Lawmakers in Washington are gearing up to pass three bills for the blockchain industry in an event they have dubbed “crypto week.”

The US Congress has been working on legislation that the crypto industry lobby says will help bring clarity to the industry and help it grow, primarily through two laws governing stablecoins and creating a crypto market structure. Congress is also considering a law preventing the creation of a central bank digital currency (CBDC).

Crypto has found support on both sides of the aisle, with Democratic and Republican lawmakers each making a number of amendments to the bills under consideration. Major crypto exchanges operating in the United States, like Coinbase, have stepped up their campaigning for the legislation as well.

With Congress set to take action on three critical bills during Crypto Week, here’s a look at what they’re considering and what it means for the crypto industry.

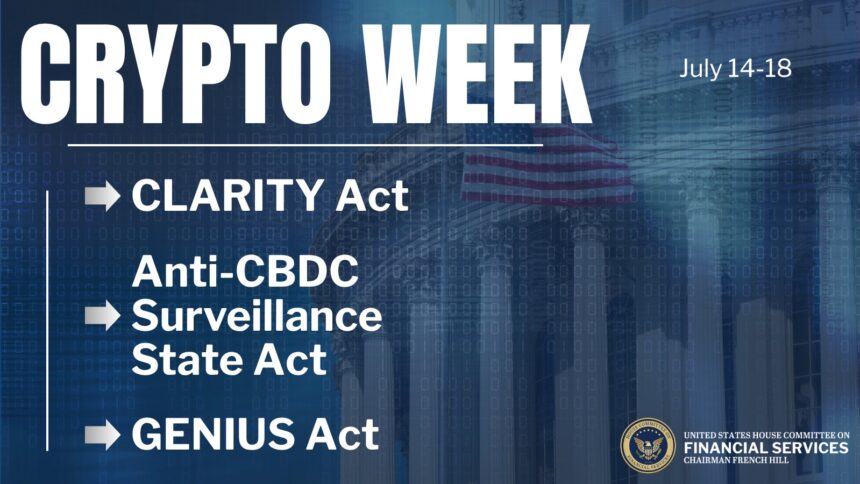

Crypto week aims to pass three bills into law

The US House Financial Services Committee announced Crypto Week would start on July 14. It will consider three bills, namely:

The Digital Asset Market Clarity Act (CLARITY Act)

Republican Representative French Hill introduced the CLARITY Act only at the end of June. The bill aims to provide a framework for the digital assets industry, including defining the roles of the Securities and Exchange Commission and the Commodity Futures Trading Commission (CFTC).

The crypto industry has long thought that the Howey test, as outlined in the Securities Act of 1933 and the Securities Exchange Act of 1934, is out of date and that the SEC should not apply it nor exercise jurisdiction over digital assets.

The CLARITY Act would “provide an exemption from the Securities Act of 1933’s registration requirement for offers of investment contracts involving digital commodities on mature blockchains that meet certain conditions.”

It also defines “mature” blockchains as networks that have a digital commodity “substantially derived from the use and functioning of the blockchain.” It can’t have user restrictions and must limit certain holders to less than 20% of ownership.

Under the bill, the CFTC would gain “exclusive regulatory jurisdiction” over crypto transactions. Crypto exchanges and brokers would be required to register with the commission and would be subject to record keeping, reporting, antitrust considerations and other regulatory considerations.

The Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act)

Perhaps the most well-known of the three bills being considered during crypto week is the GENIUS Act, the long-awaited regulatory framework for stablecoins.

The bill was introduced in February, just over a week after President Donald Trump took his oath of office, by a bipartisan group of legislators. It is now in the House after passing the Senate in a bipartisan vote on June 17.

The bill defines what type of entities may issue stablecoins and states that “issuers must maintain reserves backing the stablecoin on a one-to-one basis using U.S. currency or other similarly liquid assets, as specified.”

Related: GENIUS Act could strengthen dollar power, write ‘rulebook’ for global financial system

It also subjects issuers to the Bank Secrecy Act and sets provisions for the event of a stablecoin issuer going insolvent.

Anti-CBDC Surveillance State Act

Republican Representative Tom Emmer introduced the Anti-CBDC Surveillance State Act on March 6, which seeks to prevent the Federal Reserve, the US’s central bank, from issuing a CBDC.

Under the pretense of concern over citizens’ privacy, the act would forbid the Fed from issuing a CBDC either by itself or through a third party, prevent the Fed from using a CBDC to influence monetary policy and give Congress the sole authority to issue a digital dollar.

According to an announcement from the House Committee on Financial Services, supporting organizations include the Blockchain Association, the Digital Chamber of Commerce and a number of banking lobbies.

Can the crypto bills actually pass?

Given the glacial pace of lawmaking in Washington, one week is a short time to pass three laws, especially considering the size and economic implications of these three bills.

Major crypto companies like Coinbase have been lobbying hard. On July 7, Stand With Crypto, the “grassroots” crypto lobbying organization started by Coinbase, sent a letter to lawmakers signed by 65 executives from various crypto firms, urging Congress to pass the CLARITY Act.

Related: Coinbase crypto lobby urges Congress to back major crypto bill

On July 9, Coinbase CEO Brian Armstrong wrote a message supporting the same, saying that “America is ready for crypto.”

Polymarket doesn’t reflect this readiness. Participants in the “Clarity Act signed into law in 2025?” market give the bill a 52% chance at publishing time.

The CLARITY Act has been panned by lawmakers and consumer protection organizations alike as being a “crypto crash grab” and a means for companies to avoid SEC regulation.

Americans for Financial Reform (AFR) called the bill “a massive deregulatory bill backed by a gusher of campaign cash and lobbying muscle from ultra-wealthy venture capital firms and crypto billionaires. The bill will enrich them at the expense of consumers, communities, and financial stability.”

The AFR also raised concerns about Trump’s personal crypto dealings and noted that the bill contains no provisions regarding corruption and ethical concerns.

Senator Elizabeth Warren, a noted crypto critic, has also opposed the bill, stating that it allows major firms to skirt SEC regulation.

“Under the House bill, a publicly traded company like Meta or Tesla could simply decide to put its stock on the blockchain and — poof! — it would escape all SEC regulation,” said Warren.

The GENIUS Act, by comparison, has experienced more debate and revision in both halls of Congress. According to Senator Cynthia Lummis, one of the bill’s sponsors, the Senate has done significant work to include provisions addressing Democratic concerns over terrorism financing and money laundering.

When the bill passed the Senate in mid-June, Democratic Senator Kirsten Gillibrand said it “targets illicit finance, places limitations on Big Tech, puts in place ethical guardrails, and strengthens national security.”

Concerns remain, like the potential effect the act could have on dollar dominance and treasury markets. Even so, betting markets are optimistic. Participants on Polymarket give the bill a 92% chance of passing this year.

The anti-CBDC bill is still under deliberation. On July 9, the House Committee on Ways and Means and Oversight Subcommittee announced a July 16 hearing on “affirmative steps needed to place a tax policy framework on digital assets.”

The hearing is reportedly set to address aspects related to Emmer’s anti-CBDC bill.

Whether pro-crypto lawmakers can pass three laws in a week seems a high bar to clear, but even if they don’t, their focus in the near future is definitely crypto.

Magazine: Inside a 30,000 phone bot farm stealing crypto airdrops from real users