Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Arthur Hayes has never been shy about big numbers, but his latest essay, Time Signature, frames those targets inside a sweeping macro thesis: a wartime‑style US credit boom that—if it unfolds as he expects—could send Bitcoin and crypto markets into their largest bubble yet.

Writing on 22 July, the BitMEX co‑founder argues that financial markets, like dancers, must keep time with the “kick drum” of credit creation. “If we are out of time, we lose money,” he warns, before identifying the beat he believes traders must follow today: US wartime industrial policy, or what he bluntly calls a shift toward economic “fascism.”

Hayes centres his argument on the Pentagon’s newly announced deal with MP Materials, under which the US Defense Department will become the miner’s largest shareholder, guarantee a floor price for critical rare‑earth elements at twice China’s current market rate, and back a $1 billion bank loan to build a Nevada processing plant. The structure, he writes, is the template for “QE 4 Poor People,” a credit‑multiplier that expands the money supply without formal Congressional approval.

Related Reading

In his schematic example a single commercial‑bank loan to MP Materials “creates $1,000 of new fiat wampum,” then ripples outward as wages, deposits and discounted Treasury borrowing. “The money multiplier is > 1, and this wartime production leads to an increase in economic activity, which is accounted for as ‘growth,’” Hayes observes. The result, he says, is inevitable inflation, yet also “government‑guaranteed profits” for banks and industry.

Why Bitcoin And Crypto Is The Bubble Of Choice

Hayes’ historical analogy is China’s 1990s–2020s property boom, where a five‑thousand‑percent expansion of M2 forced households into apartments, inflating land values and local‑government coffers. In the United States, he contends, the socially acceptable pressure valve will be digital assets.

Two policy shifts underpin that call. First, retirement plans—an $8.7 trillion pool—may now allocate to crypto under a recent executive order. Second, the Trump campaign’s floated proposal to eliminate capital‑gains tax on digital assets could, in Hayes’ words, provide “insane war‑driven credit growth” with “no fucking taxes.” The broader attraction for politicians, he claims, is demographic: younger and more diverse investors own crypto in greater proportions than they own equities, so a bull market would “create a broader, more diverse set of people who are pleased with the ruling party’s economic platform.”

Related Reading

Even a credit‑fuelled boom must find an audience for the mounting federal deficit. Hayes’ solution is the stablecoin sector, which already places most of its assets under custody in US Treasury bills. On-chain data, he notes, suggest that roughly nine cents of every new dollar in total crypto market value migrates into stablecoins. “Let’s assume that Trump propels the total crypto market cap to $100 trillion by 2028,” he writes; “that would create roughly $9 trillion in T‑bill purchasing power.”

The mechanism recalls World War II financing, when the Treasury skewed issuance toward short‑term bills. In Hayes’ view, a self‑reinforcing loop emerges: wartime procurement fuels credit expansion, higher credit lifts crypto, larger crypto capitalization feeds stablecoin demand for T‑bills, and those purchases backstop further deficits.

Trading Tactics—And The Year‑End Call

Against that macro backdrop Hayes declares his investment vehicle, Maelstrom, “fully invested,” and explains why: “It’s pretty simple: Maelstrom is fully invested. Because we are degens, the shitcoin space offers amazing opportunities to outperform Bitcoin, the crypto reserve asset. […] Ether has been the most hated large-cap crypto. No more; the Western institutional investor class, whose chief cheerleader is Tom Lee, loves Ether. Buy first, ask questions later.”

His numerical convictions are explicit: Bitcoin $250,000 and Ether $10,000 by 31 December 2025. The Western credit geyser is, he writes, “about to tear the market a new asshole.” Yet he repeatedly reminds readers that these are personal views, not investment advice.

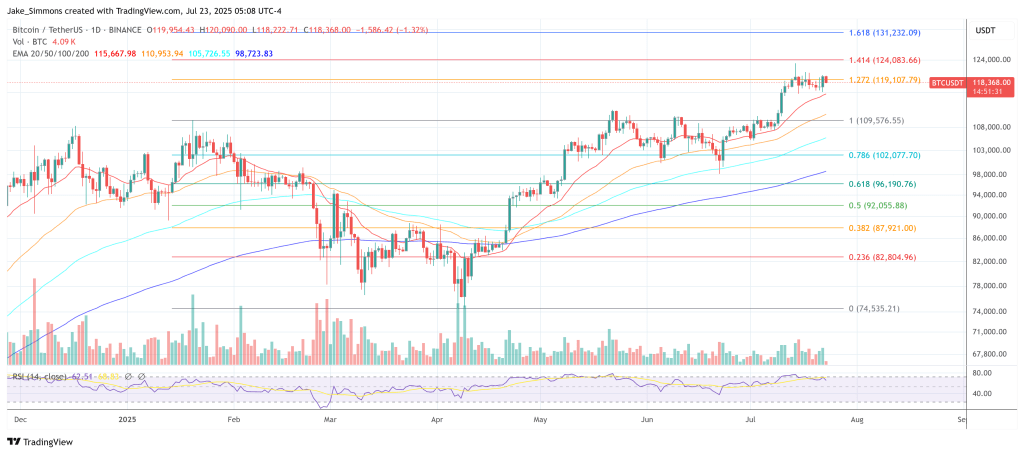

At press time, Bitcoin traded at $118,368.

Featured image created with DALL.E, chart from TradingView.com