US Bitcoin spot exchange-traded funds (ETFs) have seen more inflows this year so far compared to the same point in 2024, according to data.

Bitcoin Spot ETF Net Inflows Have Crossed $14.8 Billion In 2025 So Far

In a new post on X, the Head of Research at CryptoQuant, Julio Moreno, has discussed about how the US spot ETF inflows compare between 2024 and 2025 for Bitcoin.

Spot ETFs refer to investment vehicles that provide for an alternative route of exposure to BTC’s price movements. These ETFs trade on traditional platforms and the investor doesn’t have to deal with custody themselves, as the ETF provider holds the coin on their behalf.

This means that traders who don’t want to bother with digital asset wallets and exchanges can use these vehicles to invest into Bitcoin in a mode that’s familiar to them.

In the US, the Securities and Exchange Commission (SEC) approved BTC spot ETFs on January 10th, 2024. The ETFs were quick to gain popularity and today represent an important cornerstone of the market.

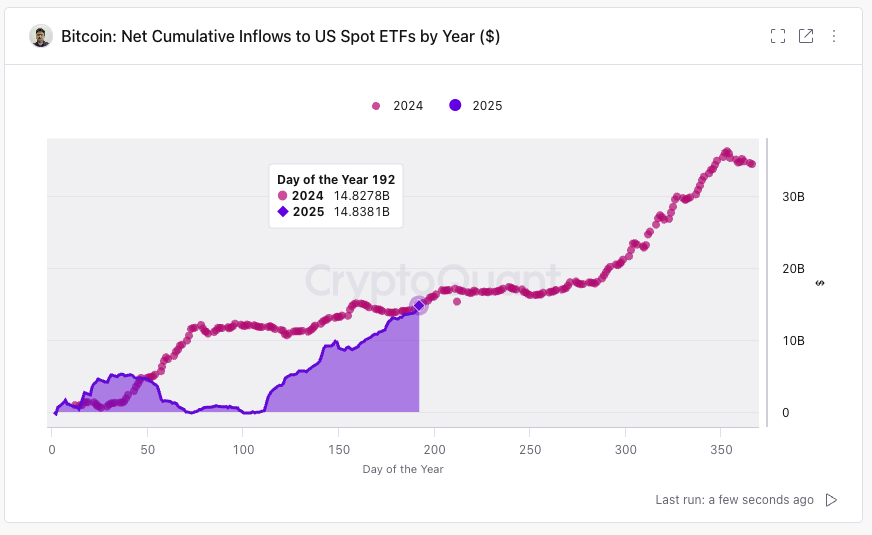

While 2024 was more of an up-only year for them, 2025 has so far been different. Below is the chart shared by Moreno that shows how the cumulative net inflow trend for the Bitcoin spot ETFs has compared this year versus the last.

Looks like the 2025 trend is now just outpacing the 2024 one | Source: @jjcmoreno on X

As is visible in the graph, the US Bitcoin spot ETF inflows were initially ahead of pace in 2025 relative to 2024, but as the market downturn took hold, inflows dried up and 2025 fell significantly behind.

A few months into the year, though, demand for spot ETFs started to return and the gap began to shrink. Now, following the latest wave of inflows that has accompanied the rally to the new price all-time highs (ATHs), 2025 inflows have flipped 2024.

From the chart, it’s apparent that 2025 cumulative net inflows stand at $14.8381 billion right now. At the same phase of the year in 2024, they amounted to $14.8278 billion.

The spot ETF demand had been sideways at this point of the time last year, so it’s possible that if inflows continue at the current pace, 2025 will gain some distance.

That said, it only remains to be seen how long demand can keep up, as in 2024, inflows saw an acceleration toward the end of the year as interest flooded into the market alongside the surge beyond $100,000.

