I have maintained that there is a need to relook at the way large/mid/small-cap stocks are classified. Currently, the Top-100 stocks by avg. marketcap during the last 6-month period qualify as Largecap stocks. The Top 100 is split as Nifty50 (with stocks ranked 1 to 50) and the Nifty Next50 (stocks ranked 51 to 100). After this, the next 150 stocks, i.e. ranked as 101 to 250 by marketcap are considered as Midcap Stocks. And everything else is considered Smallcaps.

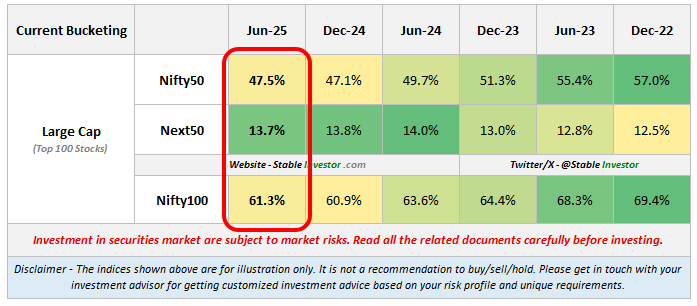

Here is what the % share of Top-100 Largecap stocks has been over the last 3 years. So, as per the Jun-2025 semi-annual update published by AMFI (link), the Largecaps form about 61.3% of the overall listed market cap.

Now, if you notice, the share of largecap stocks has reduced in the last 3 years. From 69.4% in Dec-2022 to about 61.3% in Jun-2025. And even if we split the largecaps into two parts of Nifty50 and Next50, it is clear that the share of Nifty50 stocks has reduced substantially from 57% to 47.5%, while that of Next50 has inched up slightly from 12.5% to 13.7%.

Let’s look at Midcaps and Smallcaps now.

Currently, the share of Midcap and Smallcap stocks in the overall marketcap is about 19.2% and 19.5% respectively. Over the last 3 years, the run-up in Midcaps & Smallcaps has increased this from 30-31% to almost 39% now, if considered together.

What is now happening is that, given the increased participation in stock markets and more money chasing just a handful of stocks, it is slowly but surely being felt that the current limits of 100 stocks as largecaps and 150 stocks as midcaps are getting restrictive. The smallcaps (at least theoretically) already have a huge pool to themselves, as all stocks beyond the 250th are considered smallcaps.

So as more and more money pours into the stock markets, maybe there is a need to relook at the marketcap bucketing definitions. This will increase the breathing space within the largecap and small-cap universe of stocks.

While the current approach is a fixed one (top 100 as largecaps and next 150 as midcaps and so on), an alternative may be to bring in a percentile approach to make the list dynamic (though it may have its own set of operational issues when implemented).

So, let’s say that the top X stocks making up the 70% percentile of marketcap can be categorized as largecap, followed by the next 17.5% percentile as midcaps and the remaining 12.5% as smallcaps.

And how will this impact the number of shares available in each bucket? I back-tested the last 3 years of data, and this is what I got:

As per the new percentile-based bucketing, we would have about 149 stocks as Largecaps (instead of the current 100) and another 241 stocks as Midcaps (instead of the current 150). And if I take the average for all the last 3 years for each bucket, then we can have about 130 largecaps and 215 midcaps.

This move, I am sure, will definitely bring in much-needed breathing space for fund managers and allow a wider canvas. At least for the fund managers who operated primarily in the largecap space.

As I said, while a dynamic marketcap bucketing based on percentile is what I suggested above and feels right, I also understand that it may have its own operational issues.

If a dynamic approach isn’t feasible, then at least, one can expand the current fixed definitions slightly. For example – Instead of just having the first 100 stocks as Largecaps, one increases it to (say) the first 150 stocks. A side effect of such a move will be that while Nifty50 will still have 50 stocks, the index Nifty Next50 will have to be relaunched as Nifty Next100 (sorry Next50 lovers!). Similarly, the next 200 stocks from rank 150 to 350 can be categorized as Midcaps. The new bucketing will look something like this:

The aim of such a tweaking of the marketcap bucketing structure would be to ensure that as Indian markets grow, there isn’t a situation where too much money starts chasing just a few stocks in the large and midcap space.

And while I am of the view that the definition of marketcap-based bucketing needs some degree of rethinking (to accommodate a larger number of largecap and midcap stocks), in my view, the fund categorization by itself has been good enough and provides sufficient flexibility to smart fund managers. Also, the categorization is now pretty well understood by investors since it has been in place for several years. So, there may not be a need to tinker with it and create new doubts. Only the marketcap-based bucketing of stocks is something that needs to be reassessed in my humble view from time to time.