What is Japan’s new proposed tax structure? And how does it compare to the prevailing tax structure?

Crypto investors in Japan are bracing for a major tax shake-up in the country. On Jun. 24, Japan’s Financial Services Agency (FSA) proposed classifying crypto assets as financial products, similar to equities, bonds, etc. This reclassification would put crypto assets under the scope of the Financial Instruments and Exchange Act (FIEA), a regulatory framework that is applicable to traditional financial products in the country.

Japan has long been recognized as a global pioneer in cryptocurrency adoption and regulation alike. 2025 is shaping up to be a pivotal year for digital assets in the world’s fifth-largest economy. The FSA’s proposal is aligned with the government’s wider “New Capitalism” initiative, which aims to transform the nation into an investment-driven economy. By aligning crypto taxation with traditional financial products, Japan aims to solidify its position as a leading hub for digital assets.

In the existing tax regime in Japan, all profits from cryptocurrency transactions are classified as “miscellaneous income.” This entails that, unlike the profits from stocks or real estate, gains from trading, spending or earning crypto are subject to progressive income tax rates.

These rates usually range from 5% for lower incomes to a hefty 45% for the highest earners. Accounting for the 10% local inhabitant tax, the effective higher rate can go as high as 55%, making it one of the highest crypto taxes in the world.

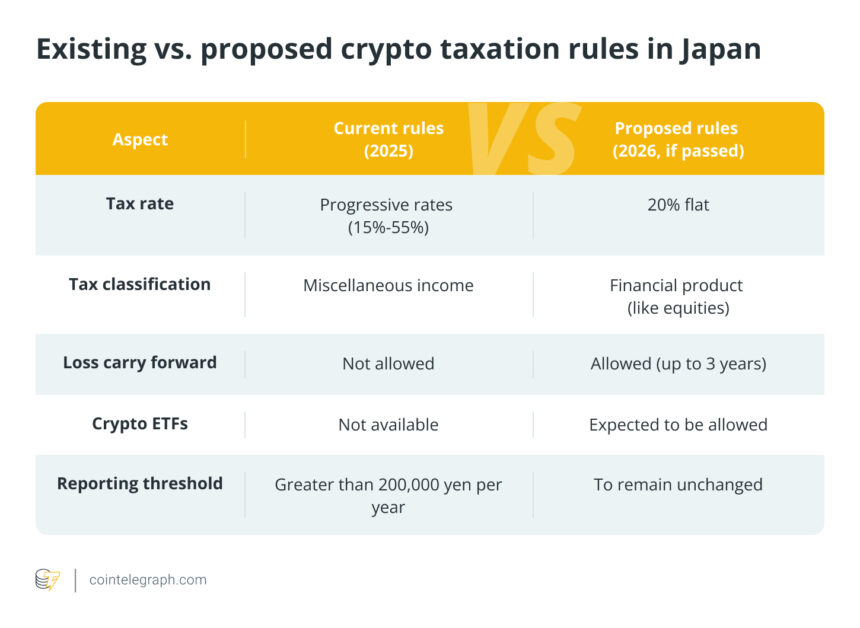

Below is a comparison of the existing tax regime for crypto assets and the proposed tax regime:

Activities that trigger taxation are:

Here, it is noteworthy that investors buying and hodling crypto, or even transferring assets between their wallets, are not triggering a tax event.

Apart from the changes in the tax rate, the most significant change is the ability for investors to allow loss carry forward for their crypto investments. This entails that investors can offset crypto losses against future gains for up to three years. Considering the volatile nature of the crypto markets, it would provide much-needed flexibility for investors.

Did you know? On Jul. 07, 2025, Japanese company Metaplanet became the fifth-largest corporate holder of Bitcoin (BTC) with a purchase of 2,204 BTC. The corporate Bitcoin treasury company now holds 15,555 BTC, with an average purchase price of approximately $99,985 each. Metaplanet plans to leverage its growing Bitcoin stockpile to acquire profit-making businesses, with a digital bank in Japan being one of the initial targets. The other Japanese companies that own Bitcoin on their balance sheet are Nexon, Remixpoint and ANAP Holdings.

A timeline of Japan’s evolving cryptocurrency regulations

The collapse of the Japanese exchange Mt. Gox was a monumental moment for the digital assets ecosystem. In February 2014, a leaked internal document revealed that the exchange had become a victim of a long-running hack, losing 744,408 BTC, which accounted for 6% of the BTC in circulation at the time. This hack underscored the lack of crypto oversight in the country and triggered regulators to take a closer look at this rapidly expanding ecosystem.

Below is a timeline of the major crypto regulatory events in Japan:

- May 2016: In response to the Mt. Gox incident, Japan’s FSA establishes a regulatory regime for crypto asset service providers under the Payment Services Act (PSA).

- April 2017: Amendments from 2016 take effect, defining cryptocurrencies under Japanese law. Exchanges have to register with the FSA, comply with AML/KYC standards and implement strict cybersecurity practices.

- September 2017: Japan’s FSA approves 11 exchanges, officially marking the beginning of regulated crypto trading in the country.

- January 2018: Cryptocurrency exchange Coincheck suffers a hack resulting in the loss of around $530 million in NEM tokens at the time, triggering even stricter regulatory oversight.

- April 2018: Following regulatory tightening, crypto exchanges come together to create the Japan Virtual Currency Exchange Association (JVCEA).

- October 2018: The FSA grants the JVCEA self-regulatory status.

- May 2020: Revised PSA and Financial Instruments Exchange Act (FIEA) take effect, further clarifying crypto regulation. Under the FIEA, crypto custody services are introduced, thus separating custody businesses from exchanges and adding investor protections.

- June 2022: Japan’s parliament introduces new regulations allowing licensed financial institutions to issue fiat-backed stablecoins, requiring issuers to fully back stablecoins with reserves held domestically in yen.

- April 2023: The Japanese Liberal Democratic Party issues a white paper outlining strategies for Web3 and blockchain adoption, recommending adjustments in tax policies and exchange-traded fund (ETF) approval frameworks.

- June 24, 2025: The FSA proposes the reclassification of crypto assets as traditional financial products, thus subjecting them to a new tax regime. The new regime is expected to be applicable from 2026 onward.

Did you know? Japan was the first country to recognize Bitcoin as a legal payment method as part of the PSA Act in April 2017. Additionally, Japan also became the first major economy to enact a dedicated regulatory framework for stablecoins in June 2022.

How does Japan’s tax structure compare with other large economies?

Historically, Japan has had one of the strictest tax regimes for crypto investors. But with the passing of the newly proposed rules by the FCA, the country’s financial regulators are poised to create one of the most investor-friendly tax structures in the world.

Below is a table comparing Japan’s proposed tax structure for crypto assets to the current tax structure for other sizeable economies like the United States and the United Kingdom:

If the proposal by the FSA is passed for 2026, Japan will move to a simpler, investor-friendly structure. The country’s crypto tax landscape is on the cusp of its biggest transformation to date.

Meanwhile, it is important for investors to maintain accurate logs (including activity both on crypto wallets and crypto exchanges), submit filings on time and keep an eye out for any regulatory announcements. Once passed, the new tax regime could be a game changer for crypto investors in the land of the rising sun.