Key points:

-

Bitcoin remains stuck in a narrow range, suggesting a breakout could be around the corner.

-

The FOMC minutes and Federal Reserve interest rate decision could set the tone for crypto’s next steps.

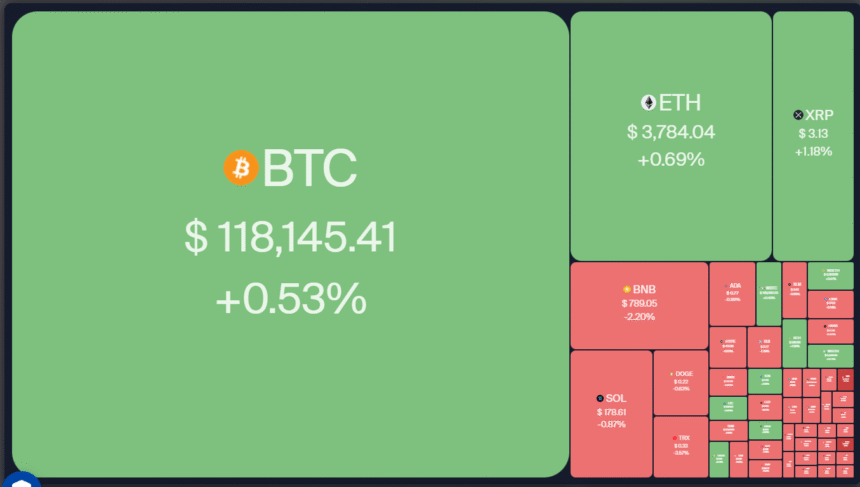

Bitcoin (BTC) continues to trade near the $120,000 resistance, indicating that the bulls have kept up the pressure. Although Bitcoin is on a strong wicket, the up move may face seasonal headwinds. According to Axel Adler Jr., BTC has recorded an average return of just 2.56% in August in the past 13 years.

However, near-term uncertainty or August’s historical weakness has not stopped Strategy from buying more BTC. The firm said on Tuesday that it had acquired 21,021 BTC at an average price of $117,256, boosting its total holding to 628,791 BTC.

As BTC consolidates, Ether (ETH) and BNB (BNB) have been gaining ground. Glassnode said in a post on X that ETH’s perpetual futures volume dominance has surpassed BTC, marking the “largest volume skew” on record. The “shift confirms a meaningful rotation of speculative interest toward the altcoin sector,” the analytics platform added.

Could BTC break out of its range? Will select altcoins continue their bull run? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC continues to trade inside a tight range between $115,000 and $120,000. The longer the price stays inside a narrow range, the larger the eventual breakout from it.

The upsloping 20-day simple moving average ($118,313) and the relative strength index (RSI) in the positive territory indicate that the path of least resistance is to the upside. If buyers drive the price above $120,000, the BTC/USDT pair could pick up momentum and surge to a new all-time high above $123,218. The pair may then ascend to $135,000.

Conversely, a break and close below $115,000 suggests the bears have overpowered the bulls. That could sink the price to $110,530. This is a vital support to keep an eye on because a break below it opens the gates for a drop to $100,000.

Ether price prediction

ETH is trying to maintain above the breakout level of $3,745, signaling that the bulls are not hurrying to book profits as they anticipate another leg higher.

If the price rebounds off the $3,745 support, the ETH/USDT pair could reach the overhead resistance at $4,094. Sellers are expected to pose a strong challenge at $4,094, but if the bulls prevail, the pair could skyrocket toward $4,868.

Instead, if the price turns down and breaks below $3,745, it suggests that the bulls have given up. That could tug the price to the 20-day SMA ($3,516), where the buyers are expected to step in. If the price rebounds off the 20-day SMA with strength, the bulls will again try to pierce the overhead resistance.

XRP price prediction

XRP (XRP) is witnessing a tough battle between the buyers and sellers at the 20-day SMA ($3.16).

If the price skids below the $3.05 support, the next stop is likely to be $2.95. Buyers are expected to fiercely defend the $2.95 level because a break below it could start a deeper correction toward $2.65.

