The upsloping 20-day EMA and the RSI in the overbought zone signal an advantage to buyers. A close above the $0.34 resistance could start the next leg of the uptrend toward $0.44.

The immediate support on the downside is at $0.29. If the price turns down from $0.34 but finds support at $0.29, it suggests the positive sentiment remains intact. The bulls will again try to drive the SEI/USDT pair above the overhead resistance. Sellers will have to pull the price below the 20-day EMA to signal a comeback.

The 4-hour chart shows the pair has broken out of the $0.24 to $0.34 range, but the bulls are struggling to maintain the higher levels. The overbought level on the RSI suggests a correction or consolidation in the near term. If the price turns up from the current level or the $0.31 support, the bulls will again try to drive the pair toward $0.44.

On the contrary, a break and close below $0.31 could sink the pair to $0.29. That suggests the pair may remain inside the $0.24 to $0.34 range for a while longer.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.