Investor Insight

Locksley Resources offers a rare combination of high-grade, drill-ready prospects and a vertically integrated downstream strategy at the heart of America’s critical minerals hub. Locksley is well placed to deliver near-term catalysts while establishing a long-term mine-to-market platform. For investors seeking exposure to secure, domestic supply chains, Locksley represents a highly leveraged opportunity at an early growth stage.

Overview

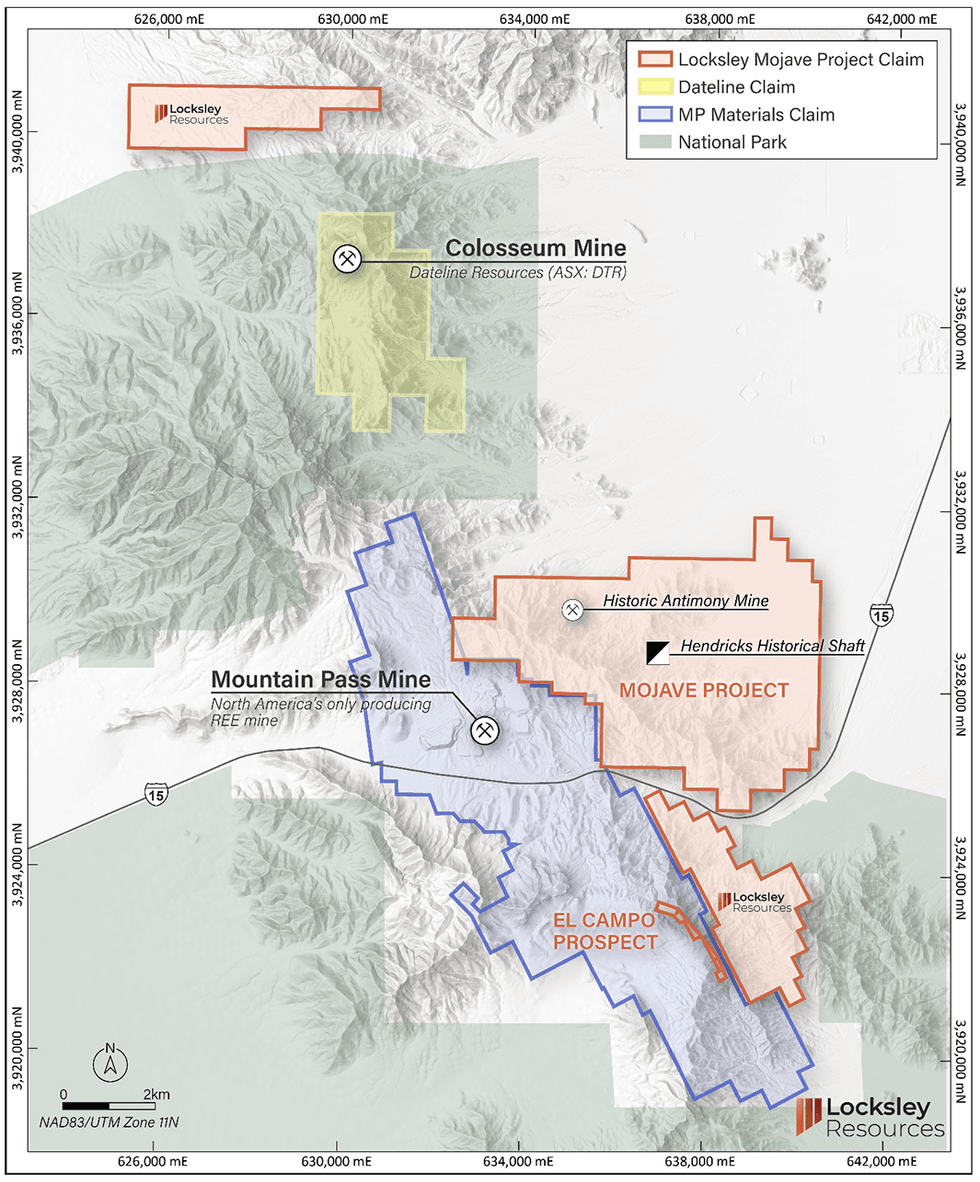

Locksley Resources (ASX:LKY,OTCQB:LKYRF,FSE:X5L) is a US-focused critical minerals company advancing high-grade rare earth elements (REEs) and antimony at its flagship Mojave project in California. Strategically positioned just 1.4 kilometers from the Mountain Pass mine, North America’s only producing REE mine, Locksley is directly aligned with the United States’ national push to onshore critical mineral supply chains, reduce reliance on China and secure inputs vital for defense, clean energy and advanced technologies.

Within the Mojave project lies the historic Desert Antimony mine (DAM), which offers near-term production potential from extremely high-grade stibnite veins, directly addressing America’s total lack of domestic antimony supply. In addition, the El Campo REE prospect provide geological continuity with Mountain Pass, where rock chip samples have returned grades up to 12.1 percent total rare earth oxides (TREO), including up to 3.19 percent neodymium-praseodymium (NdPr), bothcritical inputs for permanent magnets.

Unlike traditional mineral exploration companies, Locksley is not only focused on resource discovery but also on building downstream capacity.

