Key point:

-

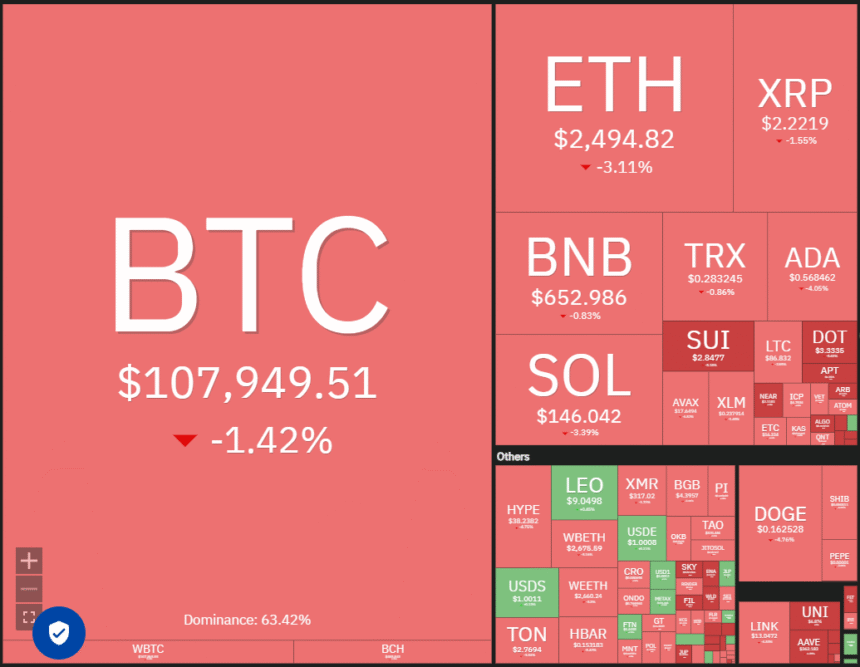

Bitcoin’s bounce off the moving averages may improve sentiment, pushing BNB, SOL, LINK, and AAVE above their overhead resistance levels.

Bitcoin’s (BTC) failure to close above $110,000 may have attracted profit-booking by short-term traders. That has pulled the price near $108,000. Crypto analyst Daan Crypto Trades said in a post on X that a close above $110,000 would be good for Bitcoin, but a drop below $108,000 could deepen the correction.

Some analysts are betting that US President Donald Trump’s “Big Beautiful Bill” will act as a catalyst to push the price above the all-time high. Prediction service Kalshi expects the US national debt to reach $40 trillion in 2025, a massive increase from $23.2 trillion in 2020. History shows that US borrowing increases have boosted Bitcoin’s price. For example, Bitcoin price soared by roughly 38% after Trump signed a COVID-19 spending bill in late 2020.

Although most analysts are bullish on the continuation of the bull market, crypto analyst Rekt Capital cautioned in a recent video that the bull market may only run for two or three more months if Bitcoin follows the 2020 pattern.

Could Bitcoin bounce off the support, pulling select altcoins higher? Let’s analyze the charts of the top 5 cryptocurrencies that look strong on the charts.

Bitcoin price prediction

Buyers tried to push Bitcoin above the $110,500 resistance on Thursday, but the bears held their ground.

Sellers have pulled the price back below the downtrend line, which is a negative sign. Buyers are expected to fiercely defend the moving averages because if they fail in their endeavor, the BTC/USDT pair could slump to $105,000 and later to psychological support at $100,000.

Instead, if the price rebounds sharply from the moving averages, it suggests a positive sentiment. That improves the likelihood of a rally to the all-time high at $111,980 and then to the neckline of the inverse head-and-shoulders pattern near $113,500.

The pair has dipped to the 50-simple moving average on the 4-hour chart, where the bulls are trying to arrest the pullback. If the price turns up from the current level and breaks above the downtrend line, it signals demand at lower levels. The bulls will again try to shove the pair above $110,500. If they do that, the possibility of a rally to $113,500 increases.

On the contrary, if the price sustains below the 50-SMA, it signals profit-booking by short-term buyers. The pair then risks a fall to $105,000. Buyers are expected to defend the $105,000 level with all their might because a close below it may extend the decline to $100,000.

