Bitlayer, a Bitcoin decentralized finance (DeFi) infrastructure startup backed by Franklin Templeton, has launched its smart contract bridge on mainnet, aiming to make Bitcoin more interoperable across multiple blockchain networks.

The bridge, called BitVM, is described by the company as a “trust-minimized bridging solution for Bitcoin holders.” It enables users to deposit Bitcoin (BTC) into a smart contract, where it is held in escrow and converted into Peg-BTC (YBTC), a tokenized version of Bitcoin that can interact with smart contract platforms.

According to Bitlayer, Peg-BTC is designed to facilitate programmability and crosschain compatibility. The company has already secured partnerships to integrate the bridge with networks including Sui, Base, and Arbitrum.

A Bitlayer spokesperson told Cointelegraph that the new bridge is intended to “complement Bitcoin’s DeFi ecosystem by making native BTC liquidity accessible on networks that support smart contracts and more complex applications, without requiring changes to Bitcoin’s base layer.”

Security has been a concern for crosschain bridges, which are often targeted by hackers due to exploitable vulnerabilities. In 2022, a hacker stole $321 million from a Wormhole bridge, though over $225 million was later recouped.

According to Bitlayer, its bridge was built on previous models’ trust assumptions to beef up security. Whereas many bridges rely on a multisig trust model, BitVM uses a single signer.

Related: A beginner’s guide to the Bitcoin Taproot upgrade

Bitcoin DeFi protocols rise after Taproot, Inscriptions

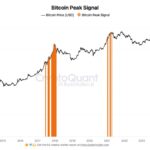

While other blockchains such as Ethereum and Solana are more known for decentralized finance, the world’s oldest public blockchain has been attracting more DeFi protocols lately. For many Bitcoin investors, the tantalizing possibility of earning yield on their coins has whetted an appetite for these services.

Bitlayer’s competitors in the Bitcoin DeFi space include BabylonChain, a proof-of-stake protocol that allows for investors to stake Bitcoin, Stacks, which rewards Bitcoin miners and BounceBit, which is a restaking protocol wherein users can delegate wrapped BTC to node operators.

As of Tuesday, the Bitlayer protocol has $384 million in value locked onchain, generating $1.7 million in fees in June. The Babylon Protocol has a much greater TVL, with $5.2 billion locked on the network.

There are currently about 30 DeFi projects building within the Bitcoin ecosystem, a trend accelerated by two major developments: the Taproot upgrade and the introduction of Inscriptions.

Taproot, implemented in November 2021, enhanced Bitcoin’s scripting capabilities, paving the way for more scalable and privacy-focused applications.

Inscriptions, popularized with the launch of the Ordinals protocol in early 2023, allowed users to embed arbitrary data, including images and code, directly onto the BTC network, unlocking new use cases for Bitcoin.

Magazine: Pakistan will deploy Bitcoin reserve in DeFi for yield, says Bilal Bin Saqib