Through its partnership with Rice University’s Ajayan Lab, the company is developing DeepSolv™, a next-generation processing solution for antimony that is environmentally benign, offers >95 percent recovery, reduced energy use and the potential for modular deployment. This initiative directly addresses the US bottleneck in refining capacity and positions Locksley to establish a vertically integrated “mine-to-market” strategy.

With imminent drilling programs, a growing US advisory team, and access to federal funding pathways through the Department of Defense, Department of Energy and EXIM Bank, Locksley is emerging as a key participant in America’s critical minerals future.

Company Highlights

- US-focused Critical Minerals Strategy: Targeting antimony and rare earths, both on the US critical minerals list, at the Mojave project in California, within a federally prioritized supply chain hub.

- Tier-1 Location: Just 1.4 km from the Mountain Pass mine, the only REE producer in the US, with highway access, infrastructure and proximity to major defense and technology industries.

- Drill-ready and Fully Funded: Approvals secured for both antimony and REE drilling programs, with initial campaigns set for 2025.

- Downstream Innovation: Partnership with Rice University to advance DeepSolv™ solvent-based processing technology for antimony and investigate applications in next-generation energy storage.

- Government and Institutional Pathways: Positioned to benefit from US policies, Department of Defense initiatives, EXIM Bank financing and Department of Energy funding.

