Update July 14, 9:33 a.m. UTC: This article has been updated to include quotes from Brickken’s market analyst.

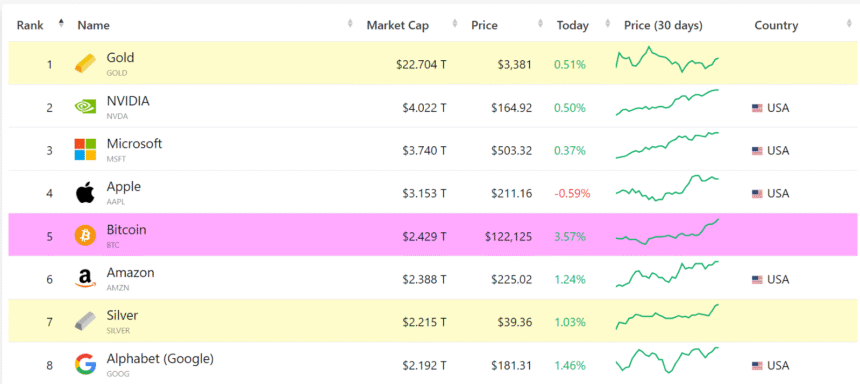

Bitcoin has become the world’s fifth-largest asset, overtaking Amazon by market capitalization.

Bitcoin (BTC) price rose to a new all-time high of $122,600 on Monday and has soared nearly 13% over the past week, as Cointelegraph reported.

These gains allowed Bitcoin to surpass a $2.4 trillion market capitalization, overtaking Amazon’s $2.3 trillion, Silver’s $2.2 trillion and Alphabet’s (Google) $2.19 trillion, Companiesmarketcap data shows.

This means Bitcoin’s market cap was only $730 million shy of tech giant Apple, at the time of writing.

“With institutional giants like BlackRock and MicroStrategy’s treasury continually increasing, the legitimacy of Bitcoin as an investable asset class is no longer in question, with regulatory momentum also shifting.”

Bitcoin’s new record high comes amid a period of growing institutional adoption, which has seen corporate Bitcoin holding companies double since June 5. Over 265 companies are now holding Bitcoin on their balance sheets, up from 124 just weeks ago.

A total of 3.5 million Bitcoin is held in company treasuries, with 853,000 BTC, or 4% of the total supply, in public company treasuries, and over 1.4 million BTC, or 6.6% of the supply, through spot Bitcoin exchange-traded funds (ETFs).

Related: Trump administration mulls ‘debanking’ executive order: WSJ

Bitcoin ETF buying spree bolsters BTC momentum

US spot Bitcoin ETFs ended last week’s trading session with a seven-day buying streak, adding significant liquidity for Bitcoin’s price momentum.

Spot Bitcoin ETFs amassed over $1 billion worth of net positive inflows on Friday, marking a seventh consecutive day of investments, Farside Investors data shows.

The inflows from the spot Bitcoin ETFs have been a significant catalyst for Bitcoin’s rise to new highs.

In February 2024, the ETFs accounted for 75% of new investments into Bitcoin over a two-week period. This activity helped propel BTC price above $50,000.

Related: Multibillion-dollar HODL: Bitcoin whales awaken after 14 years

Bitcoin’s price may also be benefiting from heightened interest due to an event dubbed by the US government as “Crypto Week.” Lawmakers are seeking to pass three key cryptocurrency bills that are expected to bolster the national crypto industry: the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, the Digital Asset Market Clarity Act (CLARITY Act) and the Anti-CBDC Surveillance State Act, which seeks to prevent the creation of a central bank digital currency (CBDC).

Magazine: Bitcoin as corporate treasury: Why Meta, Amazon and Microsoft all said no