Key Takeaways

- Federal student loan repayment is now simplified under OBBBA into just three main options: Standard, IBR, and RAP.

- The right plan depends on your income, loan balance, and career goals, with RAP best for low earners/PSLF, Standard best for faster payoff, and IBR for existing borrowers.

- Most older plans (SAVE, PAYE, and ICR) are being phased out by June 2028, so understanding the new system is essential.

Paying off student loans has always been complicated, with borrowers juggling dozens of repayment options: Standard, Graduated, Extended, IBR, PAYE, SAVE, and more.

That all changes with the One Big Beautiful Bill Act (OBBBA). Starting in July 2026, federal student loan repayment is simplified into just three main options:

- A new Standard Repayment Plan (based on your loan balance)

- An updated Income-Driven Plan (IBR) for existing borrowers

- A new Repayment Assistance Plan (RAP) for both new and existing borrowers

This streamlined system makes it easier to choose a plan, but it also raises big questions: Which repayment option is best for you? How much will you actually pay? Will you qualify for forgiveness?

This guide breaks down each repayment plan after OBBBA, compares the pros and cons, and shows you how to choose the best path based on your income, debt, and goals.

Would you like to save this?

Quick Comparison

Here’s a quick comparison of each plan option:

|

Repayment Plan |

How It Works |

Term Length |

PSLF Eligible |

Best For |

|---|---|---|---|---|

|

Standard Plan (Old) |

Fix monthly payments to fully repay loan |

10 Years |

Yes |

Borrowers who are repaying loans and don’t qualify for PSLF |

|

Extended Plan (Old) |

Fix monthly payments to fully repay loan |

Up to 25 Years |

No |

Borrowers who are repaying loans and don’t qualify for PSLF |

|

Graduated Plan (Old) |

Rising monthly payments to fully repay loan |

Up to 30 years |

No |

Borrowers who are repaying loans and don’t qualify for PSLF |

|

IBR |

Payments based on either 10% or 15% of discretionary income |

20 or 25 Years |

Yes |

Existing borrowers who need a low payment or are pursuing PSLF |

|

Standard (New) |

Fix monthly payments to fully repay loan |

Ranges from 10 to 25 Years |

Generally No |

Borrowers who are repaying loans and don’t qualify for PSLF |

|

RAP |

Payments range from $10/mo to up to 10% of AGI |

30 Years |

Yes |

New borrowers who need a low payment or are pursuing PSLF |

|

Private Loans |

Fixed repayment plan to full repay your loans. |

Varies from 5 to 20 Years |

No |

Private loans should be the last resort, and you cannot change repayment plans unless you refinance and get a new loan |

Where To Start Understanding Student Loan Repayment Plan Options?

If you don’t know where to even start, here are some helpful resources. You can also use our Student Loan Calculator to run some basic numbers. You can also use our new Repayment Assistance Plan (RAP) calculator to check what your payment may be in the future.

StudentAid.gov

The Loan Simulator on StudentAid is generally a reliable option for navigating repayment plan options. If you only have federal student loans, it can show you your options.

However, the loan simulator has NOT been updated to reflect the OBBBA changes yet. The current ETA is Winter 2025 before the changes like removal of the partial financial hardship are in place.

This video explains it more:

@thecollegeinvestor Borrowers can’t access IBR because the “Partial Financial Hardship” requirement has not been removed from the coding on the IDR application. What’s more concerning is borrowers are being steered into consolidation or ICR, which may be a worse option. #studentloans #studentloandebt ♬ original sound – The College Investor

Your Loan Servicer

Loan servicers aren’t known for the best customer service. However, a loan servicer can provide you with information about your current loans including your current repayment plan.

This is their job, and you’ll have to work with them eventually. Don’t be shy to give them a call or use their online tools.

However, they cannot provide you information about repayment plans that are not active yet – like the RAP plan. If you’re in the SAVE forbearance and trying to decide if you wait for RAP or leave now, they can’t necessarily help you decide that.

Refinancing Marketplaces

Can you easily afford your loan payment on a 10-year repayment plan or are you looking to change your private student loan options? If so, refinancing your debt could make sense. Use a marketplace like Credible to find student loan refinancing options.

You can also look at our list of the best student loan refinance lenders here.

