Key points:

-

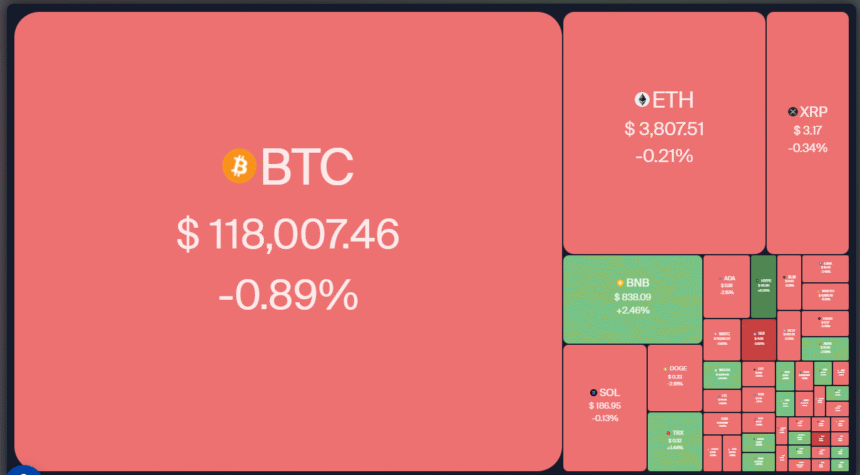

Bitcoin’s tightening range trading signals a possible range expansion in the next few days.

-

Select altcoins also face selling pressure, but remain above their near-term support levels.

Bitcoin (BTC) continues to sell off at the $120,000 level, but the repeated retest of a resistance level tends to weaken it. If buyers do not cede much ground to the bears, it improves the prospects of BTC hitting a new all-time high above $123,218.

Fundstrat head of research Tom Lee said in an interview with CNBC that BTC could soar to $200,000 to $250,000 over the next few months. At that price, Lee believes BTC would be valued at 25% of the size of the gold market.

BTC’s consolidation seems to have driven investors into Ether (ETH), which is charging higher. Spot ETH exchange-traded funds have recorded a 16-day inflow streak, boosting the cumulative net inflows from $4.25 billion on July 2 to $9.33 billion on Friday.

Could BTC break above the overhead resistance, or will it remain in a range? Could select altcoins continue their strong run? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) continued its march toward the target objective of 6,500, indicating sustained demand at higher levels.

The upsloping moving averages signal that bulls remain in control, but the overbought level on the relative strength index (RSI) suggests the rally may be getting overheated. That increases the risk of possible consolidation or correction in the near term.

If the price turns down but bounces off the 20-day simple moving average (6,283), it indicates that the sentiment remains positive. That increases the likelihood of a rally to 6,500. Sellers will have to yank the price below the 50-day SMA (6,099) to gain the upper hand.

US Dollar Index price prediction

The US Dollar Index (DXY) is trying to sustain above the 50-day SMA (97.68), indicating that the bulls are attempting to form a higher low.

If they succeed, the index could soar to 100.54 and then to the 102 level. Sellers are expected to pose a strong challenge at 102.

On the contrary, the failure to maintain the price above the 50-day SMA indicates that bears remain in control. The bears will then try to strengthen their position by pulling the price below 97.10. If they manage to do that, the index risks a retest of the crucial support at 96.37.

Bitcoin price prediction

BTC slipped below the 20-day SMA ($117,867) on Friday, but the long tail on the candlestick shows solid buying at lower levels.

The bulls are trying to drive the BTC/USDT pair above the $120,000 to $123,218 resistance zone. If they manage to do that, the pair is likely to accelerate toward $135,728 and later to the pattern target of $150,000.

Time is running out for the bears. If they want to make a comeback, they will have to swiftly pull the price below the $110,530 support. That may trap the aggressive bulls, resulting in a long liquidation. The pair may then tumble to psychological support at $100,000.

Ether price prediction

Ether surged above the $3,745 resistance on Sunday, but the bulls are struggling to hold on to the higher levels.

