Why Bitcoiners turned to AI

The 2024 Bitcoin halving reduced block rewards to 3.125 BTC, cutting miners’ income in half. This change, combined with higher electricity costs, expensive equipment maintenance and increased competition, made traditional mining less profitable. Many mining companies struggled to maintain their profit margins and began exploring other revenue sources.

Although Bitcoin mining relies on devices called ASICs, mining companies have access to energy-dense data centers and power infrastructure. As demand for AI compute skyrockets, many miners are repurposing or upgrading their facilities with GPUs to support AI training and inference workloads.

However, artificial intelligence demands immense computing power, especially for training large language models, powering autonomous systems and running enterprise AI tools.

As tech companies race to secure high-performance infrastructure, Bitcoin mining firms are stepping in. Leveraging their existing energy-intensive data centers and upgrading with GPUs, many miners have begun offering AI cloud services or renting out spare capacity. This diversification allows them to generate steady, non-crypto income streams, reducing reliance on volatile Bitcoin (BTC) revenues.

This shift offsets the impact of Bitcoin halving and has led to more profitable and stable revenue streams.

Did you know? AI workloads and Bitcoin mining both demand massive energy. By planning for both, miners can lease excess capacity to AI firms, especially during crypto downturns, turning stranded power into a stable cash flow.

Case study: Core Scientific’s $3.5 billion lifeline

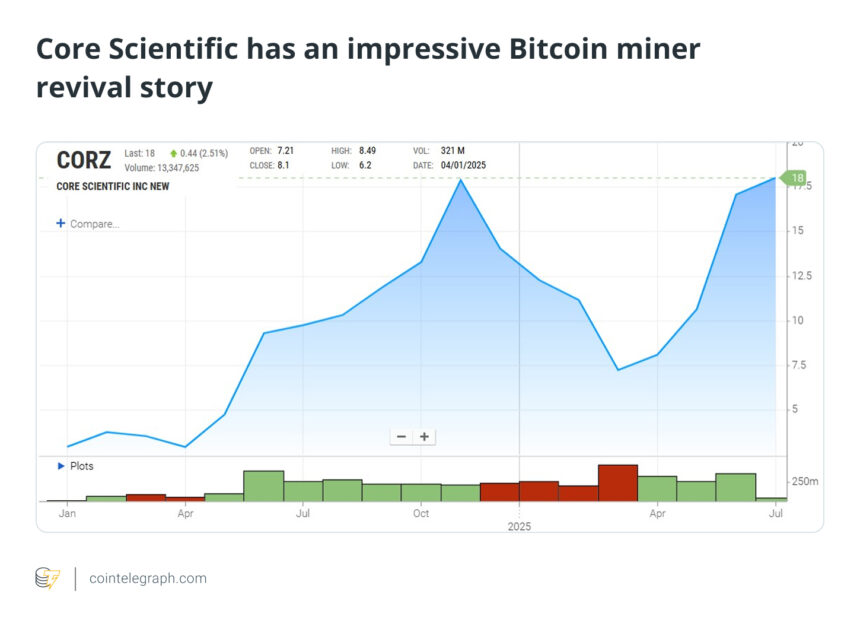

Core Scientific is a strong example of how shifting to AI can help a struggling Bitcoin mining company recover. After facing financial difficulties and filing for Chapter 11 bankruptcy in late 2022 due to low Bitcoin prices and heavy debt, the company restructured and returned to the Nasdaq in early 2024.

In June 2024, Core Scientific signed a 12-year, $3.5 billion contract with CoreWeave, an AI cloud computing company. The agreement allowed Core Scientific to use parts of its infrastructure to support CoreWeave’s high-performance computing needs, moving away from solely mining Bitcoin to also providing AI services.

Although the company’s revenue in the first quarter of 2025 fell to $79.5 million from $179.3 million the previous year, the AI strategy boosted investor confidence. The company’s stock price rose after the CoreWeave deal was announced, reflecting market support for its new direction.

By mid-2025, CoreWeave restarted talks to acquire Core Scientific, following an unsuccessful $1 billion offer the year before. This renewed interest highlights how the company’s focus on AI cushioned the impact of Bitcoin’s halving and positioned it as a key player in the growing AI computing industry.

Hut 8’s AI side hustle

Hut 8 has added AI as a secondary source of income while continuing to prioritize Bitcoin mining. This business model combines stability and growth potential through a five-year contract that includes fixed payments and a revenue-sharing component, ensuring steady income with opportunities for additional earnings based on customer success.

In September 2024, the company launched Highrise AI, a subsidiary offering GPU-as-a-Service using over 1,000 Nvidia H100 chips, specialized hardware for training and running advanced AI models. This move marked Hut 8’s official entry into the high-performance computing (HPC) market.

Despite its AI venture, Hut 8 remains dedicated to Bitcoin mining. In the first quarter of 2025, it mined 167 BTC, a decrease from 716 BTC in the same period of 2024, largely due to the 2024 Bitcoin halving. The company continues to invest in its mining infrastructure, supported by its significant Bitcoin reserve of 10,273 BTC, making it the ninth-largest corporate Bitcoin holder worldwide.

For Hut 8, AI serves as a complementary strategy, diversifying its revenue while keeping Bitcoin mining as the core of its long-term plan.