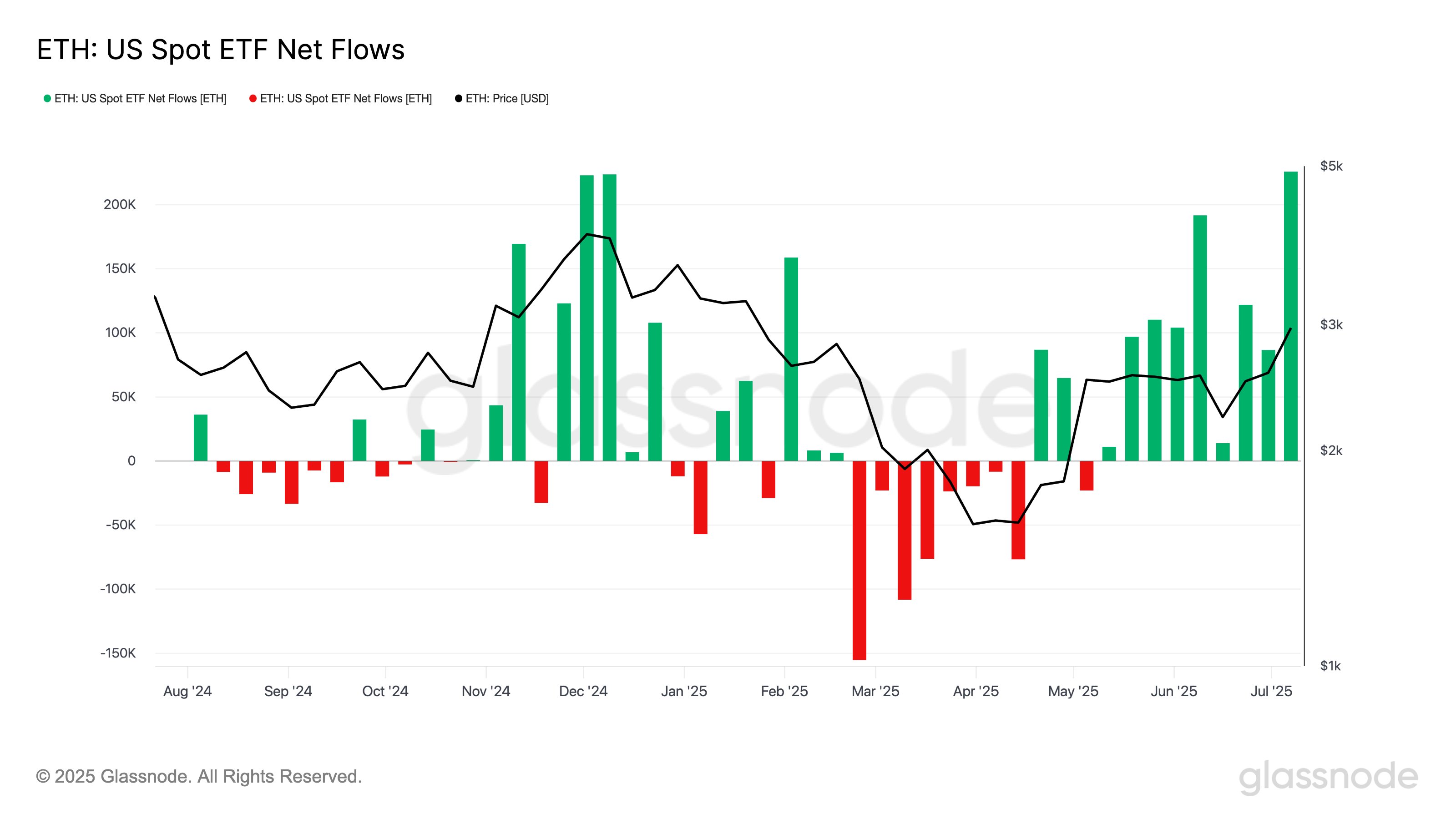

In some other news, US Ethereum spot ETFs have been seeing a boom of their own recently, as the netflow has remained green for many weeks now.

The trend in the US ETH spot ETF netflow over the past year | Source: Glassnode on X

Last week was the largest for the Ethereum spot ETFs since the SEC approval in mid-2024, with inflows totaling at 225,857 ETH.

BTC Price

Bitcoin set a new ATH beyond $123,000 yesterday, but the asset has since registered a drop as its price has returned to $117,300.

The price of the coin appears to have plunged during the last 24 hours | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.