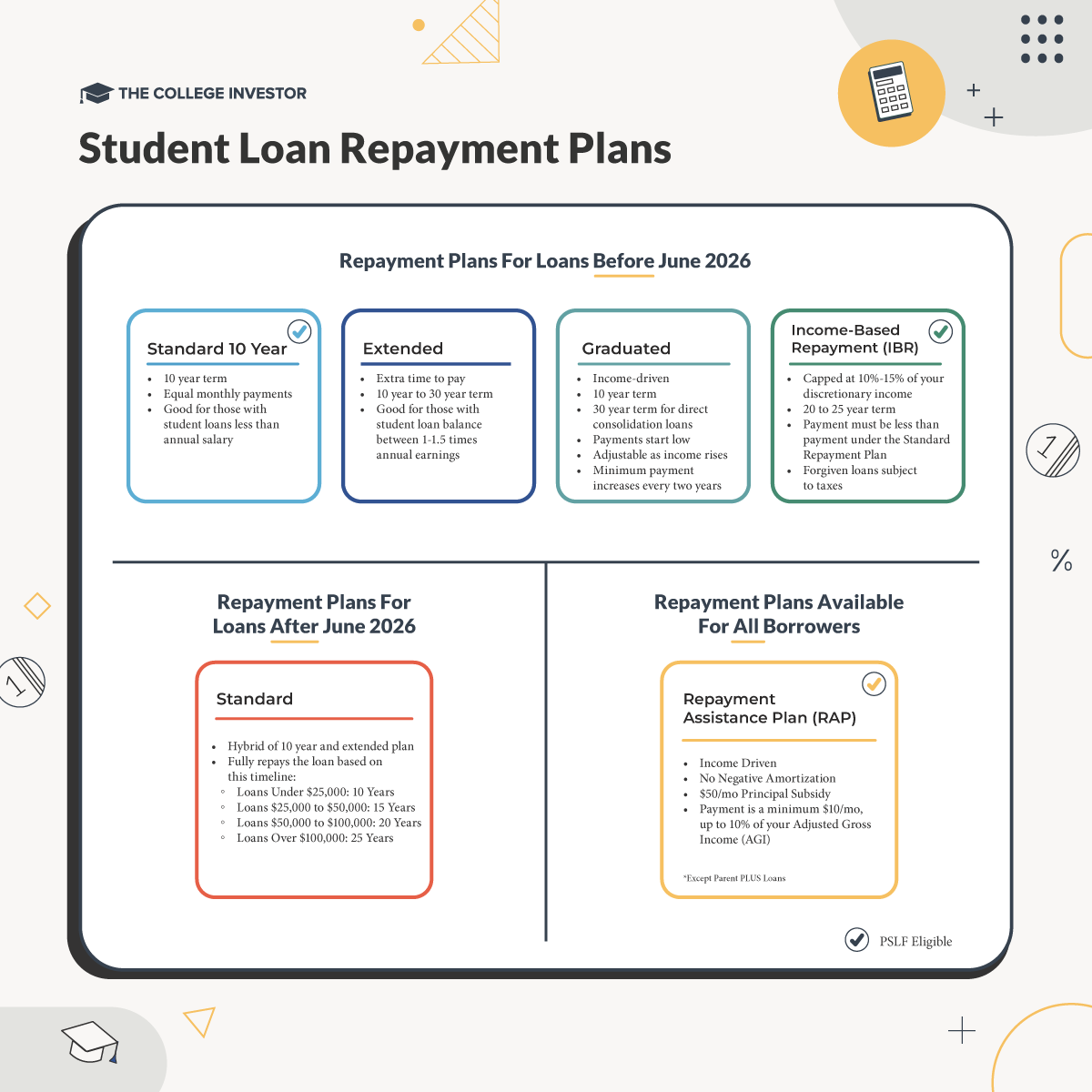

Standard Repayment Plan Options For Existing Borrowers (Pre-June 2026)

Here are the options for existing student loan borrowers.

Standard Repayment Plan

The Standard repayment plan is changing for future borrowers, but for borrowers who have loans before June 2026, the options are the same as they always have been.

The Standard Repayment Plan is the most popular student loan repayment plan, although that is probably because it is a default repayment plan.

