The Bitcoin Stablecoin Supply Ratio (SSR) points at thinning liquidity in the sector, potentially explaining the consolidation in the asset’s price.

Bitcoin SSR Rose Alongside The Earlier Price Surge

As pointed out by an analyst in a CryptoQuant Quicktake post, the Bitcoin SSR has witnessed an increase recently. The “SSR” here refers to an indicator that measures the ratio between the market cap of Bitcoin and that of the stablecoins.

Stablecoins are cryptocurrencies that peg themselves to the price of a fiat currency, with USD-based tokens being the most popular. Investors generally use stables when they want to escape the volatility associated with other digital assets like Bitcoin.

Many holders who keep their capital stashed away in stablecoins, however, eventually plan to re-invest into volatile coins. As such, some view the supply of these cryptocurrencies as a measure of the ‘dry powder‘ available in the sector for BTC and other assets.

Since the SSR compares the market cap of Bitcoin against this dry powder, it tells us about which part of the sector investor capital is dominating right now. When the metric goes up, it means that capital is transferring from stablecoins to BTC or if both are receiving inflows, that the latter is just seeing more of them. In either case, relative dry powder is going down.

Similarly, the metric registering a decline implies capital is shifting towards stables. Such a trend can be a sign that investors have more purchasing power relative to BTC’s market cap.

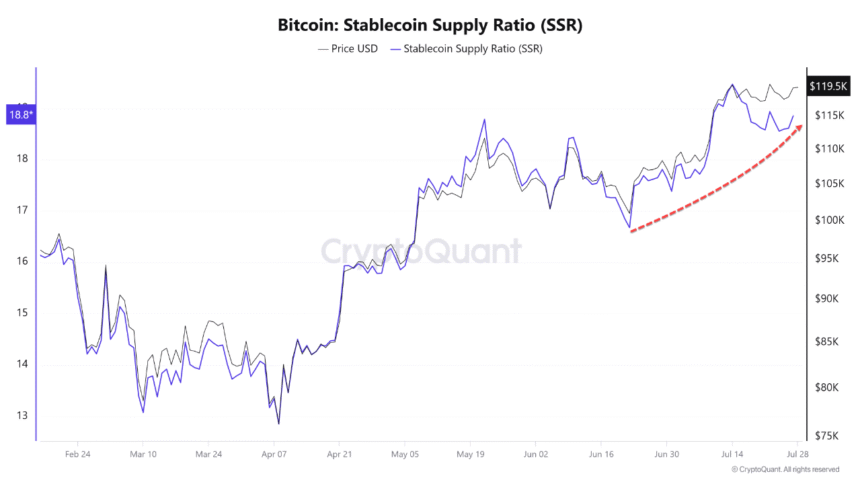

Now, here is a chart that shows the trend in the Bitcoin SSR over the last few months:

As displayed in the above graph, the Bitcoin SSR tracked the earlier BTC price surge almost 1:1, indicating that the increase in the asset’s market cap outpaced any rise in stablecoin liquidity.

Since the peak in the cryptocurrency’s price, the indicator has declined a bit, but its value still remains at a significant level of 18.8. This means that the asset’s total value is currently 18.8 times the supply of the stablecoins.

“This indicates a temporary saturation in the market unless we see additional stablecoins entering,” notes the quant. The recent high values in the Bitcoin SSR may at least be in part behind the consolidation that the cryptocurrency has been facing.

It now remains to be seen where the metric would go next. A drop in its value would naturally suggest stablecoins are witnessing inflows, which could potentially set up the next leg in the BTC rally.

BTC Price

Bitcoin briefly declined below $115,000 on Friday, but the coin has since bounced back as its price is now trading around $118,800.