Key takeaways:

-

Bitcoin is ahead of its long-term “power law” curve, historically leading to euphoric price highs in previous cycles.

-

A falling dollar and anticipated Federal Reserve interest rate cuts may trigger a broader risk-on rally, with Bitcoin as a major beneficiary.

-

Spot Bitcoin ETFs have captured 70% of gold’s inflows in 2025.

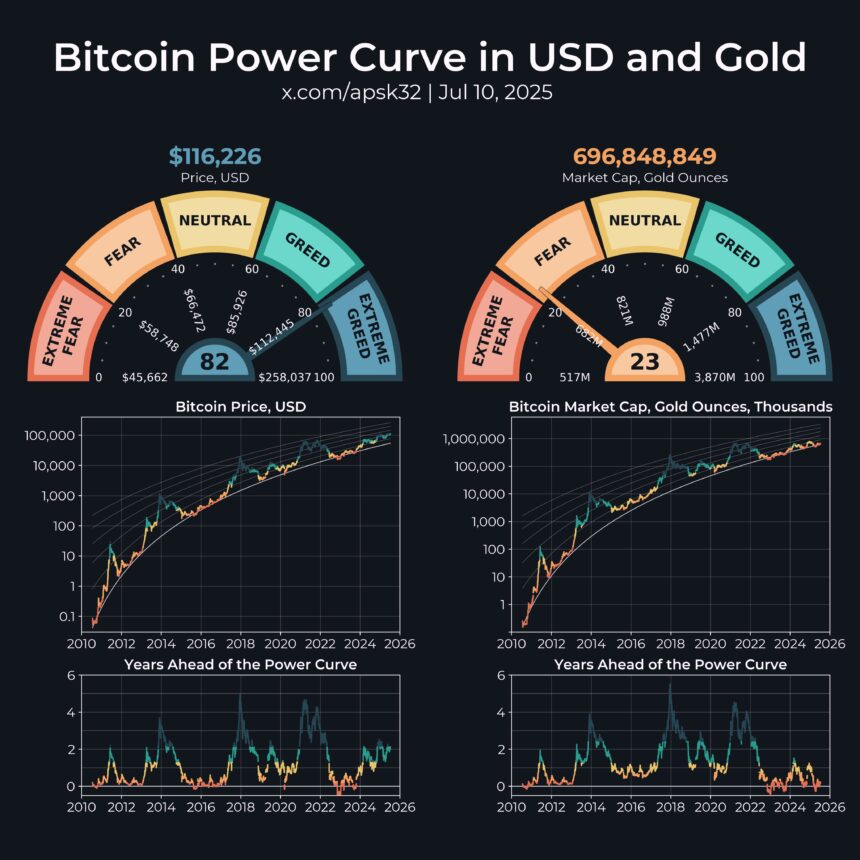

Bitcoin (BTC) has rallied by 10% in July, reaching new highs at $118,600, and this could be just the beginning of a parabolic rally according to anonymous Bitcoin analyst apsk32. The analyst said that Bitcoin could be worth as much as $258,000 if history repeats itself.

According to apsk32, Bitcoin’s price action has followed a long-term power curve trendline, a mathematical model reflecting BTC’s exponential growth over time. It measures price deviation from this trendline, not just in dollar terms, but in units of time, an approach known as Power Law Time Contours.

The analyst explained that Bitcoin is slightly more than two years ahead of its power curve, meaning if the price stayed flat, it would take over two years for the long-term trendline to intersect it again. Apsk32 said,

“We’re currently above 79% of the historical data using this metric. The top 20% is what I call “extreme greed.” These are the blow-off tops that come around every four years.”

The “extreme greed” zone spans from $112,000 to $258,000, a zone seen during Bitcoin’s euphoric peaks in 2013, 2017, and 2021. The analyst implied that “if the four-year pattern continues,” Bitcoin could be between $200,000 and $300,000 by Christmas, before the bullish momentum begins to fade at the start of 2026.

Likewise, Satraj Bambra, CEO of perpetual trading platform Rails, told Cointelegraph that a couple of macroeconomic forces could drive Bitcoin significantly higher in 2025. Bambra pointed to an expanding Federal Reserve balance sheet and a pivot toward lower interest rates, potentially under new Fed leadership responding to the economic drag from rising tariffs, as key catalysts. Together, these shifts could ignite a broad-based rally in risk-on assets, with Bitcoin poised to benefit.

Bambra cited the US Dollar Index (DXY) dropping below 100 as a critical early signal of this macro pivot, suggesting that a wave of rate cuts and fresh stimulus may soon follow. Against this backdrop, the CEO said,

“I see Bitcoin going parabolic in the region of $300K–500K driven by two key forces.”

Related: Is the crypto market entering a new supercycle? Here are 5 ways to know

Bitcoin ETF catches up to gold as risk-on rally builds

Spot Bitcoin exchange-traded funds (ETFs) are gaining ground on gold, capturing 70% of its year-to-date net inflows, according to Ecoinometrics. This strong rebound from a slow 2025 start signals growing institutional interest and confidence in Bitcoin as a legitimate store of value.

Bitcoin remains a risk-on asset, with a moderate correlation to the Nasdaq 100 over the past 12 months, consistent with its five-year average. Its low correlation with gold and bonds highlights its unique portfolio role.

Echoing that sentiment, Fidelity’s Director of Global Macro, Jurrien Timmer, recently remarked that the baton has swung back to Bitcoin. According to Timmer, the narrowing gap in Sharpe ratios between Bitcoin and gold points to BTC offering superior risk-adjusted returns. The Sharpe ratio gauges how much excess return an asset delivers for the level of risk taken, comparing its performance to a risk-free benchmark adjusted for volatility.

The chart below, based on weekly data from 2018 through July 2025, highlights how Bitcoin’s returns (1x) have been closing in on gold’s (4x). In relative performance terms, gold stands at $20.34, while Bitcoin has climbed to $16.95.

Related: Bitcoin $120K expectations add fuel to ETH, HYPE, UNI and SEI

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.