In most cases, if your annual salary is more than you owe in student loans, the Standard Repayment Plan makes sense for you. For example, if you earn $47,000 per year, and you owe $33,000 in student loans, in most cases, you can afford to repay the loans.

If you owe more in student loans than you earn each year, you’ll want to avoid this plan (at least for now).

Extended Repayment Option

When you do a direct consolidation of Federal student loans, you can opt into the extended repayment option.

Technically, there are two versions of this program. If your loan repayment started between October 7, 1998 and July 1, 2006, you’ll have 25 years to repay your loans. The payments will be level monthly payments over the 25 years, and you’ll have a minimum of a $50 monthly payment.

For those who started loan repayment after July 1, 2006, the repayment term depends on the loan balance. Repayment terms range from 10 to 30 years.

If you do not plan to apply for Public Service Loan Forgiveness, and you need some extra time to pay back your loans, this plan could make sense. It can be particularly helpful if your total loan balance is between 1 and 1.5 times your annual earnings. For example, if you earn $200,000 per year, and you owe $250,000 in student loans, this could make sense for you.

|

Loan Balance |

Repayment Term |

|---|---|

|

Less than $7,500 |

10 years |

|

$7,500 to $9,999 |

12 years |

|

$10,000 to $19,999 |

15 years |

|

$20,000 to $39,999 |

20 years |

|

$40,000 to $59,999 |

25 years |

|

$60,000+ |

30 years |

Graduated Repayment Option

A graduated repayment plan is a payment program that allows borrowers to pay off loans over a 10-year period. If you’ve taken a Direct Consolidation Loan, the repayment period may last up to 30 years depending on the balance.

Under the Graduated Repayment Plan, payments start low. But your minimum payment increases every two years. Ostensibly, this gives borrowers the ability to adjust their payments as their income rises.

However, this is a plan that seems like the worst of all possible worlds. In many cases, payments under this plan triple over the course of 10 years. Plus, a ton of your payment goes towards servicing interest in the early years, so you’re unlikely to see real progress until your last few years.

In most cases, if you can’t afford your payments right now, an income-driven repayment plan makes the most sense.

Standard Plan (Post-July 2026)

For loans originated after July 1, 2026, the default repayment plan will be the updated Standard Plan. This plan is a hybrid of the old standard and extended plans.

Term length varies by loan size:

- Under $25,000 → 10 years

- $25,000–$50,000 → 15 years

- $50,000–$100,000 → 20 years

- Over $100,000 → 25 years

For borrowers in a 10 year version of this plan, it will qualify for Public Service Loan Forgiveness. However, that doesn’t really help since PSLF is 10 years.

Income-Based Repayment (Pre-June 2026)

For borrowers looking for an income-driven repayment plan, and who took out a loan before June 30, 2026, can enroll in the Income-Based Repayment Plan.

If you started borrowing after July 1, 2014, your payment is capped at 10% of your discretionary income, and you will make payments for 20 years. If you borrowed before July 1, 2014, your payments will be capped at 15% of your discretionary income, and your term will be 25 years.

After 20 or 25 years, your loans will be forgiven, but you need to watch out for the tax bomb the year the loans are forgiven.

Previously, to qualify for IBR, your payment under IBR must be less than the payment under the Standard Repayment Plan. However, that “partial financial hardship” requirement was waived with the OBBBA. This is critical for some borrowers pursuing Public Service Loan Forgiveness, since IBR is a qualifying repayment plan.

Repayment Assistance Plan (Post-July 2026)

The Repayment Assistance Plan (RAP) is the new income-driven repayment plan options for borrowers who take out a student loan after July 1, 2026. Existing borrowers can also enroll in the plan.

RAP payments are based on annual income brackets (based on adjusted gross income or AGI):

- AGI ≤ $10,000: Flat payment of $120/year ($10/month)

- $10,001–$20,000: 1%

- $20,001–$30,000: 2%

- $30,001–$40,000: 3%

- $40,001–$50,000: 4%

- $50,001–$60,000: 5%

- $60,001–$70,000: 6%

- $70,001–$80,000: 7%

- $80,001–$90,000: 8%

- $90,001–$100,000: 9%

- AGI > $100,000: 10% of AGI

To determine a borrower’s monthly payment, the base payment is divided by 12 and adjusted by subtracting $50 for each child under 17 who lives with the borrower.