Alternatively, a strong rebound off the $2.95 level suggests solid demand at lower levels. The 20-day SMA could act as a resistance on the way up, but if the bulls overcome it, the XRP/USDT pair may climb to $3.33 and, after that, to $3.66.

BNB price prediction

BNB has pulled back to the breakout level of $794, which is a crucial support to watch out for.

If the price rebounds off $794 with strength, it suggests that the bulls are trying to flip the level into support. If that happens, the BNB/USDT pair could retest the all-time high of $861. A break and close above $861 could start the next leg of the uptrend to $900.

On the contrary, a break and close below the $794 level signals profit-booking by short-term buyers. The pair could then dip to the 20-day SMA ($751), which is likely to attract buyers. Sellers will have to yank the pair below the 20-day SMA to gain the upper hand.

Solana price prediction

Solana (SOL) has pulled back to the 20-day SMA ($178), which is likely to act as solid support.

If the price rebounds off the 20-day SMA with strength, the bulls will again try to push the SOL/USDT pair toward the overhead resistance of $209. A break and close above $209 could open the doors for a rally to $240. There is minor resistance at $220, but it is likely to be crossed.

Contrarily, a break and close below the 20-day SMA could tug the price to the 50-day SMA ($160). That suggests the pair may extend its stay inside the large range between $110 and $209 for a few more days.

Dogecoin price prediction

Dogecoin (DOGE) turned down from $0.25 on Monday and broke below the 20-day SMA ($0.22) on Tuesday, indicating selling on rallies.

The next support is at $0.21. If the price bounces off $0.21 and breaks above the 20-day SMA, the bulls will try to push the DOGE/USDT pair to $0.26 and later to $0.29. Sellers are expected to defend the $0.29 level with all their might because a close above it could propel the pair to $0.35 and then to $0.44.

On the other hand, a break and close below $0.21 could sink the pair to the 50-day SMA ($0.19). That suggests the pair may remain inside the large $0.14 to $0.29 range for a while longer.

Cardano price prediction

Cardano (ADA) slipped below the 20-day SMA ($0.79) on Tuesday, indicating that the bears are trying to take charge.

There is support at $0.76, but if the level breaks down, the ADA/USDT pair could extend the correction to $0.73 and then to the 50-day SMA ($0.67). Such a fall suggests that the pair may remain inside the $0.50 to $0.86 range for a while.

The first sign of strength will be a break and close above the 20-day SMA. That suggests a lack of aggressive selling at lower levels. The bulls will then try to push the pair above the $0.86 resistance.

Related: $3 price at risk? Why XRP was one of the worst performers this week

Hyperliquid price prediction

Hyperliquid (HYPE) has been stuck between the support line of the ascending channel and the 20-day SMA ($45.13).

The failure of the bulls to push the price above the 20-day SMA increases the risk of a break below the support line. If that happens, the HYPE/USDT pair could correct to $36 and subsequently to $32.

This negative view will be invalidated in the near term if the price turns up and rises above the 20-day SMA. The pair may then climb to the $48 to $49.87 overhead resistance zone.

Stellar price prediction

Stellar (XLM) plunged below the 20-day SMA ($0.44) on Monday, and the bears defended the level during a retest on Tuesday.

Sellers will try to strengthen their position by pulling the price below $0.40. If they manage to do that, the XLM/USDT pair could decline to the 50% Fibonacci retracement level of $0.37 and then to the 61.8% retracement level of $0.34.

Buyers are likely to have other plans. They will try to make a comeback by pushing the price above $0.46. If they can pull it off, the pair could retest the overhead resistance of $0.52. The next leg of the rally to $0.64 could begin on a close above $0.52.

Sui price prediction

Sui (SUI) rose above the $4.30 resistance on Sunday, but the breakout proved to be a bull trap as the price turned down sharply on Monday.

The bears are trying to sustain the price below the 20-day SMA ($3.85). If they do that, the SUI/USDT pair could drop to $3.51. Buyers are expected to fiercely defend the zone between $3.51 and the 50-day SMA ($3.27).

If the price turns up from $3.51 and breaks above the 20-day SMA, it suggests a possible range formation. The pair may swing between $3.51 and $4.30 for some time. A break and close above $4.30 could start a new uptrend toward $5.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.