Crypto asset investment products have recorded another significant milestone, with weekly inflows totaling $3.7 billion, according to CoinShares’ latest report released Monday.

This marks the second-largest weekly inflow on record for crypto funds, bringing the year-to-date total to $22.7 billion. CoinShares Head of Research James Butterfill noted that July 10 alone saw the third-highest daily inflow in history, reflecting a notable uptick in investor confidence.

This surge has pushed the total assets under management (AuM) for crypto investment products beyond the $200 billion mark for the first time, reaching $211 billion.

Trading volumes for exchange-traded products (ETPs) have also doubled this year’s weekly average, climbing to $29 billion. These figures highlights the increasing maturity and mainstream adoption of digital asset investment vehicles, particularly among institutional participants.

Bitcoin and Ethereum Maintain Momentum in Fund Flows

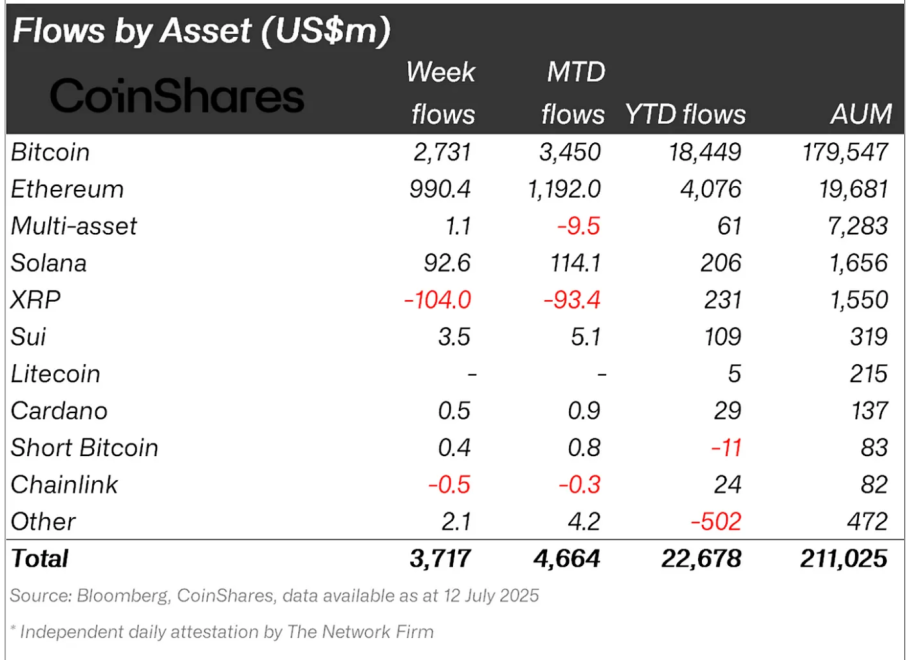

Bitcoin continues to dominate the market, securing $2.7 billion in weekly inflows, which has elevated its total AuM to $179.5 billion. Notably, this amount now equals 54% of the AuM held in gold exchange-traded products, signaling a potential shift in investor preference toward digital assets as alternative stores of value.

Despite the substantial flows into long Bitcoin products, short Bitcoin ETPs witnessed limited activity, suggesting a predominantly bullish sentiment across the board. Ethereum also saw robust interest, with inflows totaling $990 million for the week, its twelfth consecutive week of gains.

These inflows represent 19.5% of Ethereum’s AuM over the last three months, compared to 9.8% for Bitcoin, indicating stronger relative growth. Ethereum’s continued momentum may be fueled by anticipation around staking upgrades and developments in Ethereum-based tokenization and decentralized finance.

Regional Disparities and Altcoin Divergences

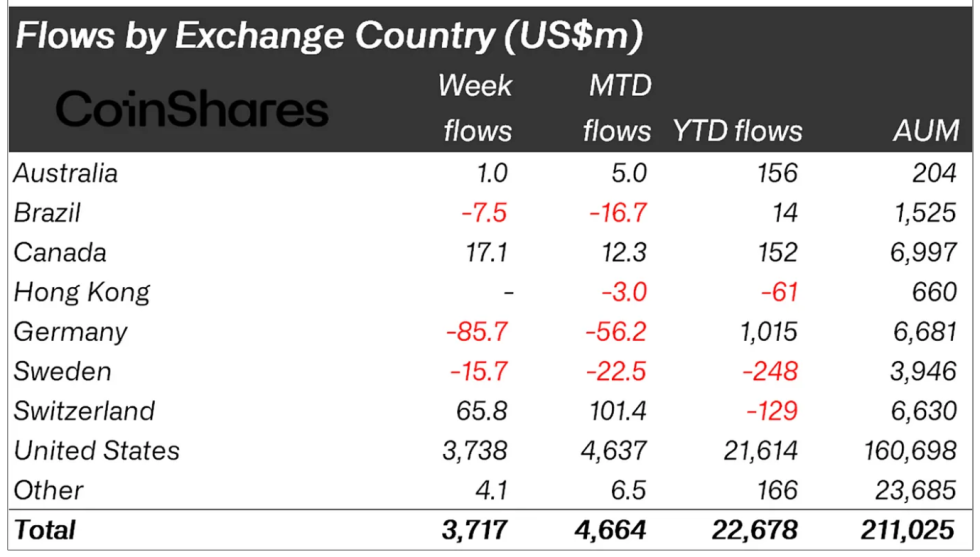

The United States accounted for the overwhelming majority of inflows at $3.7 billion, showing sustained interest from US-based investors and institutions.

Meanwhile, Germany experienced outflows of $85.7 million, a rare deviation from broader global trends. In contrast, Switzerland and Canada registered net inflows of $65.8 million and $17.1 million, respectively, reflecting growing appetite for digital assets across key European and North American markets.

Among altcoins, Solana attracted strong inflows of $92.6 million, likely driven by recent developments in its ecosystem and high-performance transaction capabilities. Conversely, XRP was the biggest outlier, recording outflows of $104 million, the largest of the week.

This divergence in flows suggests that investor sentiment remains highly selective within the altcoin segment and continues to be influenced by project fundamentals and regulatory narratives.

CoinShares’ latest report reinforces the narrative that digital asset investment is entering a new phase of institutional growth, promoted by record-breaking inflows and increasing market participation.

Interestingly, the effect is showing in the market with Bitcoin earlier today establishing a new all-time high above $123,000 while ETH, XRP and SOL surge over 10% in the past week respectively.

Featured image created with DALL-E, Chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.