How are hybrid models gaining traction: Hive and Iren

As Bitcoin mining profits shrink, hybrid models combining mining with AI compute are gaining ground. Companies like Hive and Iren are proving that it is possible to grow AI revenue without abandoning their Bitcoin roots. They are diversifying income while optimizing existing infrastructure.

Hive Digital Technologies

Formerly known as Hive Blockchain, the company rebranded in mid-2023 to reflect its broader high-performance computing ambitions. Hive invested $30 million to deploy Nvidia-powered GPU clusters, marking a decisive pivot toward AI workloads.

This investment began to pay off quickly. In fiscal 2025, Hive’s AI and HPC hosting revenue tripled to $10.1 million, almost 9% of its total revenue. Looking ahead, Hive has set an ambitious target of $100 million in AI revenue by 2026, signaling a strong commitment to expanding its hybrid model.

Iren (Iris Energy)

Australian mining firm Iren began its AI journey in early 2024 with just 248 GPUs, and by mid-2025, it had scaled up to more than 4,300 units. The firm’s hybrid model is already generating results, mining 1,514 BTC in Q3 FY2025 while pulling in $3.6 million from AI cloud services. To support this growth, Iren is building AI-focused data centers in Texas and British Columbia.

Still, the company faces a challenge: A class-action lawsuit filed in October 2024 alleges it misled investors about the operational readiness of its Texas facility, casting a shadow over its otherwise promising expansion.

How major Bitcoin miners are preparing for AI: Riot Platforms and MARA Holdings

While some Bitcoin miners have already begun earning revenue from AI, others are building foundations for future AI opportunities. Riot Platforms and MARA Holdings, two leading companies in the mining industry, are strategically planning for AI integration while maintaining their focus on Bitcoin mining.

Riot Platforms

Exploring AI possibilities, Riot Platforms has started assessing the potential to convert 600 megawatts at its Corsicana, Texas, facility into high-performance computing (HPC) infrastructure. Although Riot has not yet secured significant AI contracts, its Corsicana site, covering 355 acres, has the capacity to support up to 1 gigawatt of computing power, giving it a decisive advantage.

Financially, Riot remains robust in its primary business, having mined 1,530 BTC and earned $142.9 million in mining revenue in the first quarter of 2025. The company also holds 19,225 BTC (as of July 17, 2025), one of the largest corporate Bitcoin reserves worldwide.

MARA Holdings

MARA possesses the most extensive Bitcoin treasury among mining companies, with 50,000 BTC, second only to Strategy among public companies. Its AI strategy focuses on edge computing, including developing its MARA 2PIC700 immersion cooling system, designed to handle intensive computing tasks.

While MARA has the infrastructure ready, its AI efforts have not yet resulted in significant contracts or consistent revenue. For now, a move into AI remains a forward-looking strategy with potential for future growth.

Did you know? Bitcoin mining relies on ASICs, but AI needs GPUs like Nvidia’s H100s. Some miners are now retrofitting data centers with GPUs to support AI clients, creating dual-purpose infrastructure that balances both blockchain and AI demands.

An outlier case: Canaan’s retreat from AI

While many Bitcoin mining companies are exploring AI to broaden their income sources, Canaan has taken a different approach.

In July 2025, the company closed its AI chip division, stepping away from the high-performance computing sector. This decision reflects a renewed focus on its primary expertise: designing application-specific integrated circuits (ASICs) for Bitcoin mining.

Instead of pursuing the growing AI market, Canaan is advancing its mining hardware to maintain a competitive edge. Still, it holds only 2.1% of the global ASIC market, far behind leading competitors like Bitmain and MicroBT.

By prioritizing mining-focused hardware and strengthening its presence in markets like North America, Canaan is adopting a unique strategy when others are shifting toward AI. The long-term success of this approach is yet to be determined.

Did you know? AI firms face pressure to go green. Bitcoin miners that already use renewable energy, like hydro or solar, can attract AI clients looking to meet sustainability targets through clean colocation deals.

Key risks and considerations for miners entering the AI market

As Bitcoin miners increasingly shift to AI, this transition offers opportunities and significant risks. Miners must carefully consider the following:

- Infrastructure costs vs returns: Moving from ASIC-based mining to GPU-based AI systems requires substantial initial investment. Miners must ensure that the potential long-term revenue outweighs these costs.

- Client stability: AI clients, particularly startups, may lack consistent funding or long-term reliability. Miners should carefully evaluate clients to avoid payment defaults or service interruptions.

- Power supply reliability: AI operations demand continuous, high-energy usage. Miners must secure stable, long-term power agreements and monitor local grid capacity to prevent outages or sudden price increases.

- Cooling and thermal management: AI chips, such as Nvidia H100s, produce significant heat. Inadequate cooling systems can lead to equipment failures or reduced efficiency.

- Regulatory compliance: Hosting AI workloads may involve complex regulations related to data privacy, intellectual property, international data hosting, energy use, water consumption and carbon emissions. Miners must be prepared to navigate these rules.

- Market competition: As more miners enter the AI colocation market, pricing could decline. Early entrants should establish advantages, such as strategic locations, low energy costs or large-scale operations.

- Resource strain: Expanding into AI while maintaining mining operations may overstretch financial and management resources.