Key takeaways:

-

Bitcoin price hit new highs as a stablecoin liquidity metric pointed to fresh capital flowing into BTC.

-

Retail investor inflows dropped while Binance’s market share surged past 49%, highlighting institutional investors’ role in driving the rally.

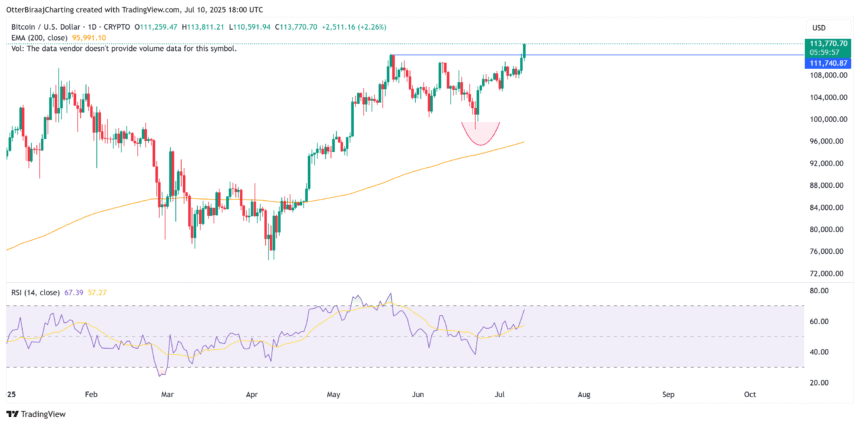

After posting new highs on Wednesday, Bitcoin (BTC) is looking to close its highest daily candle after BTC rallied to $113,800 on Thursday. With the crypto asset possibly entering a new phase of price discovery, liquidity signals are lighting up, suggesting the rally may have more fuel in the tank.

Anonymous crypto analyst SunflowerQuant pointed to a bullish development in the Stablecoin Supply Ratio (SSR) MACD, a metric that tracks the market’s available buying power.

The SSR MACD, which tracks momentum shifts, has just made a bullish crossover, where the MACD line moves above its signal line. This type of crossover has historically appeared ahead of new capital inflows and stronger upward momentum in Bitcoin’s price. It’s a sign that liquidity may re-enter the market.

Last month, Binance recorded a staggering $31 billion in USDT and USDC reserves, marking an all‑time high. This suggests a massive pool of sidelined capital, potentially ready to funnel into Bitcoin and altcoins as conditions become favorable. In this light, the SSR MACD crossover signals that this huge reserve pool might soon be leveraged.

Related: US debt rises to $36.6T: Will recession signals send Bitcoin back to $95K?

Retail traders chill while Binance volume dominates

Data from CryptoQuant noted that the exchange retail inflow (30-day sum) has dropped below $12 billion, a level not seen since April 2025. Fewer BTC deposits from retail traders suggest less selling pressure from smaller holders, removing a key source of short-term volatility. This dip in retail flows directly preceded Bitcoin’s recent surge to $112,000, hinting that the stage was set for larger players to drive price action.

Supporting that theory, analyst Amr Taha explained that Binance’s spot market share surged to over 49% just before the breakout. This underscored Binance’s deep liquidity and institutional-grade infrastructure, likely attracting large-volume buyers over the past few weeks.

With bullish signals across onchain metrics and exchange data, the market appears to be running on a fresh dose of liquidity. The SSR MACD crossover suggests new money is entering, and declining retail sell pressure paired with Binance’s volume spike indicates that whales remain behind the wheel.

Related: Bitcoin investors have now splashed over $50B on US spot ETFs

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.