Sellers will try to pull the price below $3,745. If they manage to do that, the ETH/USDT pair could slump to the 20-day SMA ($3,423). Buyers are expected to defend the 20-day SMA because a break below it signals the start of a deeper correction.

Conversely, if the price rebounds off the $3,745 level or the 20-day SMA with strength, it indicates buying on dips. The bulls will then again try to drive the pair to $4,094. If the $4,094 level is taken out, the pair could skyrocket toward $4,868.

XRP price prediction

XRP’s (XRP) pullback from $3.66 found support at the 20-day SMA ($3.10) on Thursday, indicating buying on dips.

The bulls tried to push the price toward $3.66 but are facing significant resistance from the bears. If the price continues lower and breaks below the 20-day SMA, it suggests the start of a deeper correction. The XRP/USDT pair may drop to $3 and later to $2.80.

Contrarily, if the price rebounds off the 20-day SMA, it signals that the bulls are fiercely defending the level. The pair could then rally to $3.66. A break and close above $3.66 could catapult the pair to $4 and, after that, to $4.86.

BNB price prediction

BNB (BNB) turned down from $809 on Wednesday, but the bears could not sustain the price below $761. That suggests the bulls have flipped the level into support.

Buyers thrust the price above $809 on Sunday, starting the next leg of the uptrend. The BNB/USDT pair could run toward $900 and thereafter to the psychological level of $1,000.

Although the trend remains up, the deeply overbought level on the RSI suggests the rally is due for a consolidation or correction in the near term. The first sign of weakness will be a break and close below $793. That suggests profit-booking at higher levels. The pair may then descend to $761, where the buyers are expected to step in.

Solana price prediction

Solana’s (SOL) pullback from $209 on Wednesday stalled at the 20-day SMA ($176) on Friday, indicating demand at lower levels.

The bulls are trying to push the price to $209 but are facing selling at higher levels. If buyers overcome the barrier at $209, the SOL/USDT pair could rally to $240 and eventually to $260. There is minor resistance at $220, but it is likely to be crossed.

This positive view will be invalidated in the short term if the price turns down and breaks below the 20-day SMA. The pair may then descend to the 50-day SMA ($160). That points to a possible range-bound action between $110 and $209.

Related: XRP price to $4 next? ‘Most profitable phase’ likely here, says analyst

Dogecoin price prediction

Dogecoin (DOGE) turned up from the 20-day SMA ($0.22) on Friday, indicating demand at lower levels.

The relief rally is facing selling near $0.26, indicating that the bears are active at higher levels. If the price plummets below the 20-day SMA, the DOGE/USDT pair may remain inside the large $0.14 to $0.29 range for a few more days.

Buyers will have to propel the price above $0.29 to seize control. If they manage to do that, the pair could start a new up move to $0.35 and then to the pattern target of $0.44.

Cardano price prediction

Cardano’s (ADA) bounce off the 20-day SMA ($0.78) is facing selling at the overhead resistance of $0.86.

The upsloping 20-day SMA and the RSI in the positive territory indicate an advantage to the bulls. A break above $0.86 could push the ADA/USDT pair to $0.94. Sellers will try to halt the up move at $0.94, but if the bulls prevail, the pair could soar to $1.02 and then to $1.17.

The short-term advantage will tilt in favor of the bears if the price continues lower and plummets below the 20-day SMA. That suggests profit-booking on rallies. The pair may then decline to the 50-day SMA ($0.67).

Hyperliquid price prediction

Hyperliquid (HYPE) rebounded off the support line of the ascending channel pattern on Friday, indicating buying on dips.

There is resistance at the 20-day SMA ($45.06), but if the bulls overcome it, the HYPE/USDT pair could rise to $48 and subsequently to $50. Sellers are expected to mount a strong defense at $50.

Conversely, if the price turns down from the 20-day SMA, the bears will try to pull the pair below the support line. If they succeed, the pair may start a deeper correction toward $36 and then $32.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.