A group of top Senate Democrats is raising alarms over a move that could bring cryptocurrency deeper into the US mortgage system. The group is challenging a new directive by Federal Housing Finance Agency (FHFA) Director William Pulte, who wants to allow unconverted digital assets to count in mortgage underwriting decisions.

According to a letter sent on July 25, Senators Elizabeth Warren, Bernie Sanders, Jeff Merkley, Chris Van Hollen, and Mazie Hirono are urging Pulte to reconsider the idea. They say it could open the door to instability in both the housing and financial markets.

Concerns Over Risk And Volatility

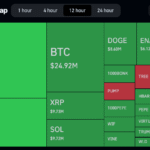

The senators say that incorporating crypto within a borrower’s asset portfolio is a huge risk. Volatility is one of the largest concerns. Bitcoin, Ethereum, and other such coins are infamous for creating steep price fluctuations. If a borrower uses digital currency to get a loan and the value depreciates, they could be more likely to default.

After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.

SO ORDERED pic.twitter.com/Tg9ReJQXC3

— Pulte (@pulte) June 25, 2025

“Historical volatility and liquidity issues remain in the crypto market,” the letter states. The lawmakers worry borrowers might struggle to sell off their holdings when needed or fail to turn their digital assets into cash quickly in emergencies.

They also pointed out how vulnerable digital assets are to scams, hacks, and theft. Since crypto isn’t protected in the same way as bank deposits, homeowners could lose their assets with little chance of getting them back.

Order Calls For Crypto In Mortgage Risk Assessments

Director Pulte’s order, issued June 25, calls on Fannie Mae and Freddie Mac to prepare a proposal that would allow cryptocurrency to count as reserves in mortgage risk evaluations. The twist? These digital assets wouldn’t need to be converted into US dollars.

That’s a key shift. Right now, borrowers are typically judged based on cash or liquid assets. Including raw, unconverted crypto would be a first.

Supporters see it as a step forward. Former Binance CEO Changpeng “CZ” Zhao applauded the move last month, saying, “This is great to see, BTC counts as assets for mortgage.”

Pushback Comes Amid Broader Crypto Adoption Debate

This clash between lawmakers and regulators comes as Washington is still figuring out how to handle crypto. Some want tighter controls. Others see the industry as maturing and ready for broader financial use.

Right now, it’s not a done deal. The rule is just being considered, not fully approved yet. But it’s a big topic because it mixes two big things—housing and crypto—and not everyone agrees it’s a good mix.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.