Australia’s latest Resources and Energy Quarterly report, released in September 2025, highlights a modest downgrade in the nation’s export outlook amid softer commodity prices.

The government now expects resource and energy export earnings to fall from a record AU$385 billion in 2024–2025 to AU$369 billion in 2025–2026 — a decline of about 5 percent.

A further dip to AU$354 billion is projected for 2026–2027 as global demand eases and prices normalize from recent highs.Despite the pullback, the resources and energy sector remains the backbone of Australia’s trade performance, accounting for roughly two-thirds of total merchandise exports.

This suggests that amidst ongoing price fluctuations, the country’s evolving mining industry continues to be a significant contributor to its economic growth.

In the June 2025 quarter, Australia’s real gross domestic product (GDP) rose by 0.6. to which mining value-added grew by 2.3 percent.

Iron ore mining rose by 6.1 percent as bad weather disruptions ended. The country also remains the largest iron ore producer globally.

Exploration and mining support services gained 2.3 percent, oil and gas extraction increased 1.2 percent, coal mining rose by 0.8 percent, while other mining fell by 0.7 percent.

The report also highlighted that the resources and energy sector contributes around 11.4 percent of gross domestic product, which is still likely a significant driver.

Direct employees in the resource and energy sector are estimated at 300,000 people.

Commodity prices

Gold continues to shine among other resources, reaching over US$3,800 an ounce in September. The report explained that prices rose due to expectations of US rate cuts and concerns about inflation and government finances.

It added that they’re likely to keep climbing until 2026, then slow down, with a chance they could drop.

As of October, gold saw a new record high of US$4,360 per ounce.

Iron ore prices took a deep dip in the June 2025 quarter, but later rose in the September quarter due to improved steel market sentiments in China. The forecast is that iron ore prices will reach US$87 a tonne in 2025 to 2026, a dollar up from the current figure.

For copper, the average price per tonne is at US$9,800 in the September quarter due to lighter reciprocal trade restrictions between China and the US.

“Prices are forecast to rise to an average of US$10,100 a tonne in 2027; a strong, structural uplift in demand will not be matched by rising supply,” the outlook read.

Aluminium prices succumbed to the effects of the US tariffs early this year, but have recovered losses as of writing. The forecast is that they will largely remain flat over the outlook period.

Prices of lithium hydroxide have seen an almost 20 percent recovery over the same period,

rising from around US$7,550 a tonne to around US$9,000 per tonne in late August.

Uranium prices ranged between US$70 to US$75 per pound in the early part of the September quarter. The quarterly report predicts that the price can go up due to upply problems and higher demand.

Nickel prices averaged US$15,276 a tonne in the first half of September 2025, trading just above five-year lows.

“Recent growth in nickel supply has continued to outstrip demand growth, contributing to weaker prices and growing nickel stockpiles,” the report wrote.

While zinc prices fell below US$2,600 in early April following the US tariff hikes, they soared to around US$2800 per tonne in late August.

The September quarterly suggests that zinc price is expected to average US$2,740 a tonne in 2025, weaken slightly in 2026 but then rise to average more than US$2,750 a tonne in 2027.

“Energy prices remain relatively weak: slow world economic growth and seasonal conditions have slowed energy use and supply has risen.”

The report cited the ceasefire in hostilities between Israel and Iran, saying that since then oil (Brent crude) prices have remained relatively steady at US$65 to US$70 per barrel.

It added that oil prices are expected to see a decrease for the forecast prices due to higher supply and the current demand for electric vehicles.

Higher US output has pushed down liquified natural gas (LNG) prices – from about US$15 per one million British thermal units or MMbtu in early 2025 to US$11 per Mmbtu in September.

It added that LNG prices are expected to become more stable as supply increases, but noted that this might not be noticeable until 2027.

Economy supported by dollar strength

Beyond 2025, the demand for gold may stay the same given geopolitical tensions, according to the office of Australia’s Chief Economist.

“A deal to end the fighting in Ukraine could involve sanctions relief on Russian exports and lead to a reorganization of trade flows,” the report stated.

Critical minerals and rare earths are currently in the hot seat, with Australian exports expected to grow from 2025 to 2026.

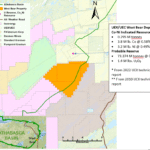

Export earnings for other critical minerals such as antimony, rare earths and cobalt are projected to grow to AU$5.0 billion by 2026 to 2027, with the recommencement of manganese exports from GEMCO and growth in rare earth exports predicted to drive most of this rise.

The recent signing of a rare earths deal between Australia and the US could likely affect or even add to the demand, as more projects and a total of US$2 billion investment are expected within the next six months.

An October 10 announcement from the Ministry of Commerce also added five new rare earth elements — holmium, erbium, thulium, europium and ytterbium — along with key refining technologies to its export control list.

The new rules carry a global reach: any foreign company producing rare earth materials or magnets using Chinese-origin equipment or technology must now obtain an export license from Beijing.

Amid the geopolitical tensions, the Australian dollars is anticipated to remain resilient.

“The AUD is expected to rise against the USD over the outlook period: deeper and faster US interest rate declines than in Australia will boost the relative attractiveness of AUD interest bearing assets.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/ph/register?ref=IU36GZC4