A 163-page report that the Trump administration billed as a “roadmap” to make the United States the “crypto capital of the world” landed on 30 July with sweeping proposals for regulation, taxation, and market structure. Yet for traders hoping to learn how many Bitcoin the federal government already owns—or how it intends to buy more without new appropriations—the document was striking for what it left unsaid.

Framed by the White House as the most comprehensive federal assessment of digital-asset policy ever produced, the report urges Congress to give the Commodity Futures Trading Commission spot-market authority, presses the Securities and Exchange Commission to deploy safe-harbours and sandboxes, and reprises the administration’s opposition to a central-bank digital currency. But after 160 pages of granular recommendations, the only reference to the long-anticipated Strategic Bitcoin Reserve (SBR) appears near the end, folded into a single section titled “Cementing US Leadership through the Bitcoin Strategic Reserve and US Digital Asset Stockpile.”

That passage reiterates earlier executive orders—No. 14178 of 23 January and No. 14233 of 6 March—which direct the Treasury to administer a bitcoin reserve capitalised primarily with forfeited crypto and to devise “budget-neutral” acquisition strategies for additional purchases. “The bitcoin in the Reserve will generally not be sold and will be maintained as reserve assets of the United States,” the report states, adding only that Treasury and Commerce “will develop strategies that could be used to acquire additional bitcoin … in ways that are budget neutral.”

Bitcoin Reserve Confirmed, But Still Secret

Hours after publication, Executive Director Bo Hines of the President’s Council of Advisers on Digital Assets faced pointed questions on Crypto in America. Asked for an update on the reserve, Hines replied, “Well, look, we have it. It’s been established through executive order in the SBR,” Hines said.

Hines emphasized the logistical complexities behind implementing such a reserve. “You have to build the infrastructure. You have to make sure that you’re crossing your T’s and dotting your I’s,” he said. Despite those assurances, the Bitcoin community has grown increasingly frustrated with the lack of substantive disclosures.

Pressed on how much Bitcoin the US government currently holds, Hines refused to provide even a ballpark estimate. “I can’t discuss that right now,” he said. When asked whether it would ever be made public, he responded, “There are several reasons in which we’re not disclosing that at this time. There might be a time in which we do. But what I will say is, you know, we want as much as we can possibly get.”

The new report from President Trump’s Digital Asset Group did not address a bitcoin strategic reserve

But I asked @BoHines for an update anyways 👀👇 pic.twitter.com/9HYb71a3rP

— Jacquelyn Melinek (@jacqmelinek) July 30, 2025

That evasiveness has only intensified speculation. As noted by macro analyst MacroScope, who previewed the report’s importance to institutional investors, “The status of both issues [government buying and current BTC holdings] is addressed… Current amount held: As the months pass without disclosure, I think it’s becoming clear that this is now viewed within the administration as a sensitive issue.” He added that one plausible explanation is that the government may be holding far less Bitcoin than markets assumed—possibly due to prior sales during the Biden administration. “That gets you back to the issue of government buying,” he said.

This silence has created a vacuum of uncertainty at a time when institutional interest in sovereign Bitcoin accumulation is growing. Analysts had hoped the report would offer details about mechanisms for acquiring Bitcoin in a budget-neutral manner, as President Trump has alluded to in the past. No such strategies were outlined in the report, nor were any timelines given for their release.

Despite the vague tone, Hines reiterated the administration’s ideological support for Bitcoin, calling it “in a class of its own” and affirming that the government “believes in accumulation… in budget-neutral ways.” But those declarations are unlikely to satisfy the demands of market participants.

Either way, the next phase of this evolving policy—especially any concrete evidence of sovereign accumulation—could prove pivotal not only for national crypto strategy but also for institutional positioning. As MacroScope concluded, “I continue to see this as a potential career-maker type of trade for institutional guys if it plays out optimally.”

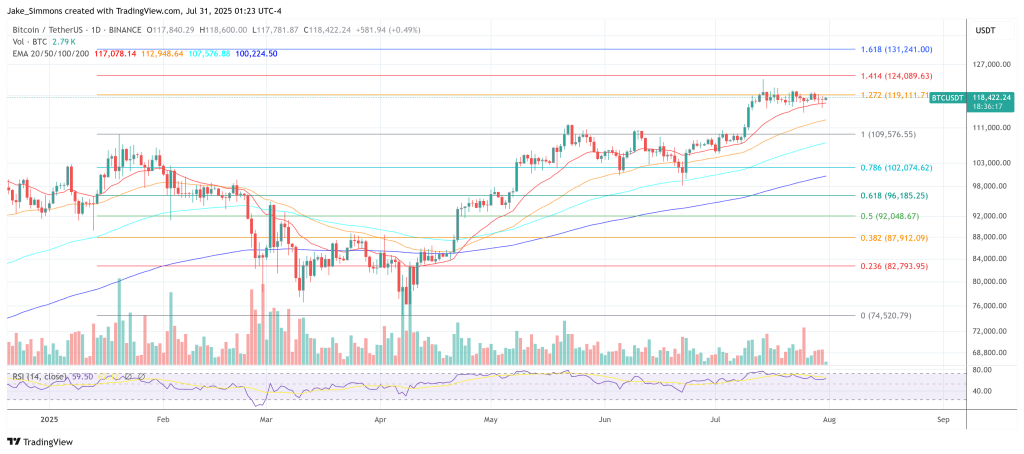

At press time, BTC traded at $118,442.

Featured image from YouTube, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.