Key Project

Mojave Project

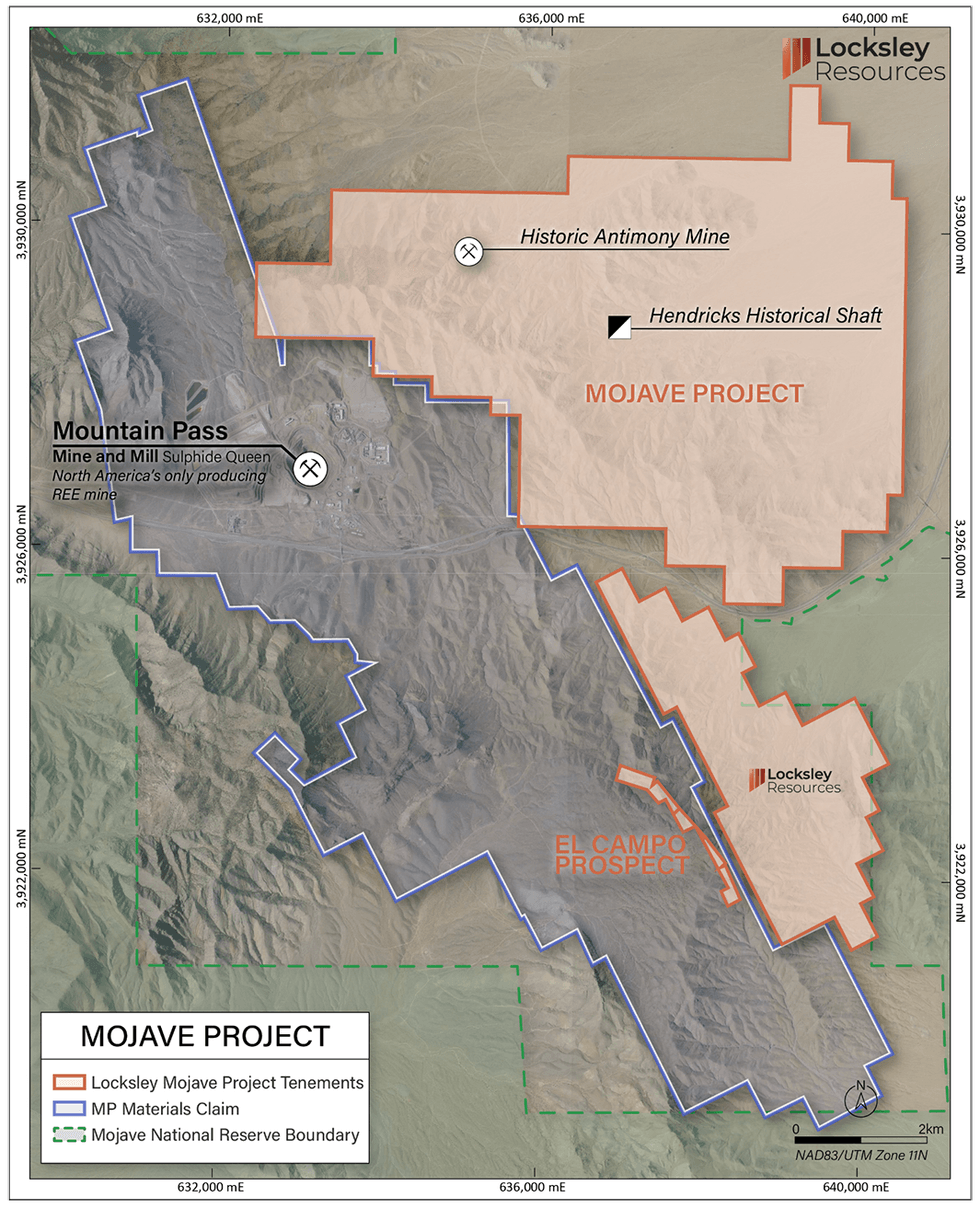

The Mojave Project is Locksley’s flagship asset and one of the most strategically located critical minerals projects in the United States. Covering 491 claims across the El Campo Prospect and the recently expanded northern blocks, Mojave directly abuts MP Materials’ Mountain Pass mine, the highest-grade REE operation in the world and the only producing REE facility in the US. This Tier-1 location benefits from excellent infrastructure, with the I-15 highway running through the claim area and Las Vegas located just one hour away by road. Drilling applications for both REE and antimony targets have been approved by the Bureau of Land Management. The project has been fully funded for its 2025 exploration season.