BNB price prediction

BNB (BNB) rebounded off the breakout level on Wednesday and broke above the 50-day SMA ($654).

The bears are trying to pull the price below the moving averages, but the bulls are expected to defend the level. If the price turns up from the moving averages and rises above $665, the BNB/USDT pair could rally to $675. Sellers will again try to halt the up move at $675, but if the bulls prevail, the pair may reach $698.

This optimistic view will be negated in the near term if the price breaks below the moving averages and re-enters the descending channel. That signals the markets have rejected the breakout above the channel.

The bears have pulled the price to the 50-SMA on the 4-hour chart. The flattening 20-EMA and the RSI just below the midpoint do not give a clear advantage either to the bulls or the bears.

Buyers will have to propel the pair above $665 to gain the upper hand. The pair may then rally to $675 and later to $698. Alternatively, a break below the moving averages suggests the bulls are losing their grip. The pair may then slip to $640.

Solana price prediction

The repeated failure of the bulls to clear the $159 hurdle in Solana (SOL) started a pullback below the 20-day EMA ($148).

The flattish 20-day EMA and the RSI just below the midpoint signal a balance between supply and demand. Buyers will be back in the driver’s seat if they propel the SOL/USDT pair above $159. That clears the path for a rally to $168 and then to $185.

Contrarily, a close below the 20-day SMA suggests the bears have overpowered the bulls. The pair may slump to the crucial support at $140. This is an essential level for the bulls to defend because a break below it may sink the pair to $126.

The failure of the bulls to defend the 50-SMA on the 4-hour chart is a negative sign. The pair could fall to $145, which is an important level to keep an eye on. If the price rebounds off $145 with strength, it signals buying on dips. The bulls will then attempt to kick the pair to $159. A close above $159 will complete a bullish inverse H&S pattern, which has a target objective of $192.

Conversely, a drop below $145 could sink the pair to $137. Buyers are expected to fiercely defend the $137 level because a break below it may tug the pair to $130.

Related: Bitcoin’s third flop at $110K puts bulls at risk: BTC price levels to watch

Chainlink price prediction

Chainlink (LINK) rose above the 20-day EMA ($13.32) on Wednesday, but the bulls could not pierce the 50-day SMA ($14.09) on Thursday. That suggests that bears are active at higher levels.

The LINK/USDT pair could drop to $12.73, which is an important level to watch out for. If the price rebounds off $12.73 with strength, the bulls will again try to propel the pair above the 50-day SMA. If they manage to do that, the pair could surge to $15.66 and thereafter to $18.

Contrary to this assumption, if the price extends its slide and breaks below $12.73, it suggests that the bears are trying to seize control. A break and close below $12.73 could sink the pair to $11.

The pair’s failure to sustain above the resistance line suggests the bears are trying to trap the aggressive bulls. The pair may fall to $12.73, where the bulls are expected to mount a strong defense. If the price turns up from $12.73, the bulls will again attempt to drive the pair above $14.10. If they do that, the pair could rally to $15.77.

Instead, a break and close below $12.73 may accelerate selling. The pair could then descend to $11.50.

Aave price prediction

Aave (AAVE) is facing resistance at $286, but a positive sign is that the bulls have not allowed the price to dip below the moving averages.

The upsloping moving averages signal an advantage to buyers, but the RSI near the midpoint indicates the bullish momentum is weakening. If the price rebounds off the moving averages with strength, the bulls will try to drive the AAVE/USDT pair above $286. If they can pull it off, the pair may jump to $325.

This positive view will be invalidated if the price continues to fall and breaks below the moving averages. Such a move indicates that the bulls have given up. The pair may dip to $240 and subsequently to $220.

The pair turned down from $286, indicating that the bears are aggressively defending the level. If the price rebounds off the uptrend line and rises above the 20-EMA on the 4-hour chart, it signals solid demand at lower levels. The bulls will again try to push the pair above $286. If they succeed, the pair could rally to $295 and then to $310.

A break below the uptrend line suggests the bulls are losing their grip. The pair may then plummet to $248, which is a critical support level to watch out for. If the $248 level cracks, the pair may nosedive to $220.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.