If the calculation ends up less than $10 per month, the borrower would pay a minimum of $10/month.

The RAP plan is also PSLF-eligible.

It’s important to note that existing borrowers who enroll in RAP will see their long-term IDR loan forgiveness payment counts carry forward. But, if they leave the RAP plan, that time in RAP won’t count towards long term IDR loan forgiveness. They basically don’t want you to take advantage of a lower RAP payment, but then leave for a 20 or 25 year IBR loan forgiveness term, rather than RAP’s 30 year term.

Private Loan Repayment Options

Private student loans don’t have the same repayment plan options that are offered by the Department of Education. Rather, the loan terms are set by your lender when you take out the loan.

Private loans have terms ranging from 1 year to 20 years, and the interest rate can be fixed or variable. We break down the best private loans here so you can see how yours compares.

Most lenders offer some or all of the following types of plans:

- Immediate Repayment – This is where you start making monthly payments immediately

- Deferment In School – This is where your payment is deferred while you’re in school, and typically for 6 months after you graduate

- Set Monthly Payment In School – This is where you have a small, set monthly payment (such as $25) while in school

- Interest Only In School – This is where you pay only your accrued interest each month while in school

It’s important to note that there aren’t really any private student loan forgiveness options either.

If you already have private loans, the typical way to change your repayment plan is to simply refinance your student loan into another student loan with better rates or terms. You can find our guide to Student Loan Refinancing here.

Which Repayment Plan Is Right For You?

Once again, the best student loan repayment plan is the one that you can afford to make every month.

If you fail to make your monthly payments, not only will your credit score be hurt, but you can see your wages garnished and more. Plus, going into default will see your loan balance automatically rise by about 25% due to accrued interest and collection costs.

The bottom line is to make sure you get in the best repayment plan that works for you!

Next Steps To Enroll

Once you understand the best student loan repayment plan for you, you need to enroll.

Changing student loan repayment plans is relatively easy:

- Login to StudentAid.gov and select “Income Driven Repayment Plan Application”. Note: if you want to enroll in a standard plan, you can only do so by calling your lender.

- Enter the information requested

- Make sure you link your tax return automatically using the IRS data retrieval tool

- You should be enrolled in your new repayment plan in the next several weeks

If you need more help with your loans, check out The College Investor forum and ask a question, The College Investor’s sub-Reddit, or our related student loan guides.

Common Questions About Student Loan Repayment Plans

What is the One Big Beautiful Bill Act (OBBBA) and how does it change student loan repayment?

The OBBBA was passed by Congress and eliminates multiple existing student loan repayment plans, including SAVE, PAYE, and ICR, and replaces them with a new, simplified option called RAP going forward.

Does OBBBA replace the SAVE Plan?

The OBBBA eliminated the SAVE plan officially. It also created a new repayment plan called the Repayment Assistance Plan (RAP) that goes live in 2026.

What happens to older repayment plans like ICR and PAYE?

ICR and PAYE are being phased out, along with SAVE, before June 30, 2026.

How does forgiveness work under the new Repayment Assistance Plan (RAP?

The RAP plan has a 30 year loan forgiveness timeline. Any remaining balance on your loan after 30 years will be forgiven.

Which repayment plan is best for PSLF (Public Service Loan Forgiveness)?

The only qualifying repayment plans for PSLF are going to be IBR and RAP going forward.

Can I switch repayment plans after enrolling?

Yes, but with some limits.

Are forgiven student loans taxable under OBBBA?

Potentially. The OBBBA continues to allow PSLF and death and disability discharge to be tax-free. However, loan forgiveness due to income-driven repayment and borrower defense to repayment will be taxable again starting January 1, 2026.

Do Parent PLUS loans qualify for these plans?

Current parent PLUS borrowers who consolidate their loans prior to June 30, 2026 will remain eligible for IBR as long as they enroll in the plan before June 30, 2028. After July 1, 2026, Parent PLUS Loans will only be eligible for the Standard repayment plan.

Do you have to repay all student loans under the same repayment plan?

Yes, you must repay all student loans under the same repayment plan, if eligible. That means if you take new loans, and only certain plans are available, it could make you have to update the repayment plan for all your existing loans as well.

The post Best Student Loan Repayment Plans (Updated For OBBBA) appeared first on The College Investor.