Desert Antimony Project

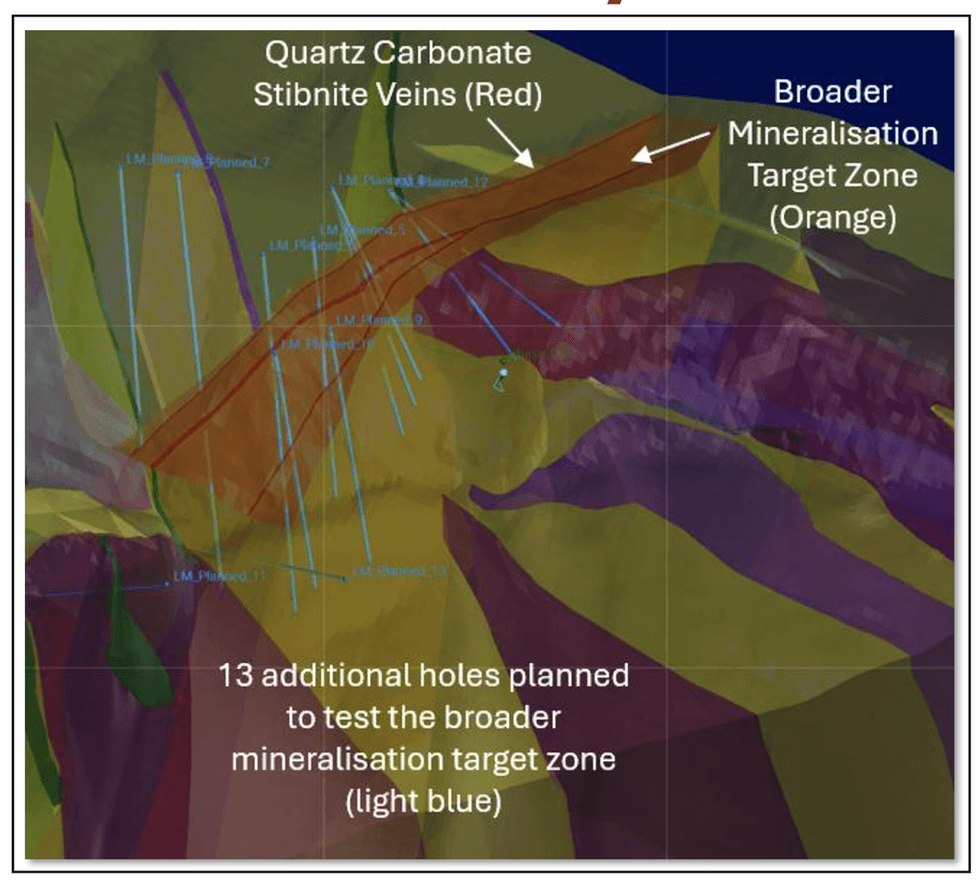

Geological model at Desert Antimony Mine highlighting mineralized zone

The Desert Antimony prospect is centered on the historic Desert Antimony mine and smelter, one of California’s few former producers of the metal. The project area hosts multiple stibnite-bearing quartz-calcite veins, with surface assays returning grades as high as 46 percent antimony. In recent fieldwork, eight surface samples graded more than 17 percent antimony, and 18 samples returned above 1.4 percent antimony, confirming the exceptional tenor of mineralization. Geological mapping has identified up to three mineralized veins within a broader structural corridor. The project area hosts many historical adits and trenching confirms the presence of unmined high-grade zones.

Locksley has secured approvals for an expanded 2,180-meter RC drilling program, targeting extensions beneath historical workings and newly mapped veins. The company’s immediate objective is to define a JORC-compliant exploration target, which will form the basis for conceptual mining studies. With antimony trading above US$60,000 per ton and designated as a US critical mineral, the project offers clear near-term production potential.

Antimony is indispensable for flame retardants, semiconductors, and emerging energy storage technologies, yet the US currently has no active production. The Desert Antimony prospect positions Locksley to be the first mover in re-establishing domestic supply.

El Campo REE Project

The El Campo REE prospect sits along strike from the Mountain Pass mine and is just 1.4 kilometers away from the active mine. Initial rock chip sampling has delivered consistently high grades, including assays of 3.74 percent to 9.49 percent TREO across a six-meter-wide mineralized zone. Follow-up sampling expanded this footprint, with twelve samples grading between 1.03 percent and 12.1 percent TREO, confirming the continuity of mineralization over an 860-meter horizon. Critically, the NdPr content of up to 3.19 percent underscores El Campo’s strategic importance, given NdPr’s role in permanent magnet production for EV motors, wind turbines and defense applications.

Drilling approvals have been secured for an initial five-hole REE program at El Campo. Locksley aims to demonstrate geological and metallurgical continuity with Mountain Pass, which would immediately enhance the project’s strategic value. With global REE supply dominated by China and long-term offtake contracts already in place at Mountain Pass, El Campo represents a compelling opportunity for Locksley to deliver a high-grade US-sourced REE resource.

