Key point:

-

BTC faces selling at $120,000, but the bulls have not ceded much ground, hinting at a breakout to new highs.

Bitcoin (BTC) turned down from the $120,000 resistance on Wednesday, indicating that the bears are fiercely defending the level. The failure to break above the overhead resistance has resulted in net outflows of $285.2 million in the past three days in the US-based spot exchange-traded funds (ETFs), per Farside Investors data. That suggests the investors have turned cautious in the near term. However, a positive sign is that the bulls have not allowed the price to dip below $115,000.

What are the crucial levels to watch out for in the near term? Let’s analyze the charts to find out.

Bitcoin price prediction

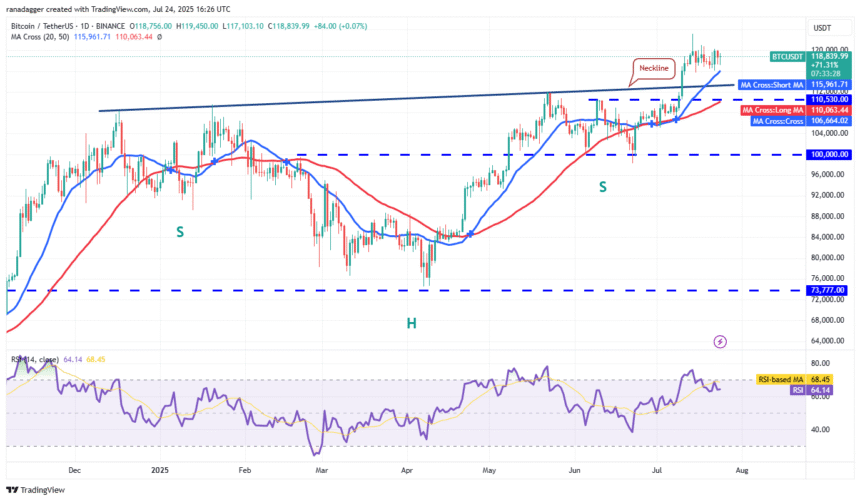

Bitcoin is getting squeezed between the 20-day simple moving average ($115,961) and the overhead resistance of $120,000.

The upsloping 20-day SMA and the relative strength index (RSI) in the positive zone indicate that the path of least resistance is to the upside. If buyers thrust the price above the $120,000 to $123,218 resistance zone, the BTC/USDT pair could resume the uptrend. The pair could skyrocket to $135,729 and later to $150,000.

The first sign of weakness will be a close below the 20-day SMA. That signals the bulls have given up and are booking profits. The pair may drop to the neckline of the inverse head-and-shoulders pattern and then to $110,530. A break and close below $110,530 could tilt the advantage in favor of the bears.

Related: XRP tanks 10% but ATH comeback is still in play: Bitpanda exec

Both moving averages have flattened out, and the RSI is near the midpoint in the 4-hour chart. That suggests a balance between supply and demand. A tight consolidation near the all-time high is a bullish sign as it shows the buyers are holding on to their positions as they anticipate another leg higher. Buyers will be back in command on a break and close above $123,218.

On the contrary, a break and close below $115,500 may accelerate selling as short-term buyers rush to the exit. That could sink the pair to $110,530, where the buyers are expected to step in.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.