For resource investors, geological potential is only one piece of the puzzle.

Whether it’s gold, silver, copper, nickel, uranium or any other commodity, the long-term success of a mining project is heavily dependent on jurisdiction. Mining is a capital-intensive, multi-year undertaking, and an asset’s economics can be undermined by political instability, sudden regulatory changes or shifting government policies.

Canada stands out as a global leader in this regard. Its reputation as a stable and reliable mining jurisdiction is built on a foundation of political stability, the rule of law and a mature, transparent regulatory framework. This environment provides the certainty that investors require to commit the significant capital needed for exploration and development.

The Fraser Institute’s latest Annual Survey of Mining Companies, which ranks jurisdictions based on the organization’s Investment Attractiveness Index, puts Canada in the spotlight, with two regions in the top 10.

Read on to learn what makes Canada a strong mining jurisdiction for both companies and investors.

Canada’s top mining provinces

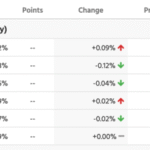

The two Canadian jurisdictions ranked the highest by the Fraser Institute are Saskatchewan, which came in seventh on the Investment Attractiveness Index, and Newfoundland and Labrador, which took the eighth spot.

Both provinces ranked highly in terms of policy, with Saskatchewan earning a score of 96.37 to take the third spot out of 82, and Newfoundland and Labrador achieving a score of 91.84 for sixth place.

Alberta also placed in the top 10 for policy, coming in ninth place at a score of 87.8.

When it comes to mineral potential, both Saskatchewan and Newfoundland and Labrador were left out of the top 10, placing 21st and 16th, respectively. Still, Canada maintained a presence, with BC scoring 85.45 for fourth, Yukon receiving a score of 79.03 for eighth and Manitoba coming in ninth with 78.57.

Behind the figures, respondents to the Fraser Institute’s survey identified uncertainty as their chief concern. In BC, political stability and disputed land claims were top concerns, but these worries were also accompanied by decreased apprehension surrounding regulatory duplication and environmental regulations.

In Saskatchewan, there were increased concerns over the province’s taxation regime and regulatory duplication, but there was less worry over the availability of labor.

Canadian mining policies and tax credits

At both the provincial and national levels, Canada has established various programs with the intent of attracting investment capital to the country’s resource sector.

Among them are flow-through shares (FTS), which enable companies to pass certain expenses onto shareholders. For tax purposes, investors can claim 100 percent of eligible expenses, ultimately lowering their tax burden.

On top of FTS are several tax credit programs. The Mineral Exploration Tax Credit (METC) provides a 15 percent tax credit on exploration expenses incurred through FTS. The program was designed to stimulate investment in early stage exploration projects, which tend to carry higher risk than assets already in production.

The federal government has a similar program tailored for investment in critical minerals projects. Although it cannot be combined with the METC, the Critical Mineral Exploration Tax Credit (CMETC) doubles the tax credit to 30 percent and targets exploration for minerals, including lithium, cobalt, copper, nickel and rare earths.

Other programs exist at the provincial level as well. This is one of the reasons Saskatchewan scored so highly on policy in the Fraser Institute’s report — the province offers a 30 percent tax credit, which, when combined with either the METC or CMETC, gives investors total tax credits worth 45 percent and 60 percent.

BC has also incentivized investment in the mining sector with a 20 percent tax credit, which grows to 30 percent if projects are located in areas affected by the invasive mountain pine beetle.

Additionally, as tariff threats from south of the border loomed in the first half of 2025, the Canadian government introduced the Building Canada Act, intended to streamline the regulatory approval process for infrastructure projects deemed to be in the national interest, including resource development.

The goal is to reduce red tape by consolidating federal reviews into a single process, eliminating redundancies between the federal and provincial governments and reducing timelines to within two years.

Similar initiatives have been introduced on the provincial level. In May of this year, the BC government introduced the Infrastructure Projects Act, designed to expedite permitting and environmental reviews.

Mining challenges in Canada

Although regulations vary from province to province and are subject to change with the election of new governments, Canada has developed a reputation for being a safe mining jurisdiction due to its political stability.

These positive outcomes are reflected in how many provinces scored highly in the Fraser Institute’s report; however, respondents weren’t without criticisms of Canada. One participant suggested that investment in BC is deterred by regulatory failures that create uncertainty, while another stated that taxation is a significant issue.

When examining Manitoba, which fell sharply in the standings to 26th from sixth in 2023, one exploration company president noted that a long list of roadblocks makes exploration in the province challenging.

How the new acts and shifts in policy will affect the mining industry won’t be known for some time. Still, they could go a long way to addressing issues outlined in the report and begin attracting new projects to the Canadian resource sector, which would be a boon to both mining companies and investors.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.