Broader Mojave Claims

Locksley’s broader Mojave claims contain additional REE targets, located north of El Campo. While less advanced, these claims have yielded geophysical anomalies and geochemical signatures consistent with carbonatite-hosted REE systems. Locksley intends to prioritize follow-up fieldwork and surface sampling to define targets for inclusion in its next phase of drilling. The North Blocks provide upside optionality, with the potential to expand Mojave into a district-scale REE opportunity. In addition, newly added claims immediately north of Dateline’s Colosseum mine are anticipated to contain significant polymetallic potential, based on published USGS soil sampling profiles.

Downstream Strategy – DeepSolv™ & Rice University Collaboration

Beyond exploration, Locksley is investing heavily in downstream processing capabilities to fill a critical gap in the US supply chain. Through its partnership with Rice University, the company is advancing DeepSolv™, a solvent-based hydrometallurgical process derived from deep eutectic solvents (DES). Unlike conventional pyrometallurgy, which requires smelting above 1000°C and generates significant SO₂ and CO₂ emissions, DeepSolv™ operates at 100–200°C, delivers >95 percent recovery rates and significantly reduces hazardous by-products. The technology is ore-agnostic, scalable and modular – aligning with US policies around clean technology and ESG compliance.

In addition to processing, Rice University is also leading research into antimony’s role in next-generation energy storage, including sodium-ion and lithium-ion batteries. Antimony’s high alloying capacity, metallic conductivity and cycling stability make it an attractive candidate for long-duration grid storage, supporting Department of Energy (DOE) priorities. This collaboration broadens Locksley’s strategy from exploration to commercialization, positioning it not just as a mine developer, but as a critical player in the US clean energy transition.

Together, the dual workstream collaboration with Rice University strengthens Locksley’s positioning by broadening eligibility for U.S. federal funding programs and unlocking access to Department of Defense and the Department of Energy grant pathways.

Management Team

Pat Burke – Non-executive Chairman

Pat Burke brings more than 20 years of experience in corporate law, governance and ASX-listed company leadership. He has served as executive chairman of Meteoric Resources, where he oversaw the acquisition of the Tier-1 Caldeira REE project in Brazil. Burke has held board roles across ASX, AIM and NASDAQ companies, guiding recapitalizations, acquisitions and strategic pivots. At Locksley, he provides governance oversight and M&A expertise, particularly in aligning the company with US capital markets.

Bevan Tarratt – Non-executive Director:

With more than two decades in corporate finance, accounting and broking, Bevan Tarratt specializes in ASX company recapitalizations, acquisitions and restructuring. He has played key roles in financing strategies for junior and mid-tier miners, ensuring efficient access to capital and maintaining financial discipline. Tarratt strengthens Locksley’s ability to navigate funding pathways and corporate structuring.

Steve Woodham – Non-executive Director

Steve Woodham brings more than 30 years of exploration, development and corporate leadership experience. He was a founding director of Centaurus Metals and YTC Resources (now Aurelia Metals) and previously served as managing director of Kingwest Resources and Tellus Resources. Woodham’s career highlights include advancing greenfield discoveries into development pipelines and steering companies through growth phases. His role at Locksley is to guide corporate strategy and ensure technical programs are aligned with shareholder value creation.

Kerrie Matthews – Chief Executive Officer

Ms. Matthews has over 20 years of executive experience including delivering complex, capital-intensive projects, including leading BHP’s US$3.8 billion South Flank Project and Iluka’s A$1.8 billion Eneabba Rare Earths Refinery, Australia’s first fully integrated rare earths refinery. She excels in streamlining approvals and fasttracking outcomes, which aligns with Locksley’s accelerated U.S. strategy

Danny George – Chief Operating Officer

Mr. George is a seasoned executive with extensive global experience in feasibility studies and executing EPCM and EPC contracts in mining and energy. He has successfully delivered major projects with top firms including WSP, Fortescue, Mineral Resources, and Ausenco, for clients such as Vale and BHP. Mr. George is recognised for quickly bringing projects online with capital discipline and operational agility, positioning Locksley as a fast mover in the U.S. market.